Investors in semiconductor stocks face a growing threat to industry valuations: a chronic shortage of water.

For Abrdn Plc, there are now few issues as pressing as water for the sector, according to David Smith, a senior investment director for Asian equities at the asset manager.

Abrdn, which holds stakes in Taiwan Semiconductor Manufacturing Co. and ASML Holding NV, isn’t alone in its view. Morgan Stanley analysts warn of shortages and tensions ahead with technologies like artificial intelligence requiring vast amounts of water, while climate change and extreme heat are making access more precarious than ever.

Achieving such goals is becoming increasingly challenging as the planet heats up. Bloomberg Intelligence estimates that Taiwan is facing “abnormal climate patterns” due to global heating and weather patterns such as El Nino, which has the potential to impact “the stability of its water supply.”Last year, TSMC’s water per wafer mask layer rose 14.5%, hurting its efforts to meet a 16% savings goal, BI analysts Charles Shum and Sean Chen wrote in an August note.

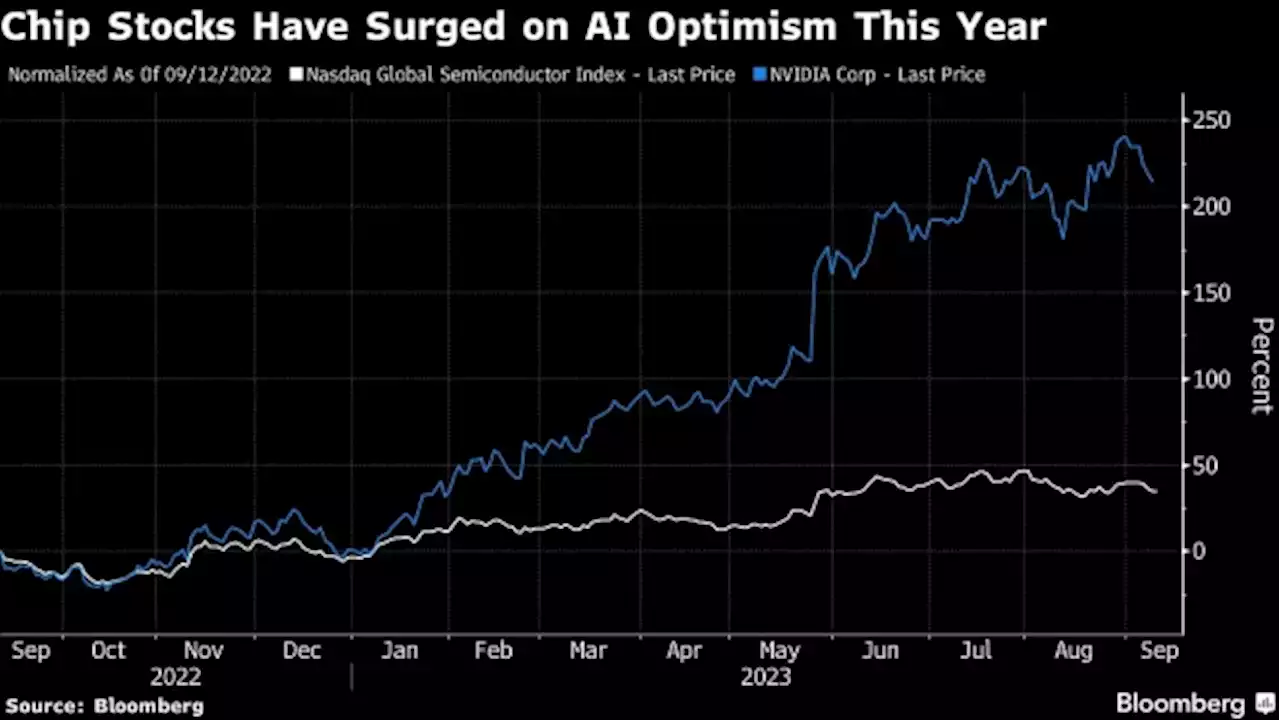

But there are some notable exceptions. One of the world’s biggest climate funds, which is managed by Nordea Asset Management and adheres to the European Union’s strictest ESG rules, didn’t hold TSMC at the end of July, according to the latest available data compiled by Bloomberg. The sector has soared as semiconductors support everything from artificial intelligence to building 5G technology. Valuations also have been underpinned by supply concerns fanned by US-China tensions and the trade barriers that have ensued. But with the Nasdaq Global Semiconductor Index up about 40% year-to-date, some investors are starting to look for potential cracks. That’s particularly true for a few of the sector’s absolute top performers, with Nvidia up more than 200% this year.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

