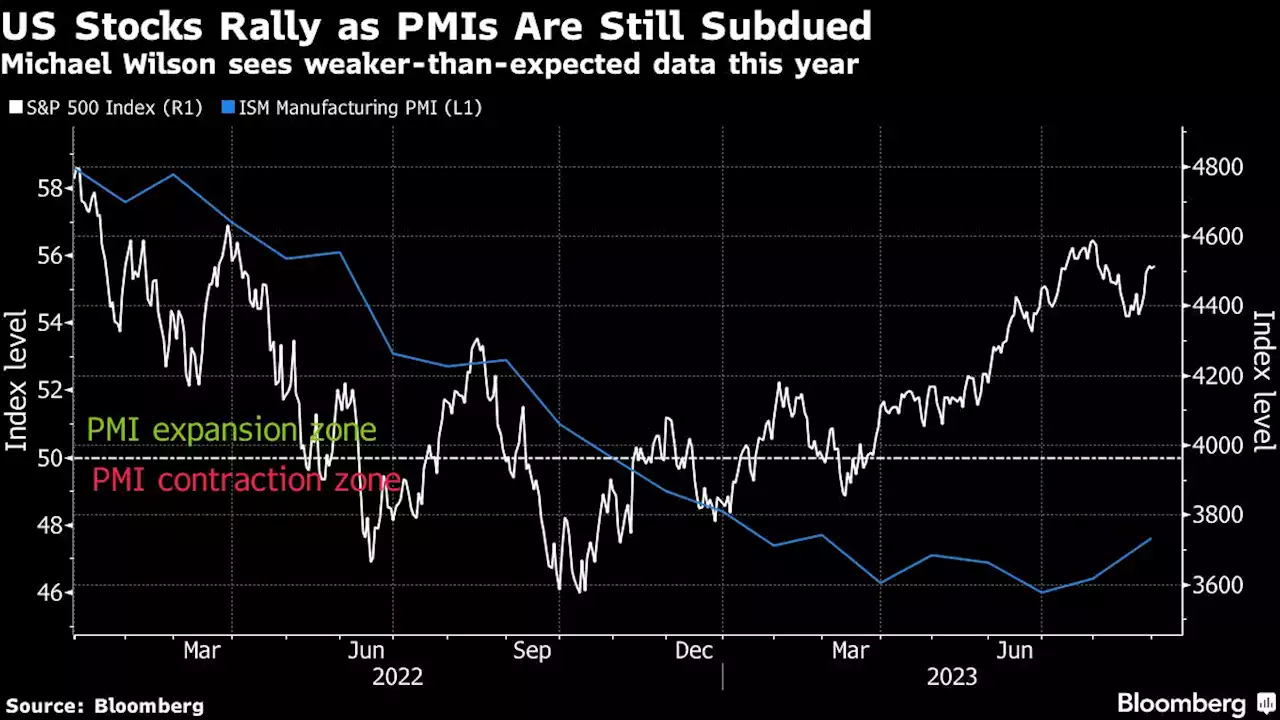

(Bloomberg) -- US equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWhy China Is Avoiding Using ‘Bazooka’ to Spur EconomyMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketThe strategist’s warning contrasts with the rally on Wall

The strategist’s warning contrasts with the rally on Wall Street, driven by expectations the economy can withstand the Federal Reserve’s hiking campaign, which is seen as peaking soon. Tech stocks have outperformed on the excitement around developments in artificial intelligence.

“At current prices, markets are now expecting a meaningful re-acceleration in growth that we think is unlikely this year, especially for the consumer,” Wilson wrote in a note on Tuesday. “Potentially softer September and October data is not priced into many stocks and expectations.” Last month, Wilson — whose negative outlook on stocks hasn’t materialized yet this year — said the “risk-off complexion” of markets will last through fall and potentially winter. Some other strategists echo his bearish view, like Bank of America Corp.’s Michael Hartnett, who said US stocks still face a pullback from the risk of a hard economic landing. JPMorgan Chase & Co.

“The bottom line is that at this stage in the cycle, the economic data can be conflicting and uncertain for both the bulls and bears,” Wilson said. “During such periods, price action tends to influence sentiment and positioning more than normal.”The strategist prefers industrials and energy companies within cyclical stocks that benefit from economic growth, while avoiding consumer discretionary and small caps.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Morgan Stanley’s Wilson Says Too Much Optimism in Stock PricesUS equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.

Morgan Stanley’s Wilson Says Too Much Optimism in Stock PricesUS equity investors are in for disappointment as economic growth is set to be weaker than expected this year, according to Morgan Stanley’s staunch bear, Michael Wilson.

