The market for carbon offsets is approaching a “material tipping point” following months of bad news that’s spooked investors, according to an analysis by Morgan Stanley.

The voluntary carbon market has been gripped by a steady stream of scandals, leading to wild price swings and even collapsing valuations. That has implications for firms trading such credits, which have been saddled with vast piles of stranded assets, as well as for the companies using them to underpin green claims to customers and regulators.

Futures prices have fallen between 38% and 77% so far this year “amidst significant negative press of the market,” the analysts wrote. Spot market prices have fared better, on average, they said, but there’s been “a broader market softening across most major project types.” The upshot, they said, is that the market now faces “a reckoning,” but there’s reason to believe that “progress” is coming.

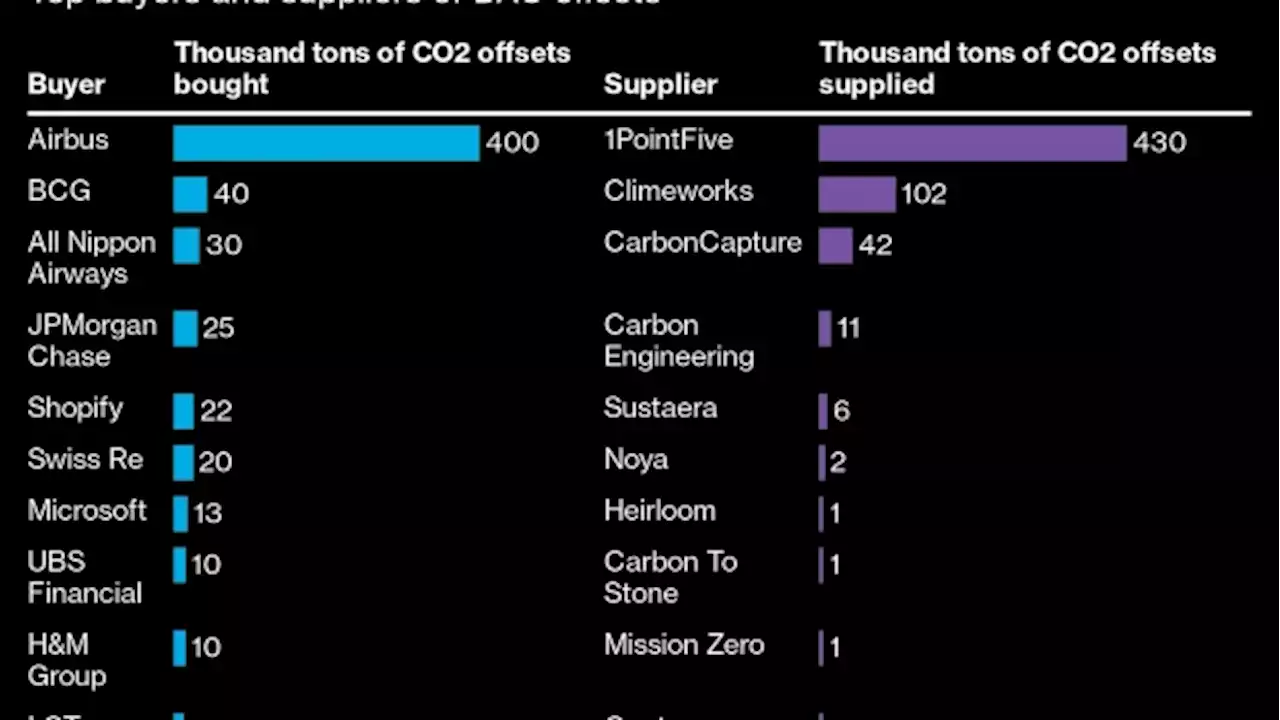

But independent scientific analysis of a project’s CO2 reduction claims often lags behind the issuance of the corresponding carbon credits, leaving buyers in the $2 billion market exposed to losses. That said, there are still a number of major corporations keen to tap the offsets market as they struggle to reduce their carbon footprints, with Morgan Stanley singling out Microsoft Corp., Shopify Inc. and JPMorgan Chase & Co. in its note.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

