ECB Chief Economist Philip Lane offered a cautiously optimistic take on inflation, saying slowing in goods and services gauges are welcome and that underlying pressures will keep weakening.

In an interview with Irish website the Currency, he described 2023 as the year of “peak second round” as the effects of prior increases feed through the economy.

Lane didn’t specify a preference for what to do at the upcoming Sept. 14 interest-rate decision, where officials are poised to debate either another increase or a pause. President Christine Lagarde, speaking on Monday, also refrained from offering a view. Officials have stated that they want to bring consumer price growth to 2% in a “timely manner.” Lane offered a definition of that.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Lagarde Keeps Up ECB Rate Suspense, Favoring Action Over Words(Bloomberg) -- Christine Lagarde avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week as she delivered a speech in London.

Lagarde Keeps Up ECB Rate Suspense, Favoring Action Over Words(Bloomberg) -- Christine Lagarde avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week as she delivered a speech in London.

Lire la suite »

Lagarde Keeps ECB Rate Suspense, Favoring Action Over Words(Bloomberg) -- Christine Lagarde avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week as she delivered a speech in London. Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupThe president of the Frankfurt-based institution ke

Lagarde Keeps ECB Rate Suspense, Favoring Action Over Words(Bloomberg) -- Christine Lagarde avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week as she delivered a speech in London. Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupThe president of the Frankfurt-based institution ke

Lire la suite »

Spain’s Calvino Would Welcome End of ECB Rate-Hike Aggression(Bloomberg) -- Spanish Deputy Prime Minister Nadia Calvino said she’d welcome an immediate end to European Central Bank rate hikes.

Spain’s Calvino Would Welcome End of ECB Rate-Hike Aggression(Bloomberg) -- Spanish Deputy Prime Minister Nadia Calvino said she’d welcome an immediate end to European Central Bank rate hikes.

Lire la suite »