Lire la suite »

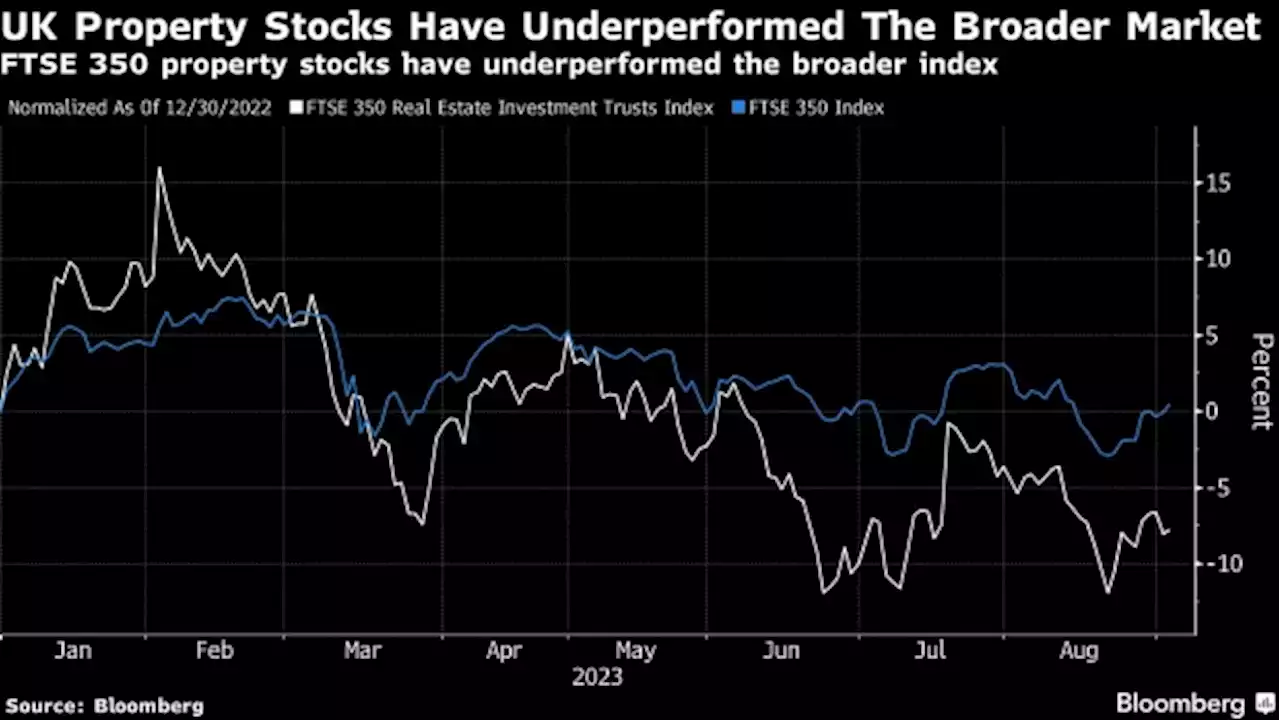

‘Oversold’ UK Property Stocks a Value Play, Morgan Stanley SaysUK property stocks are a value play, rather than a value trap, according to Morgan Stanley analysts.

‘Oversold’ UK Property Stocks a Value Play, Morgan Stanley SaysUK property stocks are a value play, rather than a value trap, according to Morgan Stanley analysts.

Lire la suite »

Lab-Grown Gems Are Crashing Prices for One Key Type of Diamond(Bloomberg) -- One of the world’s most popular types of rough diamonds has plunged into a pricing free fall, as a growing number of Americans choose engagement rings made from lab-grown stones instead.Most Read from BloombergTesla’s $41,000 Model X Discount Unlocks Subsidies Musk Wanted GoneCovid Is Back. Is It Time to Pull Out Our Masks Again?BMW Unwraps Next-Generation EV to Take on Tesla, China’s BYDJimmy Buffett, Singer Who Spun Margaritas Into Gold, Dies at 76Mohamed Al Fayed, Tycoon Who Cl

Lab-Grown Gems Are Crashing Prices for One Key Type of Diamond(Bloomberg) -- One of the world’s most popular types of rough diamonds has plunged into a pricing free fall, as a growing number of Americans choose engagement rings made from lab-grown stones instead.Most Read from BloombergTesla’s $41,000 Model X Discount Unlocks Subsidies Musk Wanted GoneCovid Is Back. Is It Time to Pull Out Our Masks Again?BMW Unwraps Next-Generation EV to Take on Tesla, China’s BYDJimmy Buffett, Singer Who Spun Margaritas Into Gold, Dies at 76Mohamed Al Fayed, Tycoon Who Cl

Lire la suite »

Lab-Grown Gems Are Crashing Prices for One Key Type of DiamondDe Beers has been forced to slash prices aggressively for one of its benchmark products.

Lab-Grown Gems Are Crashing Prices for One Key Type of DiamondDe Beers has been forced to slash prices aggressively for one of its benchmark products.

Lire la suite »

Bitcoin: As miners sell big, here’s what it means for BTC pricesWith Bitcoin trading under $26,000, miners on the network have begun to empty their wallets. With market sentiments already dampened by the SEC's latest decision, this might put further downward pressure on the coin's price.

Bitcoin: As miners sell big, here’s what it means for BTC pricesWith Bitcoin trading under $26,000, miners on the network have begun to empty their wallets. With market sentiments already dampened by the SEC's latest decision, this might put further downward pressure on the coin's price.

Lire la suite »

Stellar struggles at the mid-range, will XLM prices dipXLM breached the mid-range level and could tempt sellers to push prices lower.

Stellar struggles at the mid-range, will XLM prices dipXLM breached the mid-range level and could tempt sellers to push prices lower.

Lire la suite »