Speculation is mounting the European Central Bank will shrink its bond portfolio at a quicker pace to ensure it keeps financing conditions tight as the end of its rate-hiking cycle approaches.

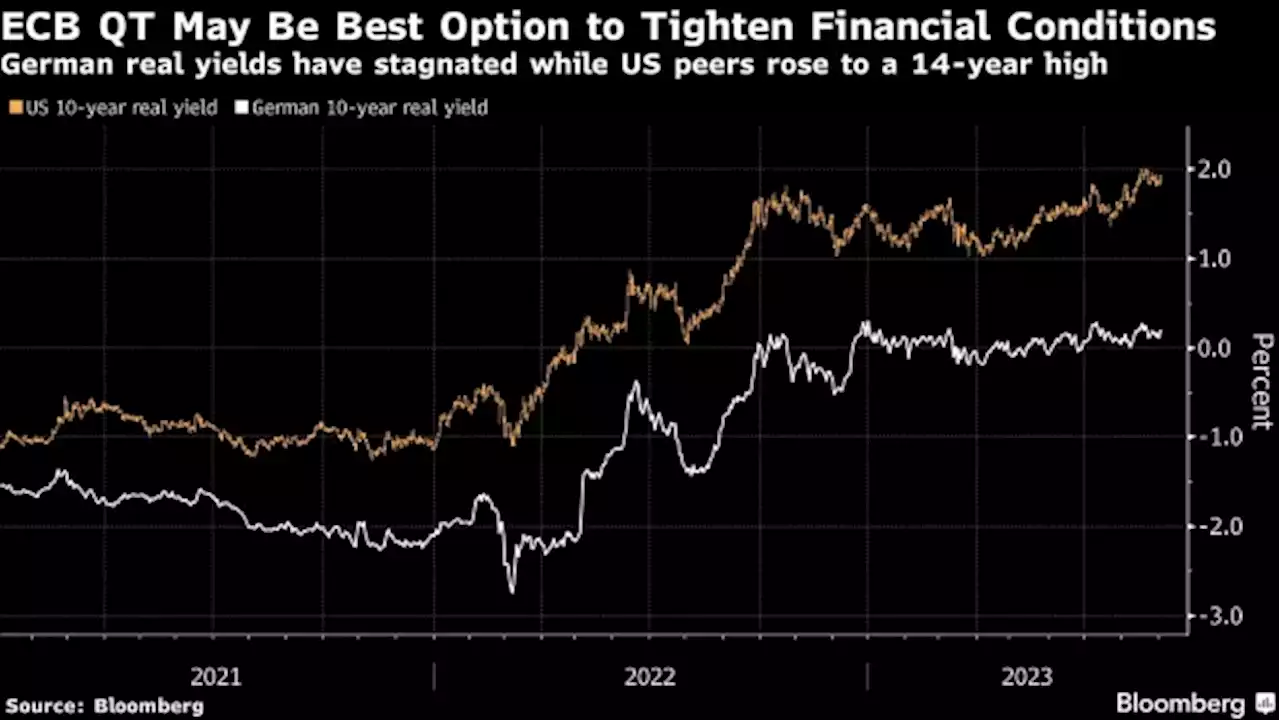

Traders are betting the ECB is almost done lifting borrowing costs as evidence of the economic damage inflicted by tighter monetary policy builds up. But with longer-term real rates failing to rise in response this year, analysts at ING Group NV, Mizuho International Plc and AFS Group suggest the central bank may seek to shrink its bond holdings at a faster lick.

Evelyne Gomez-Liechti, a rates strategist at Mizuho, said the ECB will start considering changes to quantitative tightening, or the process by which it shrinks its balance sheet, even if, as she expects, policymakers choose to hike rates again next week. Still-elevated inflation “calls for a tight policy stance, especially where policy is still loose –- the long end of the curve,” he said.The gap between US and German 10-year real yields has grown to around the widest since late 2022, as inflation-protected Treasuries sold off and German equivalents stagnated.

For now, reinvestments under its pandemic program of debt purchases — PEPP — are expected to run at least through the end of 2024, even as bonds bought under an older program are allowed to roll off.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Mohamed Salah scores in Liverpool's win over Aston Villa as speculation swirls about his futureMohamed Salah put aside intense speculation about his future by scoring again for Liverpool in its dominant 3-0 win over Aston Villa that made it three straight victories in the Premier League for Jürgen Klopp's team on Sunday.

Mohamed Salah scores in Liverpool's win over Aston Villa as speculation swirls about his futureMohamed Salah put aside intense speculation about his future by scoring again for Liverpool in its dominant 3-0 win over Aston Villa that made it three straight victories in the Premier League for Jürgen Klopp's team on Sunday.

Lire la suite »

Mortgage rates at 7% a 'tragedy' for homebuyersMortgage rates above 7% further exacerbate the nation’s affordability crisis, with many would-be buyers staying on the sidelines.

Mortgage rates at 7% a 'tragedy' for homebuyersMortgage rates above 7% further exacerbate the nation’s affordability crisis, with many would-be buyers staying on the sidelines.

Lire la suite »

Lower unemployment rates creating higher anxiety for seasonal fishery workers in Newfoundland and LabradorRate adjusted monthly

Lower unemployment rates creating higher anxiety for seasonal fishery workers in Newfoundland and LabradorRate adjusted monthly

Lire la suite »

Dollar steady as traders bet Fed done with ratesBy Ankur Banerjee SINGAPORE (Reuters) - The dollar started Monday on a steady footing as investors assessed U.S. jobs data that showed some signs of ...

Dollar steady as traders bet Fed done with ratesBy Ankur Banerjee SINGAPORE (Reuters) - The dollar started Monday on a steady footing as investors assessed U.S. jobs data that showed some signs of ...

Lire la suite »

Belgium raises record 22 billion euros from savers in 'clear signal' for higher bank ratesBelgium has raised a record 21.9 billion euros ($23.65 bln) from savers in a bond sale designed to compete with bank deposits, a sign of growing popularity for government debt as discontent grows with lenders failing to keep up with surging interest rates. It marks the biggest funding drive from households in Belgium's history and is likely Europe's biggest retail bond sale, the country's debt agency said on Monday. Equivalent to around 5% of Belgian deposits, it eclipses the 5.7 billion euros raised from savers at the height of the euro zone debt crisis in 2011 and beats the 18 billion euros Italy raised from savers earlier this year.

Belgium raises record 22 billion euros from savers in 'clear signal' for higher bank ratesBelgium has raised a record 21.9 billion euros ($23.65 bln) from savers in a bond sale designed to compete with bank deposits, a sign of growing popularity for government debt as discontent grows with lenders failing to keep up with surging interest rates. It marks the biggest funding drive from households in Belgium's history and is likely Europe's biggest retail bond sale, the country's debt agency said on Monday. Equivalent to around 5% of Belgian deposits, it eclipses the 5.7 billion euros raised from savers at the height of the euro zone debt crisis in 2011 and beats the 18 billion euros Italy raised from savers earlier this year.

Lire la suite »

No need for the Bank of Canada to raise rates again: CIBCBank of Canada does not need to raise its interest rate again but it might anyway. Watch CIBC economist Benjamin Tal on the economy

No need for the Bank of Canada to raise rates again: CIBCBank of Canada does not need to raise its interest rate again but it might anyway. Watch CIBC economist Benjamin Tal on the economy

Lire la suite »