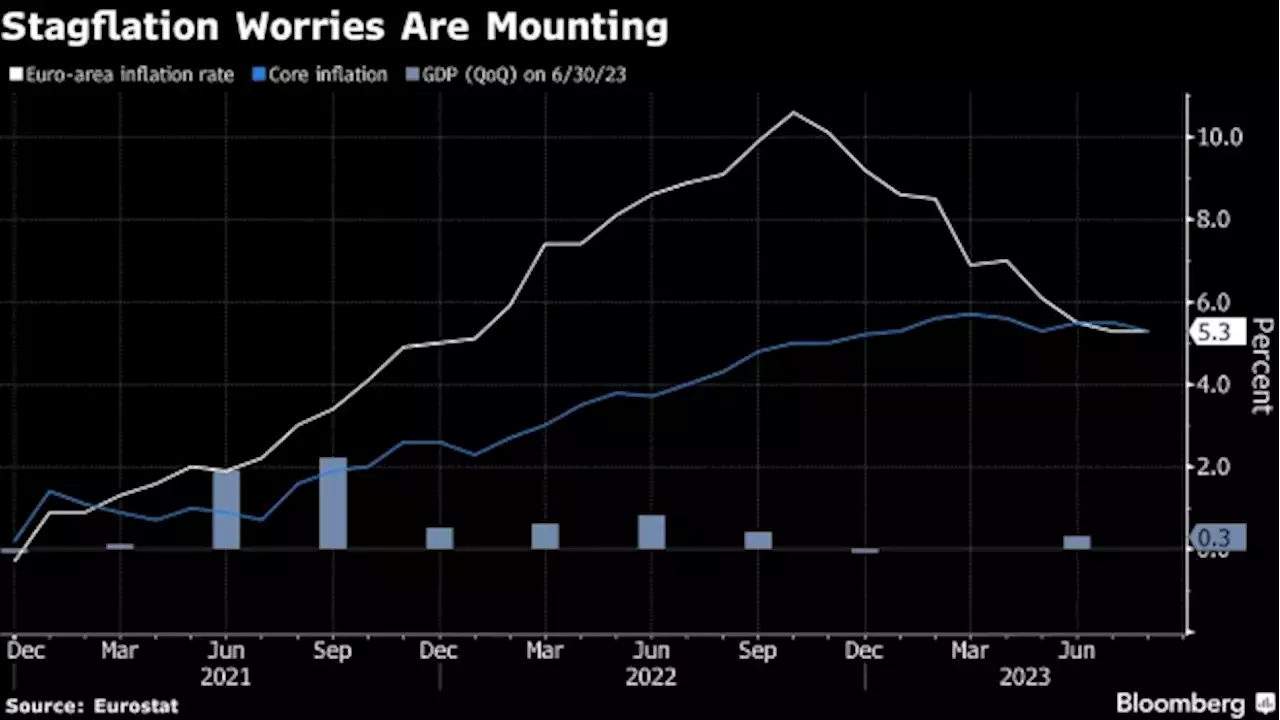

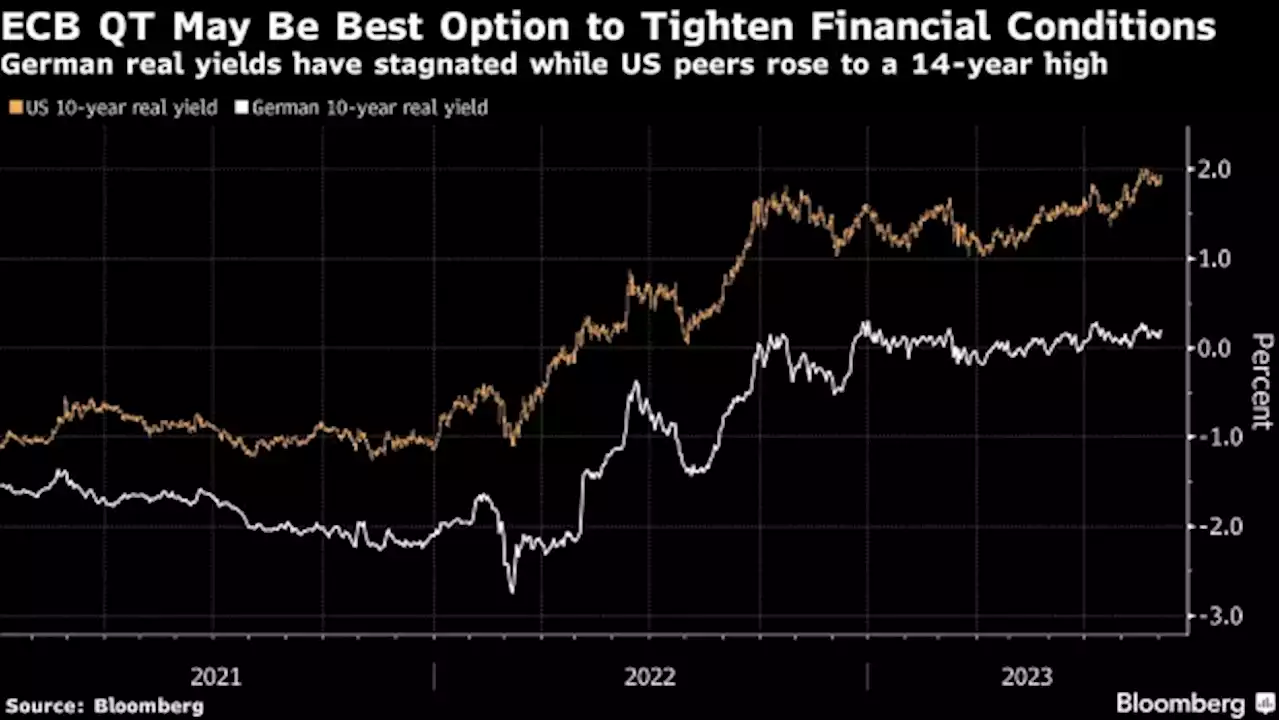

Europe’s Real Rates Fuel Speculation Over Faster ECB Bond RunoffSpeculation is mounting the European Central Bank will shrink its bond portfolio at a quicker pace to ensure it keeps financing conditions tight as the end of its rate-hiking cycle approaches.

Europe’s Real Rates Fuel Speculation Over Faster ECB Bond RunoffSpeculation is mounting the European Central Bank will shrink its bond portfolio at a quicker pace to ensure it keeps financing conditions tight as the end of its rate-hiking cycle approaches.

Lire la suite »

JPMorgan Sees City of London Office Values Falling 20% This YearOffice buildings in London’s financial district will lose a fifth of their value in the year through March, said JPMorgan Chase & Co. analysts, who stopped recommending clients buy shares of The British Land Co. Plc.

JPMorgan Sees City of London Office Values Falling 20% This YearOffice buildings in London’s financial district will lose a fifth of their value in the year through March, said JPMorgan Chase & Co. analysts, who stopped recommending clients buy shares of The British Land Co. Plc.

Lire la suite »

Salvation Army backpack program in P.E.I. sees increase demand this yearApplications to program rise this year while donations have dropped

Salvation Army backpack program in P.E.I. sees increase demand this yearApplications to program rise this year while donations have dropped

Lire la suite »