Strong upcoming earnings results could reverse the decline in mega-cap technology and growth stocks, which have been hammered by the rise in Treasury yields and are trading at their cheapest levels in six years by one measure, according to Goldman Sachs strategists. The so-called Magnificent Seven group of megacap stocks -Apple, Microsoft, Amazon.com, Alphabet, Nvidia, Tesla, and Meta Platforms - have fallen 7% over the last two months, compared with a 3% decline in the broad S&P 500, as Treasury yields jumped more than 60 basis points to 16-year highs. Those declines have pushed mega-cap forward price-to-earnings ratios down by a collective 20% over the last two months, leaving them trading at their largest discount to the market based on long-term growth since January 2017, Goldman Sachs said in a note dated Oct. 1.

NEW YORK - Strong upcoming earnings results could reverse the decline in mega-cap technology and growth stocks, which have been hammered by the rise in Treasury yields and are trading at their cheapest levels in six years by one measure, according to Goldman Sachs strategists.

The mega caps in aggregate have beaten consensus sales growth expectations 81% of the time and have outperformed in two-thirds of earnings seasons since the fourth quarter of 2016, Goldman's strategists said. The average recommended allocation to equities in balanced funds remained unchanged at 53% in September, below the benchmark of 60%, Subramanian noted. Falling sentiment has historically been a signal of broad gains over the following 12 months, she noted.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

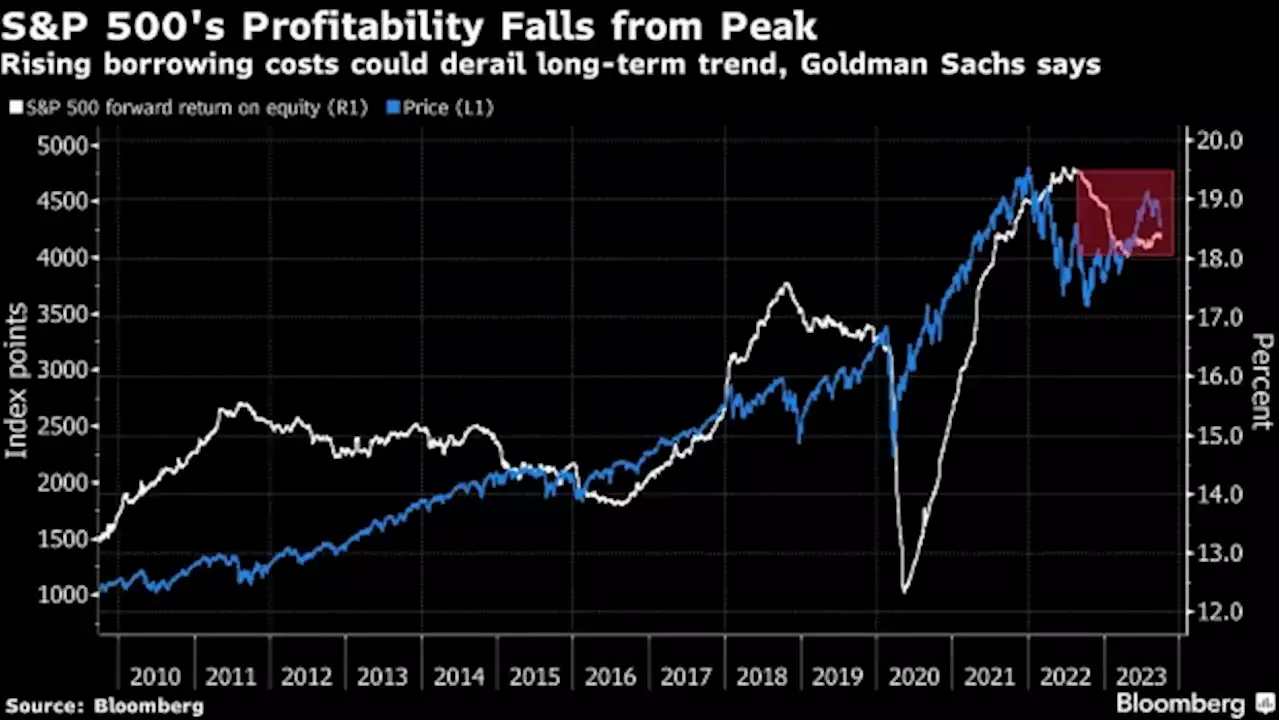

Higher Rates Starting to Hit US Profits, Goldman Strategists WarnRising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.

Higher Rates Starting to Hit US Profits, Goldman Strategists WarnRising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.

Lire la suite »

Goldman Sees Earnings-Led Rally in Big Tech Stocks After RoutUS technology stocks may be about to turn a corner after the Nasdaq 100’s biggest monthly decline this year, according to strategists at Goldman Sachs Group Inc.

Goldman Sees Earnings-Led Rally in Big Tech Stocks After RoutUS technology stocks may be about to turn a corner after the Nasdaq 100’s biggest monthly decline this year, according to strategists at Goldman Sachs Group Inc.

