China’s anticipated cut to rates on existing mortgages marks one of the most concrete actions yet to boost the beleaguered economy, though it likely won’t be enough on its own to shore up growth.

That’s according to several economists after Bloomberg News reported Tuesday that the nation’s largest lenders are preparing to cut interest rates on existing mortgages and deposits. The state-directed measures mark the latest push by Beijing to spur consumer spending, juice the stock market and ease pressure on bank profit margins as the world’s second-largest economy loses steam.

China’s economic recovery is struggling under the weight of deflationary pressures, waning exports and a persistent property crisis. Real estate giant Country Garden Holdings Co. is teetering on the brink of default and risks from the property turmoil are now spreading to the country’s $60 trillion financial system.

“A big cut may prompt some to repay early loans on some properties they hold to make mortgages on the rest of homes they own eligible for the rate reduction,” Xing said. He doesn’t expect the magnitude of the cuts to be huge, given the need to reconcile the interests of developers, homebuyers and financial institutions.

Major lenders are also poised to cut deposit rates later this week for the third time in a year, Bloomberg News reported. That measure should help reduce costs for the state-owned banks and protect their profit margins, allowing them to lower their lending rates over time. Analysts recently polled by Bloomberg see the People’s Bank of China trimming the rate on its one-year policy loans by another 10 basis points before the end of the fourth quarter, after cutting it twice in 2023 already.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

China Mega Banks Weigh Further Deposit Rate Cuts to Boost GrowthChina’s biggest state-owned banks are considering lowering deposit rates for at least the third time in a year, according to people familiar with the matter, as they ramp up efforts to boost the economy and protect margins.

China Mega Banks Weigh Further Deposit Rate Cuts to Boost GrowthChina’s biggest state-owned banks are considering lowering deposit rates for at least the third time in a year, according to people familiar with the matter, as they ramp up efforts to boost the economy and protect margins.

Lire la suite »

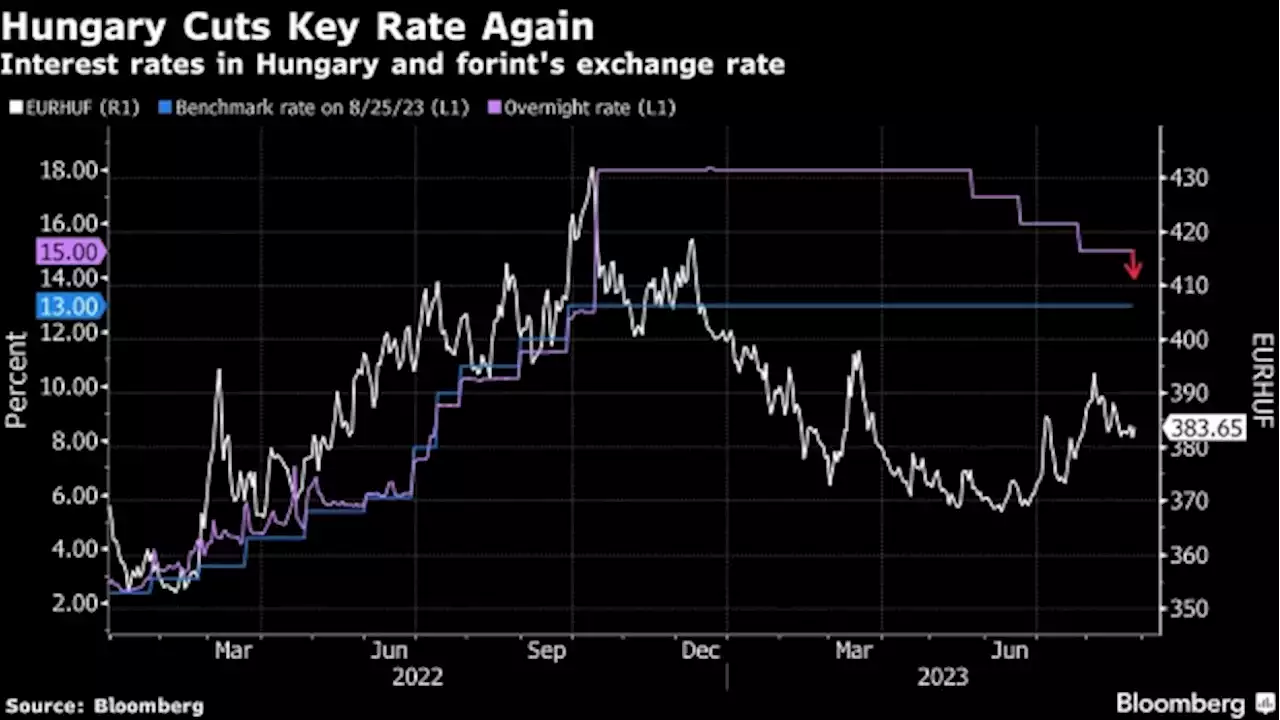

Hungary Cuts Key Interest Rate to 14% as Record Recession Bites(Bloomberg) -- Hungary lowered the highest key interest rate in the European Union by a full percentage point as policymakers try to combat the country’s longest recession since at least 1995.

Hungary Cuts Key Interest Rate to 14% as Record Recession Bites(Bloomberg) -- Hungary lowered the highest key interest rate in the European Union by a full percentage point as policymakers try to combat the country’s longest recession since at least 1995.

Lire la suite »

Fed to keep markets guessing on rate pauses and cuts -former policymakersBy Divya Chowdhury and Lisa Pauline Mattackal (Reuters) - The U.S. Federal Reserve is unlikely to provide clear signals on whether it will pause ...

Fed to keep markets guessing on rate pauses and cuts -former policymakersBy Divya Chowdhury and Lisa Pauline Mattackal (Reuters) - The U.S. Federal Reserve is unlikely to provide clear signals on whether it will pause ...

Lire la suite »

My mortgage is coming up for renewal – what should I do now?HELOC vs. fixed rate vs. variable rate

My mortgage is coming up for renewal – what should I do now?HELOC vs. fixed rate vs. variable rate

Lire la suite »

Home prices rose again in June but higher mortgage rates complicate housing's outlookThe S&P Case-Shiller US National Composite home price index increased by 0.7% in June compared with May on a seasonally adjusted basis.

Home prices rose again in June but higher mortgage rates complicate housing's outlookThe S&P Case-Shiller US National Composite home price index increased by 0.7% in June compared with May on a seasonally adjusted basis.

Lire la suite »

First-Time Buyers Leave UK Housing Market as Mortgage Rates JumpFirst-time buyers deserted the UK housing market in the second quarter after a surge in mortgage costs prevented many from getting a foot on the property ladder.

First-Time Buyers Leave UK Housing Market as Mortgage Rates JumpFirst-time buyers deserted the UK housing market in the second quarter after a surge in mortgage costs prevented many from getting a foot on the property ladder.

Lire la suite »