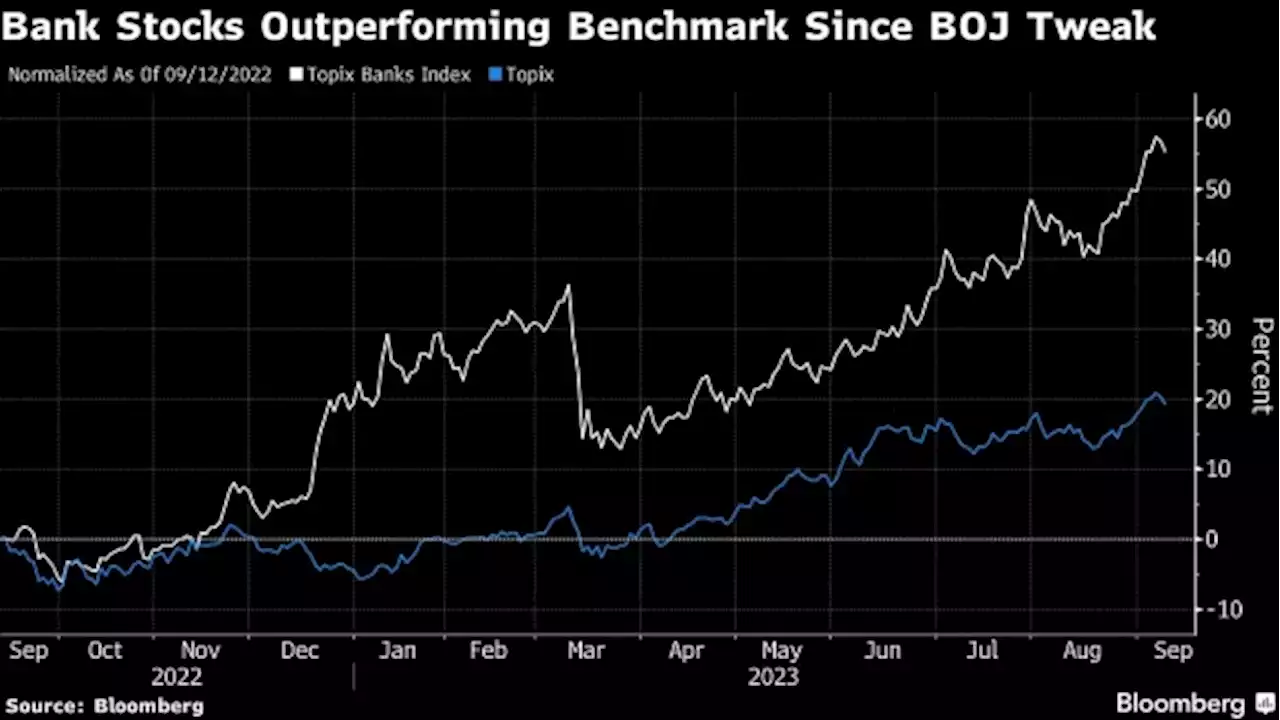

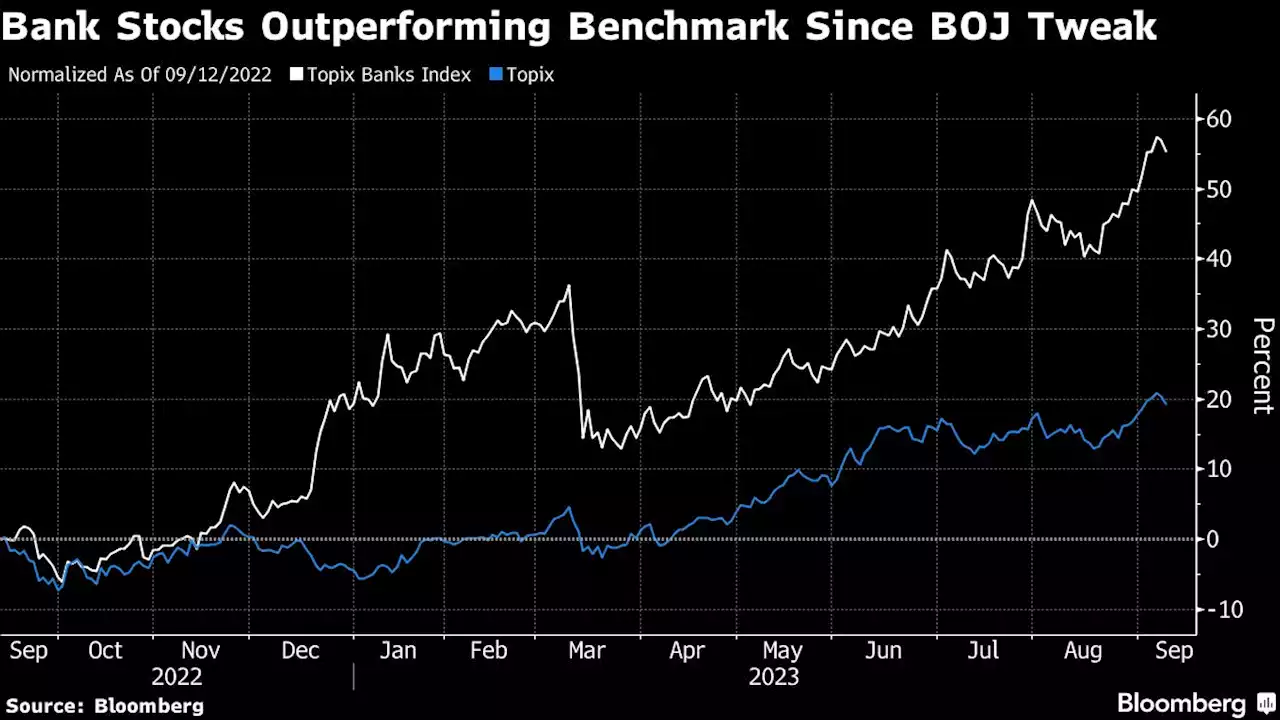

Top Fund Managers Pile Into Japan Banks on BOJ Tightening BetsA top-ranked fund that keeps a fifth of assets in shares of Japanese lenders is ready to increase that position on the possibility the central bank is preparing to end its ultra-easy monetary policy.

Top Fund Managers Pile Into Japan Banks on BOJ Tightening BetsA top-ranked fund that keeps a fifth of assets in shares of Japanese lenders is ready to increase that position on the possibility the central bank is preparing to end its ultra-easy monetary policy.

Lire la suite »

Top Fund Managers Snap Up Japan Banks on BOJ Tightening Bets(Bloomberg) -- A top-ranked fund that keeps a fifth of assets in shares of Japanese lenders is ready to increase that position on the possibility the central bank is preparing to end its ultra-easy monetary policy. Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiThe Mighty American Consumer Is About to Hit a Wall, Investors SayTesla and China Risk Leaving Volkswagen on a Road to NowhereTech Giants Power Stock Gains as Tesla Jumps 10%: Marke

Top Fund Managers Snap Up Japan Banks on BOJ Tightening Bets(Bloomberg) -- A top-ranked fund that keeps a fifth of assets in shares of Japanese lenders is ready to increase that position on the possibility the central bank is preparing to end its ultra-easy monetary policy. Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiThe Mighty American Consumer Is About to Hit a Wall, Investors SayTesla and China Risk Leaving Volkswagen on a Road to NowhereTech Giants Power Stock Gains as Tesla Jumps 10%: Marke

Lire la suite »

Global fund managers increasingly bullishDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow

Global fund managers increasingly bullishDaily roundup of research and analysis from The Globe and Mail’s market strategist Scott Barlow

Lire la suite »

Gulf Sovereign Fund, Hedge Fund Tycoons Bankroll Biotech to Fight AgingSwiss biotech firm Rejuveron Life Sciences AG has attracted backing from sovereign fund Mubadala Investment Co. to help bankroll its development of drugs targeting the effects of aging, people familiar with the matter said.