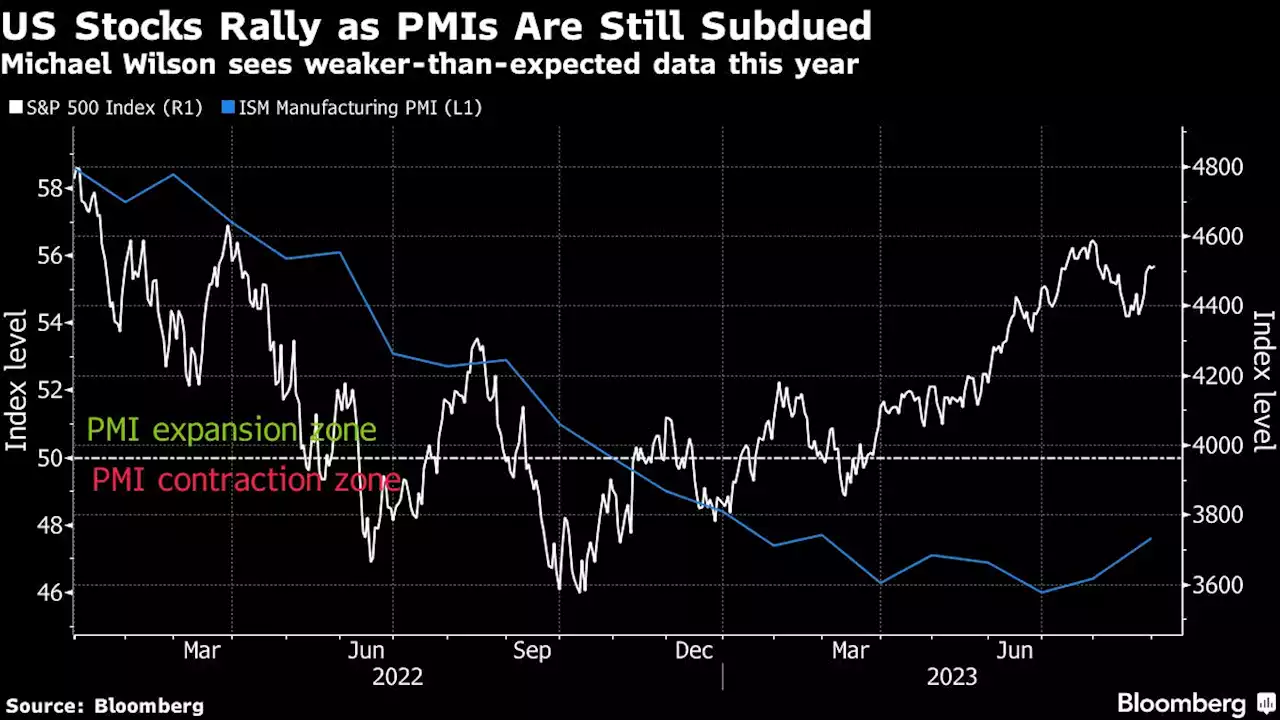

Morgan Stanley’s Wilson Says Too Much Optimism in Stock PricesUS equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.

Morgan Stanley’s Wilson Says Too Much Optimism in Stock PricesUS equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.

Lire la suite »

Morgan Stanley’s Wilson Says Too Much Optimism in Stock Prices(Bloomberg) -- US equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWhy China Is Avoiding Using ‘Bazooka’ to Spur EconomyMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketThe strategist’s warning contrasts with the rally on Wall

Morgan Stanley’s Wilson Says Too Much Optimism in Stock Prices(Bloomberg) -- US equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWhy China Is Avoiding Using ‘Bazooka’ to Spur EconomyMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketThe strategist’s warning contrasts with the rally on Wall

Lire la suite »

Ex-Morgan Stanley Executive Pruzan Tapped as Pretium’s PresidentJonathan Pruzan, former chief operating officer at Morgan Stanley, is joining single-family rental giant Pretium as the company seeks to continue its rapid growth.

Ex-Morgan Stanley Executive Pruzan Tapped as Pretium’s PresidentJonathan Pruzan, former chief operating officer at Morgan Stanley, is joining single-family rental giant Pretium as the company seeks to continue its rapid growth.

Lire la suite »

Barclays Hires Morgan Stanley’s Costa as Vice Chairman in TMTBarclays Plc hired investment banker Pedro Costa as a vice chairman focused on technology, media and telecommunications mergers in the Americas, according to a statement reviewed by Bloomberg.

Barclays Hires Morgan Stanley’s Costa as Vice Chairman in TMTBarclays Plc hired investment banker Pedro Costa as a vice chairman focused on technology, media and telecommunications mergers in the Americas, according to a statement reviewed by Bloomberg.

Lire la suite »

Morgan Stanley turnsLONDON (Reuters) - Morgan Stanley's analysts returned to a 'bearish' stance on emerging market FX on Tuesday, predicting China's economic strains would ...

Morgan Stanley turnsLONDON (Reuters) - Morgan Stanley's analysts returned to a 'bearish' stance on emerging market FX on Tuesday, predicting China's economic strains would ...

Lire la suite »

Ai investment in health care to jump in 2024: Morgan StanleyA new report from Morgan Stanley predicts AI spending in the health care industry will jump to 10.5% in 2024. Yahoo Finance Health Care Reporter Anjalee Khemlani breaks down the report

Ai investment in health care to jump in 2024: Morgan StanleyA new report from Morgan Stanley predicts AI spending in the health care industry will jump to 10.5% in 2024. Yahoo Finance Health Care Reporter Anjalee Khemlani breaks down the report

Lire la suite »