UK mortgage approvals fell for the first time in three months in July as higher interest rates made it harder for Britons to afford a home.

Banks and building societies authorized 49,444 home loans, the fewest since February, according to the Bank of England. Economists had expected a decline to 51,000.

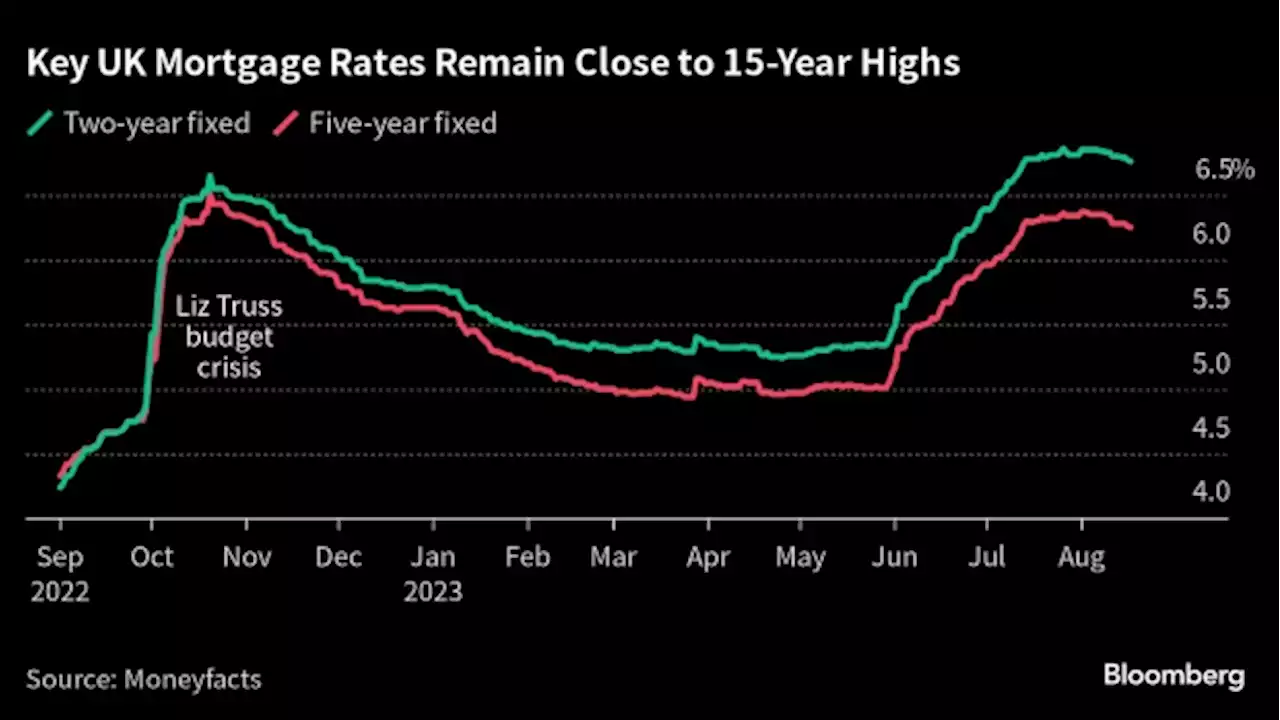

The figures add to evidence showing the housing market is cooling in the face of surging mortgage costs. Earlier Wednesday, property portal Zoopla said UK home sales are on track to plunge more than 20% this year to their lowest level since 2012. While mortgage rates are beginning to edge lower, borrowing costs for households remain far higher than they were a year ago. That’s compounding the cost-of-living crisis, with prospective buyers facing rising rental costs and elevated prices for food and other everyday goods.

The effective interest rate on new mortgages rose by a further 3 basis points, to 4.66% in July, the BOE said. Consumers took out £1.2 billion on unsecured credit such as credit cards, down from £1.6 billion the previous month. They deposited an additional £400 million with banks and building societies, compared to £3.8 billion in June.“Mortgage approvals nosedived by almost 10% in one month as the spike in borrowing costs hit demand in July. We expect elevated interest rates will continue to contain new mortgage applications, weighing on the British housing market ahead.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

China’s Mortgage Rate Cuts Fall Short of ‘Game Changer’ PoliciesChina’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth.

China’s Mortgage Rate Cuts Fall Short of ‘Game Changer’ PoliciesChina’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth.

Lire la suite »

China Mortgage Rate Cuts Fall Short of ‘Game Changer’ Policy(Bloomberg) -- China’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth. Most Read from BloombergCitadel Vets 69,000 Intern Applicants to Find Next Math GeniusesPutin Agrees to Visit China in First Trip Since Arrest WarrantWhat to Do With a 45-Story Skyscraper and No TenantsCrypto Scores Landmark US Legal Win With Grayscale ETF RulingStocks Up Most Since June

China Mortgage Rate Cuts Fall Short of ‘Game Changer’ Policy(Bloomberg) -- China’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth. Most Read from BloombergCitadel Vets 69,000 Intern Applicants to Find Next Math GeniusesPutin Agrees to Visit China in First Trip Since Arrest WarrantWhat to Do With a 45-Story Skyscraper and No TenantsCrypto Scores Landmark US Legal Win With Grayscale ETF RulingStocks Up Most Since June

Lire la suite »

First-Time Buyers Leave UK Housing Market as Mortgage Rates JumpFirst-time buyers deserted the UK housing market in the second quarter after a surge in mortgage costs prevented many from getting a foot on the property ladder.

First-Time Buyers Leave UK Housing Market as Mortgage Rates JumpFirst-time buyers deserted the UK housing market in the second quarter after a surge in mortgage costs prevented many from getting a foot on the property ladder.

Lire la suite »

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Lire la suite »

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Lire la suite »

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Concerned citizens oppose glyphosate spray approvals for Nova Scotia forestConcerned residents in the Annapolis Valley and across mainland Nova Scotia are mobilizing to prevent the aerial spraying of herbicide on forestry ...

Lire la suite »