By Echo Wang and David Carnevali (Reuters) - Waystar Inc, a private equity-owned vendor of software that helps hospitals and doctors' practices manage ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOS - Waystar Inc, a private equity-owned vendor of software that helps hospitals and doctors' practices manage their finances, has tapped banks for an initial public offering that could value it at as much as $8 billion, including debt, according to people familiar with the matter.

The IPO could come later this year or early next year, subject to market conditions, the sources added, requesting anonymity because the matter is confidential. The valuation attained will also be subject to market conditions, the sources added. Waystar was formed in 2017 through the merger of Navicure and ZirMed. The company develops payment software helping clients such as large hospital systems with the collection of bills from patients.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Arm IPO to put SoftBank's AI hard sell to the testWhen SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key question - will the company have 'exponential growth' due to the boom in artificial intelligence as CEO Masayoshi Son claims? Since acquiring the chip designer in 2016, Son has positioned Arm as the tech investment conglomerate's crown jewel asset, and in recent months has enthusiastically talked up the role it could play in AI. Arm 'is at the centre of a group of AI-related companies to generate synergies' and '85% of SoftBank Group assets are AI-related companies overseas,' he told investors in June.

Arm IPO to put SoftBank's AI hard sell to the testWhen SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key question - will the company have 'exponential growth' due to the boom in artificial intelligence as CEO Masayoshi Son claims? Since acquiring the chip designer in 2016, Son has positioned Arm as the tech investment conglomerate's crown jewel asset, and in recent months has enthusiastically talked up the role it could play in AI. Arm 'is at the centre of a group of AI-related companies to generate synergies' and '85% of SoftBank Group assets are AI-related companies overseas,' he told investors in June.

Lire la suite »

Arm IPO to put SoftBank's AI hard sell to the testBy Anton Bridge TOKYO (Reuters) - When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key ...

Arm IPO to put SoftBank's AI hard sell to the testBy Anton Bridge TOKYO (Reuters) - When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key ...

Lire la suite »

Arm Listing Set to Be Turning Point for IPO Market, SoftBankArm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.

Arm Listing Set to Be Turning Point for IPO Market, SoftBankArm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.

Lire la suite »

European shares rise on energy, healthcare boost(Reuters) - European shares advanced on Monday after energy stocks tracked global crude prices higher and as a strong performance by Danish drugmaker ...

European shares rise on energy, healthcare boost(Reuters) - European shares advanced on Monday after energy stocks tracked global crude prices higher and as a strong performance by Danish drugmaker ...

Lire la suite »

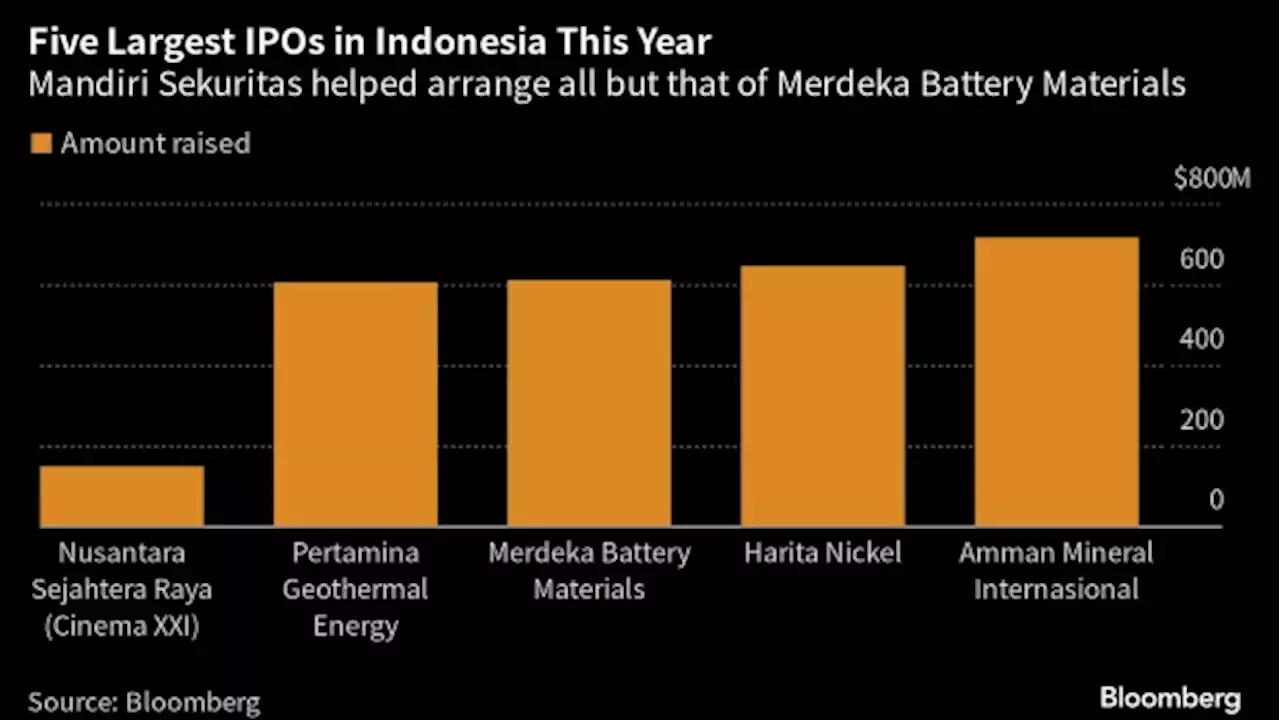

Top IPO Arranger in Indonesia Sees Larger Deals as Polls LoomLarge initial public offerings are expected to return to Indonesia next year as the country’s upcoming polls are seen to reduce political uncertainty, according to its top IPO banker.

Top IPO Arranger in Indonesia Sees Larger Deals as Polls LoomLarge initial public offerings are expected to return to Indonesia next year as the country’s upcoming polls are seen to reduce political uncertainty, according to its top IPO banker.

Lire la suite »

Instacart IPO: Why ad revenue is important to watchInstacart is planning for an IPO in September, according to a report from Bloomberg. It would be the latest in a string of companies that have gone public in recent months, such as Cava (CAVA), Savers Value Village (SVV), and VinFast Auto (VFS). Rainmaker Securities Managing Director Greg Martin says the market 'has shown some receptivity to new issuances' and that 'there's demand for growth companies.' For Instacart, Martin says, the challenge is 'its actual grocery volume... is actually not growing very fast', noting that the company is actually seeing more growth in ad revenue.

Instacart IPO: Why ad revenue is important to watchInstacart is planning for an IPO in September, according to a report from Bloomberg. It would be the latest in a string of companies that have gone public in recent months, such as Cava (CAVA), Savers Value Village (SVV), and VinFast Auto (VFS). Rainmaker Securities Managing Director Greg Martin says the market 'has shown some receptivity to new issuances' and that 'there's demand for growth companies.' For Instacart, Martin says, the challenge is 'its actual grocery volume... is actually not growing very fast', noting that the company is actually seeing more growth in ad revenue.

Lire la suite »