Gulf Sovereign Fund, Hedge Fund Tycoons Bankroll Biotech to Fight AgingSwiss biotech firm Rejuveron Life Sciences AG has attracted backing from sovereign fund Mubadala Investment Co. to help bankroll its development of drugs targeting the effects of aging, people familiar with the matter said.

Lire la suite »

Canada's AIMCo to open its first Asia office in SingaporeCanadian pension fund manager Alberta Investment Management Corporation (AIMCo) said on Tuesday it was expanding into Asia and opening its first regional office in Singapore. The fund manager, which manages $158 billion in assets, invests globally on behalf of 17 pension, endowment and government funds in the Canadian province of Alberta. Kevin Bong, a former managing director at Singaporean sovereign wealth fund GIC, will head the Asia Pacific office, the fund manager said.

Canada's AIMCo to open its first Asia office in SingaporeCanadian pension fund manager Alberta Investment Management Corporation (AIMCo) said on Tuesday it was expanding into Asia and opening its first regional office in Singapore. The fund manager, which manages $158 billion in assets, invests globally on behalf of 17 pension, endowment and government funds in the Canadian province of Alberta. Kevin Bong, a former managing director at Singaporean sovereign wealth fund GIC, will head the Asia Pacific office, the fund manager said.

Lire la suite »

Money managers divided on energy’s prospects as demand for oil hits ‘highest point in history’One expert expects global oil inventories to end 2023 at the lowest point in more than eight years and fall even further in 2024, putting upward pressure on the price of oil

Money managers divided on energy’s prospects as demand for oil hits ‘highest point in history’One expert expects global oil inventories to end 2023 at the lowest point in more than eight years and fall even further in 2024, putting upward pressure on the price of oil

Lire la suite »