A popular that exacerbated a crash in the world’s biggest bond market in 2020 has retuned

Researchers at the Federal Reserve have issued warnings in recent weeks about possible disruptions in U.S. Treasuries due to the return of a popular hedge fund trading strategy that exacerbated a crash in the world’s biggest bond market in 2020.

In two separate notes in recent weeks, economists at the Fed have highlighted potential financial vulnerability risks related to these trades, which are taking place at a time of volatility in the U.S. government bond market due to higher interest rates and uncertainty over future monetary policy actions.

This would exacerbate episodes of market stress, they warned, “potentially contributing to increased Treasury market volatility and amplifying dislocations in the Treasury, futures, and repo markets.” Should financing costs increase in the repo market - where hedge funds obtain short-term loans against Treasury and other securities - the spread, or premium, of futures contracts over underlying cash Treasuries would also need to increase to maintain basis trade positions profitable.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Digital asset market liquidity hits lowest level since 2020, report saysAlthough the digital assets market has seen a notable decline in liquidity and trading volume since November 2022, long-term holders of Bitcoin have retained their holdings.

Digital asset market liquidity hits lowest level since 2020, report saysAlthough the digital assets market has seen a notable decline in liquidity and trading volume since November 2022, long-term holders of Bitcoin have retained their holdings.

Lire la suite »

NYC pension funds and state of Oregon sue Fox over 2020 election coverageNEW YORK (AP) — New York City's pension funds and the state of Oregon sued Fox Corporation on Tuesday, alleging the company harmed investors by allowing Fox News to broadcast falsehoods about the 2020 election that exposed the network to defamation lawsuits. The case, filed in Delaware, accuses the company of inviting defamation lawsuits through its amplification of conspiracy theories about the election, including a case Fox News agreed to settle for nearly $800 million with the voting machine

NYC pension funds and state of Oregon sue Fox over 2020 election coverageNEW YORK (AP) — New York City's pension funds and the state of Oregon sued Fox Corporation on Tuesday, alleging the company harmed investors by allowing Fox News to broadcast falsehoods about the 2020 election that exposed the network to defamation lawsuits. The case, filed in Delaware, accuses the company of inviting defamation lawsuits through its amplification of conspiracy theories about the election, including a case Fox News agreed to settle for nearly $800 million with the voting machine

Lire la suite »

Fed: November rate hike is 'still in play,' strategist saysAugust's Consumer Price Index (CPI) print comes out this Wednesday, ahead of the Fed's September meeting next week. Comerica Wealth Management Chief Investment Officer John Lynch shares his thoughts on the Fed's path for interest rates based on inflation trends, forecasting a 50 basis point hike in the coming months, as well as what markets are expecting. 'The market discourse now is the Fed's done or close to done, and my message to investors is that the market is not done because for several reasons on the 10-year Treasury with market interest rates rising,' Lynch explains. Lynch notes how investors should position their portfolios on various Fed forecasts.

Fed: November rate hike is 'still in play,' strategist saysAugust's Consumer Price Index (CPI) print comes out this Wednesday, ahead of the Fed's September meeting next week. Comerica Wealth Management Chief Investment Officer John Lynch shares his thoughts on the Fed's path for interest rates based on inflation trends, forecasting a 50 basis point hike in the coming months, as well as what markets are expecting. 'The market discourse now is the Fed's done or close to done, and my message to investors is that the market is not done because for several reasons on the 10-year Treasury with market interest rates rising,' Lynch explains. Lynch notes how investors should position their portfolios on various Fed forecasts.

