(Bloomberg) -- Rising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.Most Read from BloombergWhy a US Recession Is Still Likely — and Coming SoonOnce Unthinkable Bond Yields Now the New Normal for MarketsCongress Averts US Government Shutdown Hours Before DeadlineSevere Crash Is Coming for US Office Properties, Investors SayAging Trees Show a Crisis Looms for the World’s Eve

-- Rising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.Aging Trees Show a Crisis Looms for the World’s Everything Oil

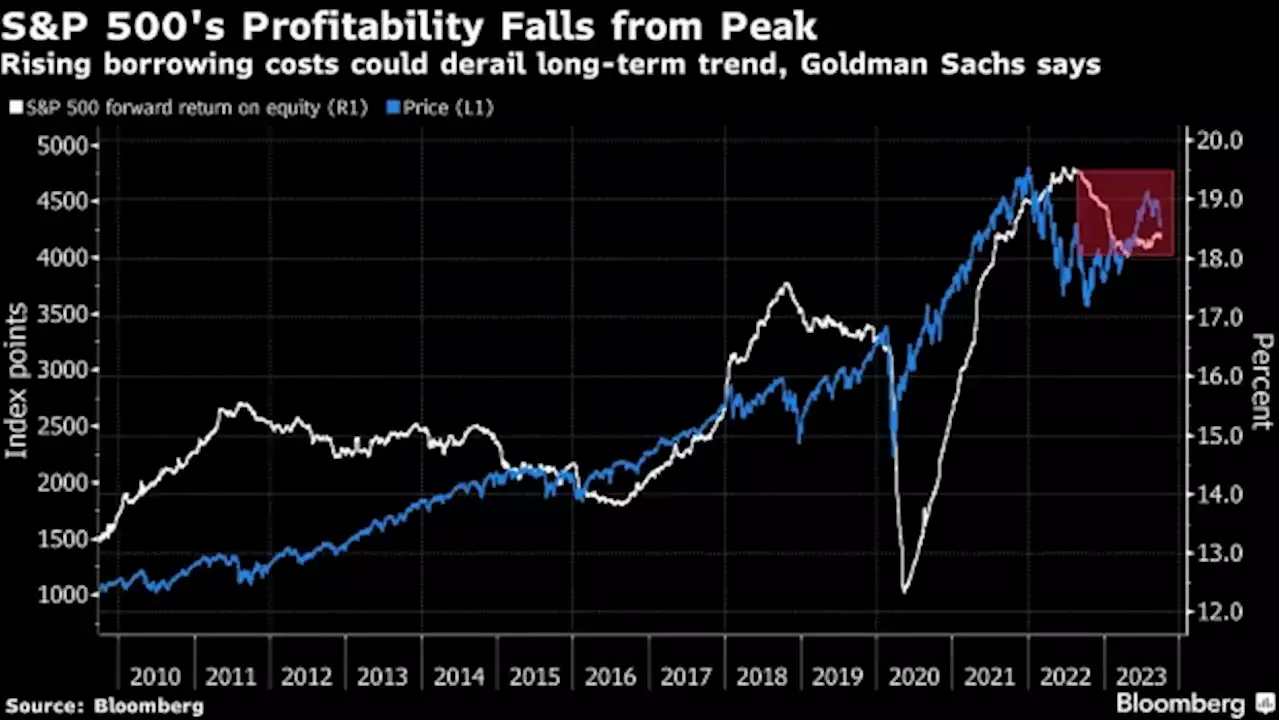

For decades, falling interest costs and greater leverage have accounted for nearly one-fifth of an overall 8.8 percentage points increase in the return on equity of S&P 500 firms, according to the strategists. US stocks have struggled since the start of August, with the S&P 500 dropping about 6.5% on rising bond yields and subdued economic growth expectations. While the Federal Reserve paused its rate-hike campaign in September, hawkish messages from officials pushed the 10-year Treasury yield above 4.6% — its highest level in nearly 16 years.

Separately, Goldman strategists said US technology stocks may be about to turn a corner after the Nasdaq 100’s biggest monthly decline this year.The S&P 500’s profitability, ex-financials, has continued to decline this year from its peak in the second quarter of 2022, with increased interest expenses being the largest drag on earnings, the analysts wrote. They expect ROE to stabilize in 2024 with a low likelihood of increasing due to subdued economic growth.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Higher Rates Starting to Hit US Profits, Goldman Strategists WarnRising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.

Higher Rates Starting to Hit US Profits, Goldman Strategists WarnRising rates are starting to weigh on US corporate profits and if they stay higher for longer it may upend a historical trend, according to Goldman Sachs Group Inc. strategists.

Lire la suite »

Homeowners brace for mortgage payment shock amid higher-for-longer interest ratesMany homeowners who locked in low rates years ago are bracing themselves for financial pain as their mortgage comes up for renewal. Read on.

Homeowners brace for mortgage payment shock amid higher-for-longer interest ratesMany homeowners who locked in low rates years ago are bracing themselves for financial pain as their mortgage comes up for renewal. Read on.

Lire la suite »

Homeowners brace for mortgage payment shock amid higher-for-longer interest ratesMany homeowners who locked in low rates years ago are bracing themselves for financial pain as their mortgage comes up for renewal. Read on.

Homeowners brace for mortgage payment shock amid higher-for-longer interest ratesMany homeowners who locked in low rates years ago are bracing themselves for financial pain as their mortgage comes up for renewal. Read on.

Lire la suite »

Homeowners brace for mortgage payment shock amid higher-for-longer rate outlookTORONTO, Australia — From ultra-low interest rates that led to a huge spike in real estate demand to the speed with which interest rates shot up to levels not seen in a generation, it’s been hard to keep up with the shifting landscape for mortgage holders. Now, with interest rates increasingly expected to stay higher for longer, many of the homeowners who locked in low rates years ago are likely bracing themselves for financial pain as their mortgage comes up for renewal. “Each month that passes

Homeowners brace for mortgage payment shock amid higher-for-longer rate outlookTORONTO, Australia — From ultra-low interest rates that led to a huge spike in real estate demand to the speed with which interest rates shot up to levels not seen in a generation, it’s been hard to keep up with the shifting landscape for mortgage holders. Now, with interest rates increasingly expected to stay higher for longer, many of the homeowners who locked in low rates years ago are likely bracing themselves for financial pain as their mortgage comes up for renewal. “Each month that passes

Lire la suite »

Current rates will tempt some mortgage pros to recommend variable options, one broker warnsThe financial incentive to recommend longer-term variable mortgages, which pay a higher commission, is substantial, says Toronto-based broker

Current rates will tempt some mortgage pros to recommend variable options, one broker warnsThe financial incentive to recommend longer-term variable mortgages, which pay a higher commission, is substantial, says Toronto-based broker

Lire la suite »