Swiss biotech firm Rejuveron Life Sciences AG has attracted backing from sovereign fund Mubadala Investment Co. to help bankroll its development of drugs targeting the effects of aging, people familiar with the matter said.

Rejuveron has raised about $75 million from a series B funding round and convertible loan deal, the people said. Investors in the fundraising include Catalio Capital Management, the life sciences-focused firm backed by hedge fund billionaires Stan Druckenmiller and Alan Howard, the people said.

Rejuveron is developing therapies to prevent or reverse diseases of aging and extend people’s lifespans. It’s running clinical trials for treatments targeting retinitis pigmentosa, a group of rare eye diseases that cause progressive vision loss, as well as sarcopenia, a condition that causes muscle loss as a person gets older.

“The MENA region has already seen several major announcements to propel longevity research and development,” Rejuveron said in response to Bloomberg queries. “We believe that taking our place in this thriving ecosystem will help our development goals and invigorate healthcare delivery that is much needed to advance the cause of preventative medicine.”

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

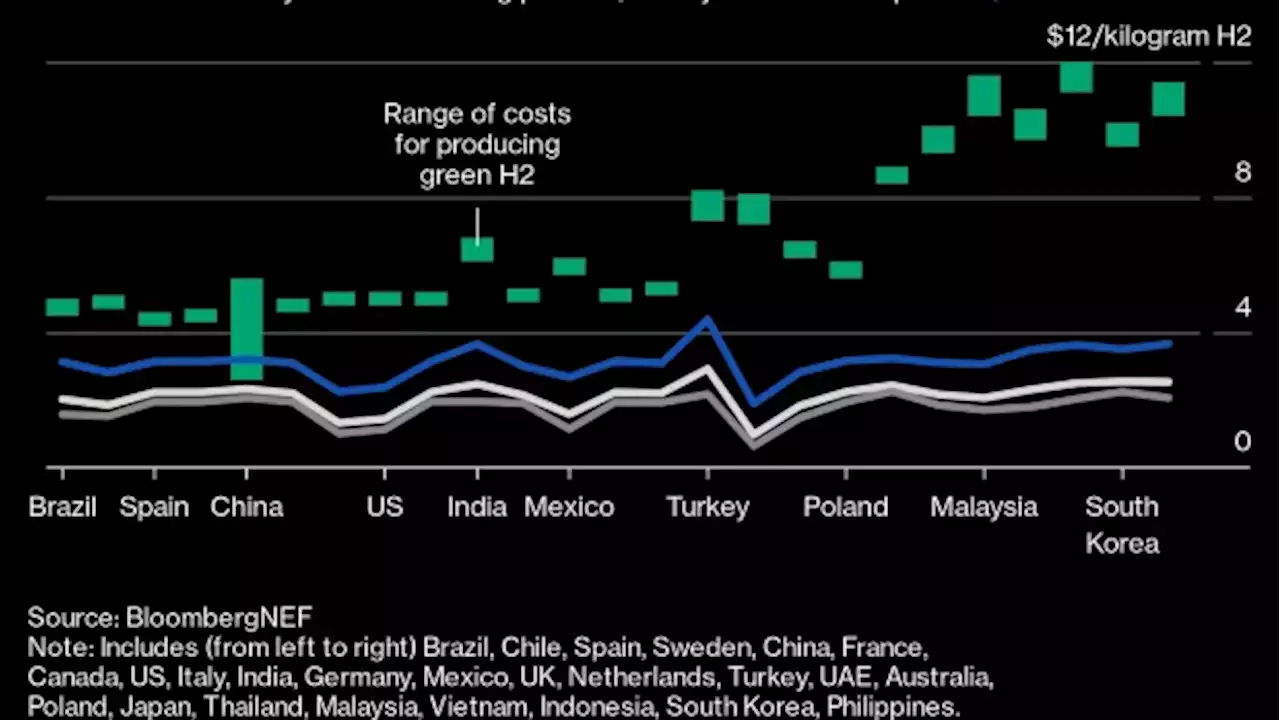

Hedge Fund Boss Slams Hydrogen Bets as ‘Complete Waste of Time’Hydrogen is a losing bet for investors interested in making money in the foreseeable future, according to Barry Norris, the founder and chief investment officer of UK hedge fund Argonaut Capital Partners.

Hedge Fund Boss Slams Hydrogen Bets as ‘Complete Waste of Time’Hydrogen is a losing bet for investors interested in making money in the foreseeable future, according to Barry Norris, the founder and chief investment officer of UK hedge fund Argonaut Capital Partners.

Lire la suite »

Canada's AIMCo to open its first Asia office in SingaporeCanadian pension fund manager Alberta Investment Management Corporation (AIMCo) said on Tuesday it was expanding into Asia and opening its first regional office in Singapore. The fund manager, which manages $158 billion in assets, invests globally on behalf of 17 pension, endowment and government funds in the Canadian province of Alberta. Kevin Bong, a former managing director at Singaporean sovereign wealth fund GIC, will head the Asia Pacific office, the fund manager said.

Canada's AIMCo to open its first Asia office in SingaporeCanadian pension fund manager Alberta Investment Management Corporation (AIMCo) said on Tuesday it was expanding into Asia and opening its first regional office in Singapore. The fund manager, which manages $158 billion in assets, invests globally on behalf of 17 pension, endowment and government funds in the Canadian province of Alberta. Kevin Bong, a former managing director at Singaporean sovereign wealth fund GIC, will head the Asia Pacific office, the fund manager said.

Lire la suite »

Hedge Funds Turn Most Bearish on Euro Since January Ahead of ECBHedge funds have turned the most negative on the euro since the start of the year ahead of a watershed European Central Bank decision this week that could see policymakers break their cycle of interest-rate hikes.

Hedge Funds Turn Most Bearish on Euro Since January Ahead of ECBHedge funds have turned the most negative on the euro since the start of the year ahead of a watershed European Central Bank decision this week that could see policymakers break their cycle of interest-rate hikes.

Lire la suite »

Gold, silver need to see new bullish interest from hedge fundsKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Gold, silver need to see new bullish interest from hedge fundsKitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

Lire la suite »

Most Gulf markets in black ahead of US inflation dataMarket News

Most Gulf markets in black ahead of US inflation dataMarket News

Lire la suite »

Rosewood to Manage Julian Robertson’s New Zealand Luxury LodgesLuxury hotel operator Rosewood Hotels & Resorts will take over the management of the late hedge fund billionaire Julian Robertson’s three resorts in New Zealand.

Rosewood to Manage Julian Robertson’s New Zealand Luxury LodgesLuxury hotel operator Rosewood Hotels & Resorts will take over the management of the late hedge fund billionaire Julian Robertson’s three resorts in New Zealand.

Lire la suite »