Lire la suite »

New York Fed poll finds mostly stable inflation views, more financial worries in AugustThe bank said in its Consumer Sentiment Survey for August that respondents see inflation a year from now at 3.6%, up from July’s 3.5%, while they project inflation three years from now to hit 2.8% versus 2.9% in July

New York Fed poll finds mostly stable inflation views, more financial worries in AugustThe bank said in its Consumer Sentiment Survey for August that respondents see inflation a year from now at 3.6%, up from July’s 3.5%, while they project inflation three years from now to hit 2.8% versus 2.9% in July

Lire la suite »

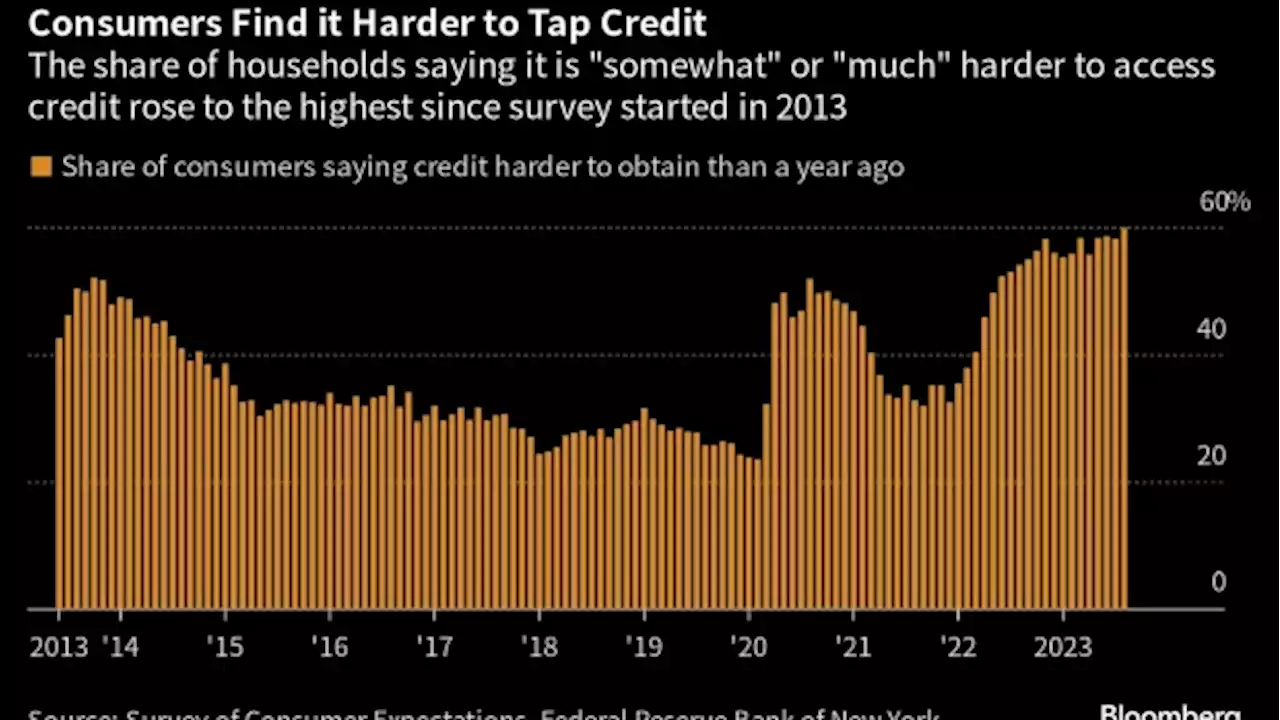

US Inflation Outlook Stable, Credit Pessimism Rises in Fed StudyUS consumers’ inflation expectations were mostly stable in August, but households grew more concerned about their finances and more pessimistic about the job market, according to a Federal Reserve Bank of New York survey.

US Inflation Outlook Stable, Credit Pessimism Rises in Fed StudyUS consumers’ inflation expectations were mostly stable in August, but households grew more concerned about their finances and more pessimistic about the job market, according to a Federal Reserve Bank of New York survey.

Lire la suite »

NY Fed poll finds mostly stable inflation views, more financial worries in AugustBy Michael S. Derby (Reuters) - Americans’ overall views on inflation were little changed in August, even as they predicted rising price increases for ...

NY Fed poll finds mostly stable inflation views, more financial worries in AugustBy Michael S. Derby (Reuters) - Americans’ overall views on inflation were little changed in August, even as they predicted rising price increases for ...

Lire la suite »