The FHSA comes into force on April 1 and experts have been getting questions from parents looking at ways to help adult kids buy their first homes

, which has a withdrawal limit of $35,000 from an RRSP, for the same home purchase. The FHSA and HBP funds can also be combined with more than one person such as a couple buying a home together. With a couple, each person can put a minimum of $75,000 – or a combined $150,000 – toward a qualifying new home purchase. The FHSA minimum of $40,000 doesn’t include any potential gains made on the original investment.

For example, he suggests gifting each child $8,000 a year for the FHSA once they turn 18, so they can invest the money and allow it to grow for a future down payment. It’s similar to the advice he gave parents and grandparents when the tax-free savings account started in 2009. Now, he recommends starting with the FHSA before the TFSA.

Another benefit is that the FHSA tax deduction can be carried forward, similar to what’s possible with an RRSP, he notes.Zainab Williams, certified financial planner at Elleverity Wealth Management in Caledon, Ont., says parents should discuss homeownership goals with their adult children before earmarking funds for the FHSA.

Ms. Williams notes that if the child doesn’t buy a home, the money can be transferred to an RRSP within 15 years of the plan being opened or by the time they’re age 71, whichever comes first. She also warns that if you transfer funds from your RRSP to fund your FHSA, your RRSP’s contribution room is lost forever. It doesn’t get replenished as it does with the TFSA.

“If they’re going to sell investments, then they have to look at the tax implications,” Ms. Metzger says. “Are there other sources they can use for the funds without triggering a capital gain,” such as cash or high-interest savings accounts? He says some parents might prefer to loan their kids money instead, especially if they need some or all of it down the road in retirement.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

First Quantum and Panama reach tentative deal to end tax feud on giant Cobre Panama mineVancouver-based miner says it will pay a minimum of US$375-million in taxes a year to Panama over the next 20 years

First Quantum and Panama reach tentative deal to end tax feud on giant Cobre Panama mineVancouver-based miner says it will pay a minimum of US$375-million in taxes a year to Panama over the next 20 years

Lire la suite »

How to separate work from home, when working from homeMornings look a lot different than they used to for Kelly Simms and her family.

Lire la suite »

How to separate work from home, when working from homeRemote work presents a “double\u002Dedged sword” for many Canadian women.

How to separate work from home, when working from homeRemote work presents a “double\u002Dedged sword” for many Canadian women.

Lire la suite »

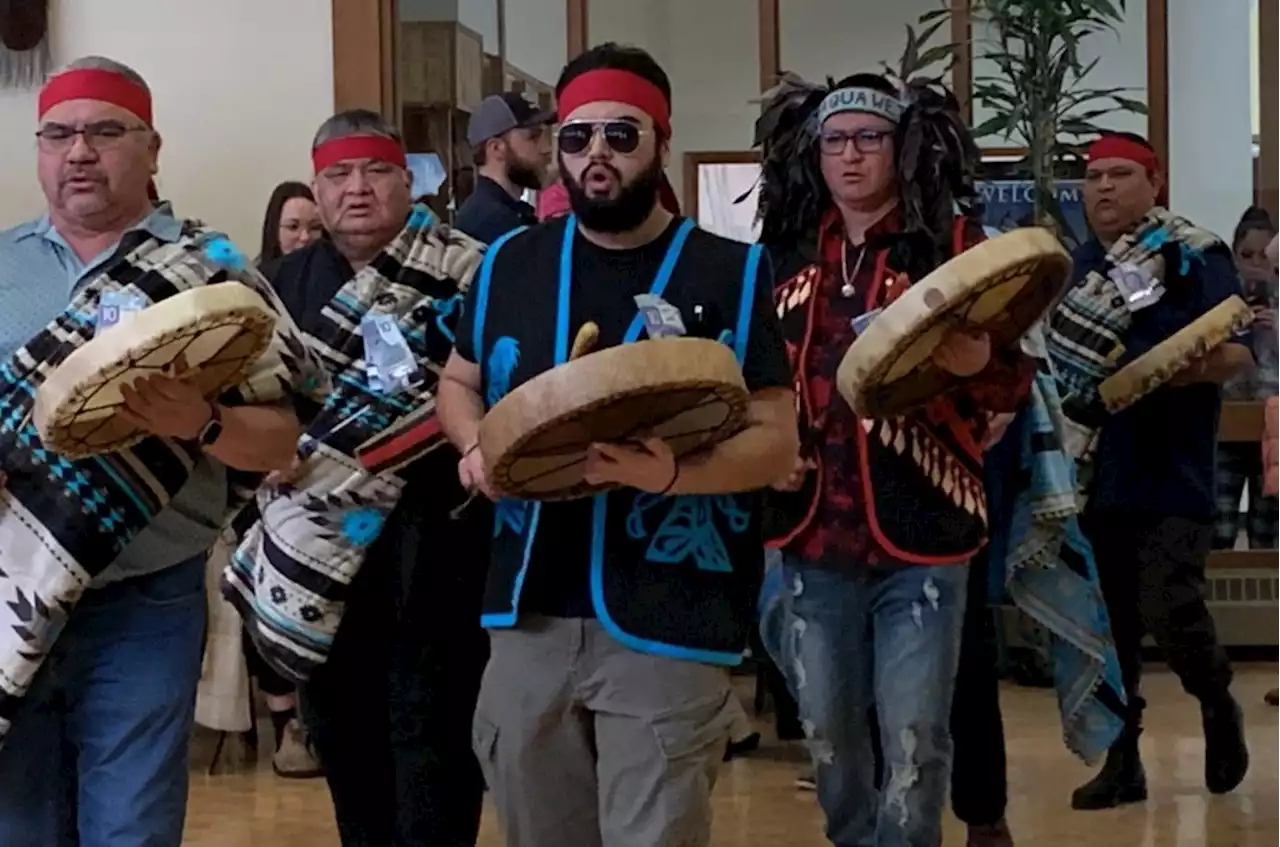

PHOTOS: ‘This beautiful work’: Sts’ailes First Nation welcomes 29 baskets home - Terrace StandardPHOTOS: ‘This beautiful work’: Sts’ailes First Nation welcomes 29 baskets home

PHOTOS: ‘This beautiful work’: Sts’ailes First Nation welcomes 29 baskets home - Terrace StandardPHOTOS: ‘This beautiful work’: Sts’ailes First Nation welcomes 29 baskets home

Lire la suite »

N.S. non-alcoholic beer venture co-founder toasting revenue doubling | SaltWireUpstreet Brewing launched first alcohol-free product in 2020

N.S. non-alcoholic beer venture co-founder toasting revenue doubling | SaltWireUpstreet Brewing launched first alcohol-free product in 2020

Lire la suite »

First Nations woman first to testify in trial for former residential school priestThe Canadian Press doesn’t typically name complainants in such cases, but McIntosh wants to speak publicly and no publication ban was ordered

First Nations woman first to testify in trial for former residential school priestThe Canadian Press doesn’t typically name complainants in such cases, but McIntosh wants to speak publicly and no publication ban was ordered

Lire la suite »