Researchers at the Federal Reserve have issued warnings in recent weeks about possible disruptions in U.S. Treasuries due to the return of a popular hedge fund trading strategy that exacerbated a crash in the world's biggest bond market in 2020. Hedge funds' short positions in some Treasuries futures - contracts for the purchase and sale of bonds for future delivery - have recently hit record highs as part of so-called basis trades, which take advantage of the premium of futures contracts over the price of the underlying bonds, analysts have said. The trades - typically the domain of macro hedge funds with relative value strategies - consist of selling a futures contract, buying Treasuries deliverable into that contract with repurchase agreement (repo) funding, and delivering them at contract expiry.

By Davide Barbuscia

The trades - typically the domain of macro hedge funds with relative value strategies - consist of selling a futures contract, buying Treasuries deliverable into that contract with repurchase agreement funding, and delivering them at contract expiry. Separately, in a Sept. 8 note that looked among other things at hedge funds' Treasury exposures, Fed economists said there was a risk of a rapid unwind of basis trade positions in case of higher repo funding costs.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Fed economists sound alarm on hedge funds gaming US TreasuriesBy Davide Barbuscia NEW YORK (Reuters) - Researchers at the Federal Reserve have issued warnings in recent weeks about possible disruptions in U.S.

Fed economists sound alarm on hedge funds gaming US TreasuriesBy Davide Barbuscia NEW YORK (Reuters) - Researchers at the Federal Reserve have issued warnings in recent weeks about possible disruptions in U.S.

Lire la suite »

Fed economists sound alarm on hedge funds gaming U.S. TreasuriesA popular that exacerbated a crash in the world’s biggest bond market in 2020 has retuned

Fed economists sound alarm on hedge funds gaming U.S. TreasuriesA popular that exacerbated a crash in the world’s biggest bond market in 2020 has retuned

Lire la suite »

Fed: November rate hike is 'still in play,' strategist saysAugust's Consumer Price Index (CPI) print comes out this Wednesday, ahead of the Fed's September meeting next week. Comerica Wealth Management Chief Investment Officer John Lynch shares his thoughts on the Fed's path for interest rates based on inflation trends, forecasting a 50 basis point hike in the coming months, as well as what markets are expecting. 'The market discourse now is the Fed's done or close to done, and my message to investors is that the market is not done because for several reasons on the 10-year Treasury with market interest rates rising,' Lynch explains. Lynch notes how investors should position their portfolios on various Fed forecasts.

Fed: November rate hike is 'still in play,' strategist saysAugust's Consumer Price Index (CPI) print comes out this Wednesday, ahead of the Fed's September meeting next week. Comerica Wealth Management Chief Investment Officer John Lynch shares his thoughts on the Fed's path for interest rates based on inflation trends, forecasting a 50 basis point hike in the coming months, as well as what markets are expecting. 'The market discourse now is the Fed's done or close to done, and my message to investors is that the market is not done because for several reasons on the 10-year Treasury with market interest rates rising,' Lynch explains. Lynch notes how investors should position their portfolios on various Fed forecasts.

Lire la suite »

New York Fed poll finds mostly stable inflation views, more financial worries in AugustThe bank said in its Consumer Sentiment Survey for August that respondents see inflation a year from now at 3.6%, up from July’s 3.5%, while they project inflation three years from now to hit 2.8% versus 2.9% in July

New York Fed poll finds mostly stable inflation views, more financial worries in AugustThe bank said in its Consumer Sentiment Survey for August that respondents see inflation a year from now at 3.6%, up from July’s 3.5%, while they project inflation three years from now to hit 2.8% versus 2.9% in July

Lire la suite »

Rise in federal interest rates leave Calgary landlords struggling to afford rental property costsRise in costs have forced landlords to increase rents on tenants while other consider selling their properties to stave off unaffordability

Rise in federal interest rates leave Calgary landlords struggling to afford rental property costsRise in costs have forced landlords to increase rents on tenants while other consider selling their properties to stave off unaffordability

Lire la suite »

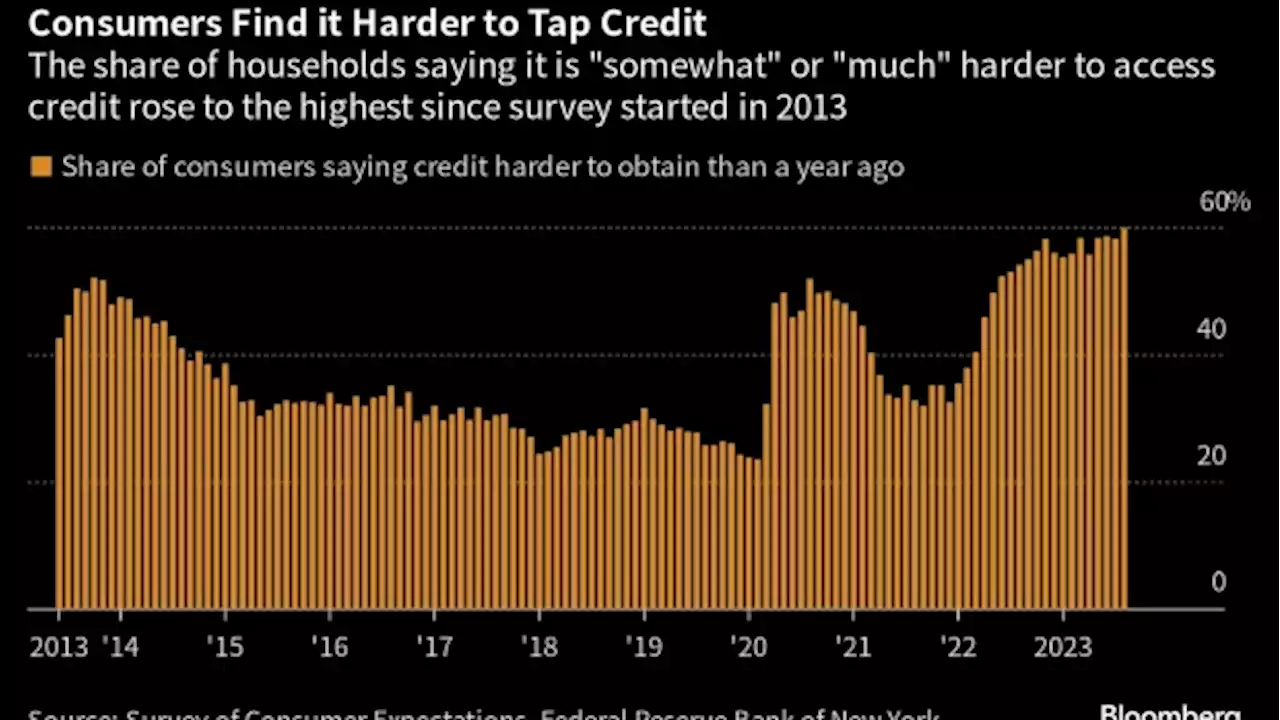

US Inflation Outlook Stable, Credit Pessimism Rises in Fed StudyUS consumers’ inflation expectations were mostly stable in August, but households grew more concerned about their finances and more pessimistic about the job market, according to a Federal Reserve Bank of New York survey.

US Inflation Outlook Stable, Credit Pessimism Rises in Fed StudyUS consumers’ inflation expectations were mostly stable in August, but households grew more concerned about their finances and more pessimistic about the job market, according to a Federal Reserve Bank of New York survey.

Lire la suite »