Lire la suite »

Higher Rates Starting to Hit US Profits, Goldman Strategists Warn(Bloomberg) -- Rising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.Most Read from BloombergWhy a US Recession Is Still Likely — and Coming SoonOnce Unthinkable Bond Yields Now the New Normal for MarketsCongress Averts US Government Shutdown Hours Before DeadlineSevere Crash Is Coming for US Office Properties, Investors SayAging Trees Show a Crisis Looms for the World’s Eve

Higher Rates Starting to Hit US Profits, Goldman Strategists Warn(Bloomberg) -- Rising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.Most Read from BloombergWhy a US Recession Is Still Likely — and Coming SoonOnce Unthinkable Bond Yields Now the New Normal for MarketsCongress Averts US Government Shutdown Hours Before DeadlineSevere Crash Is Coming for US Office Properties, Investors SayAging Trees Show a Crisis Looms for the World’s Eve

Lire la suite »

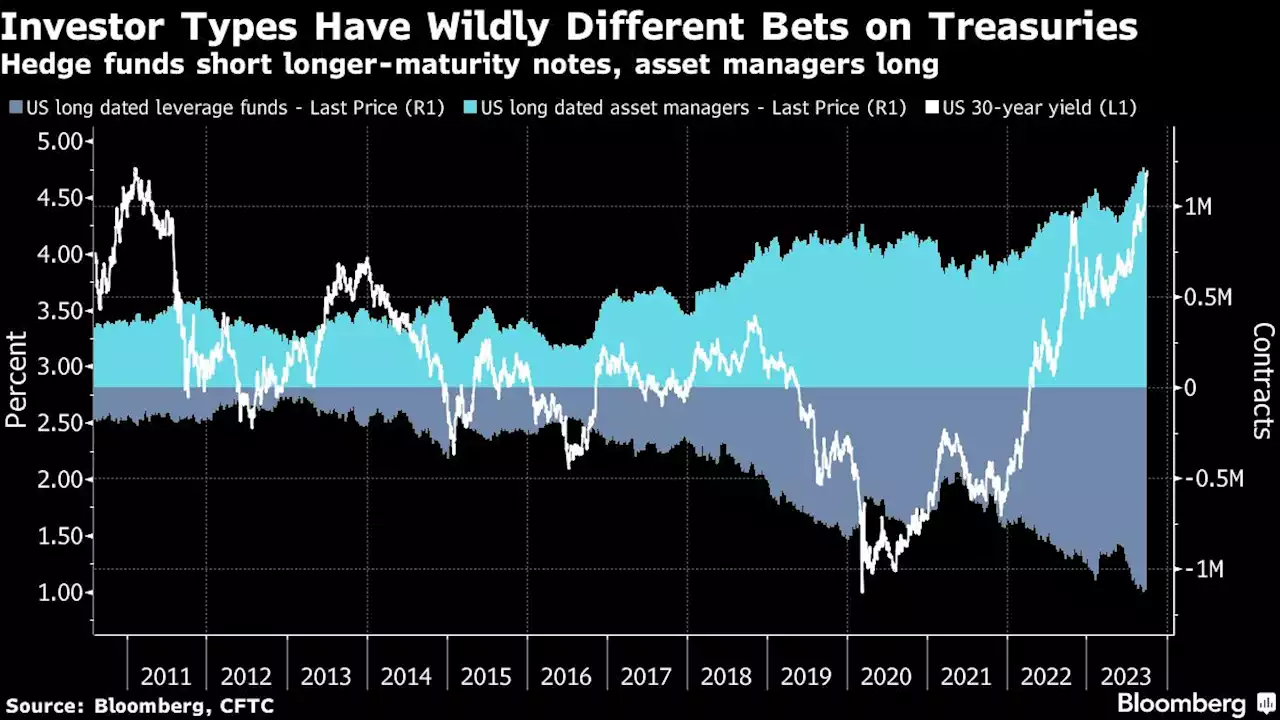

Treasury Yields Climb After US Deal Returns Focus to Rate HikesTreasuries began the week on the back foot after a US government shutdown was averted, eliminating a point of uncertainty for traders and returning their focus to the path ahead for interest rates.

Treasury Yields Climb After US Deal Returns Focus to Rate HikesTreasuries began the week on the back foot after a US government shutdown was averted, eliminating a point of uncertainty for traders and returning their focus to the path ahead for interest rates.

Lire la suite »

Treasury Yields Climb After US Deal Returns Focus to Rate Hikes(Bloomberg) -- Treasuries began the week on the back foot after a US government shutdown was averted, eliminating a point of uncertainty for traders and returning their focus to the path ahead for interest rates.Most Read from BloombergOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineMcCarthy to Face Far-Right Attempt to Oust Him as House SpeakerSenate Voting on Bill to Avert US Government ShutdownWhy a US Recession Is Still L

Treasury Yields Climb After US Deal Returns Focus to Rate Hikes(Bloomberg) -- Treasuries began the week on the back foot after a US government shutdown was averted, eliminating a point of uncertainty for traders and returning their focus to the path ahead for interest rates.Most Read from BloombergOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineMcCarthy to Face Far-Right Attempt to Oust Him as House SpeakerSenate Voting on Bill to Avert US Government ShutdownWhy a US Recession Is Still L

Lire la suite »