When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key question - will the company have 'exponential growth' due to the boom in artificial intelligence as CEO Masayoshi Son claims? Since acquiring the chip designer in 2016, Son has positioned Arm as the tech investment conglomerate's crown jewel asset, and in recent months has enthusiastically talked up the role it could play in AI. Arm 'is at the centre of a group of AI-related companies to generate synergies' and '85% of SoftBank Group assets are AI-related companies overseas,' he told investors in June.

TOKYO - When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key question - will the company have "exponential growth" due to the boom in artificial intelligence as CEO Masayoshi Son claims?

The billionaire also said he has spent months creating hundreds of inventions with AI-powered ChatGPT that he believes can be realised through Arm. "An intra-company transaction isn't as strong a comparable as if it were with a third party," he said. Nvidia has developed a "superchip" for use in data centres - the GH200, which contains CPUs based on Arm architecture. That said, the chip must compete with a host of alternatives.

But Bulk said Arm's opportunity lies in AI and machine learning moving away from centralised cloud servers towards the devices used by end users, such as phones, home appliances and machinery components.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Arm Listing Set to Be Turning Point for IPO Market, SoftBankArm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.

Arm Listing Set to Be Turning Point for IPO Market, SoftBankArm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.

Lire la suite »

Arm IPO to put SoftBank's AI hard sell to the testBy Anton Bridge TOKYO (Reuters) - When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key ...

Arm IPO to put SoftBank's AI hard sell to the testBy Anton Bridge TOKYO (Reuters) - When SoftBank Group-owned chip designer Arm files for a Nasdaq IPO on Monday, investors are set to hone in on a key ...

Lire la suite »

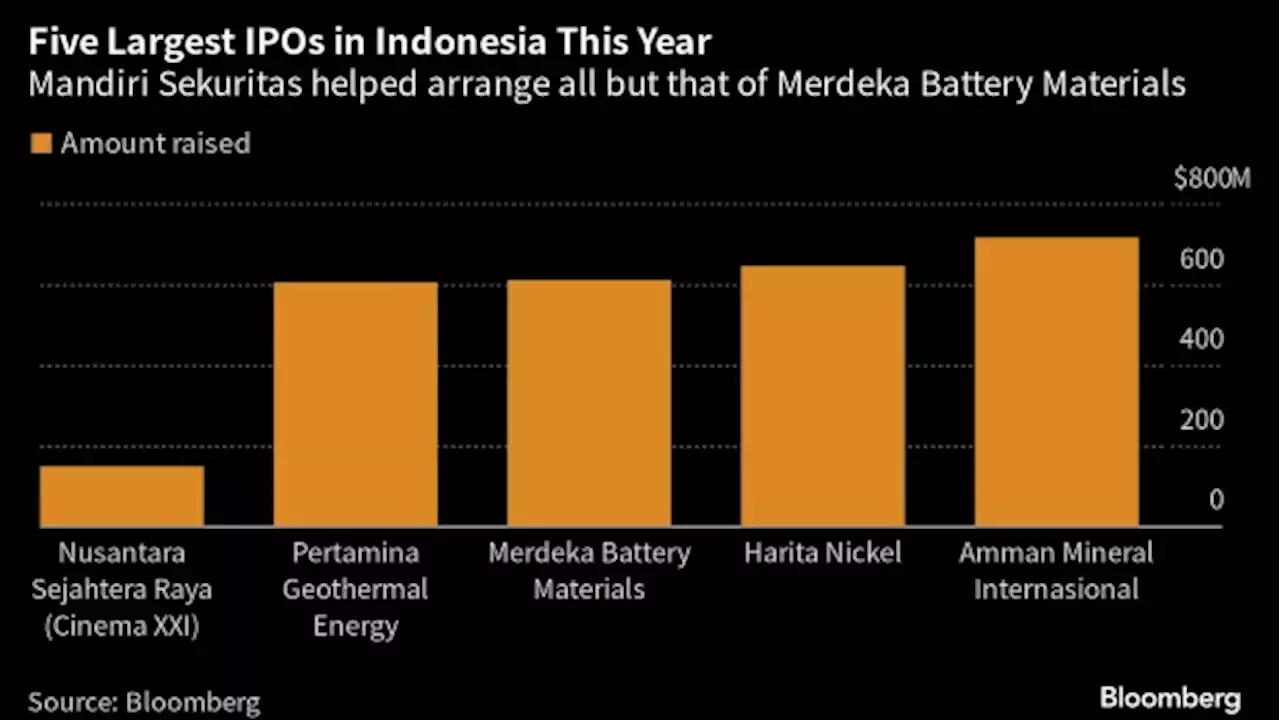

Top IPO Arranger in Indonesia Sees Larger Deals as Polls LoomLarge initial public offerings are expected to return to Indonesia next year as the country’s upcoming polls are seen to reduce political uncertainty, according to its top IPO banker.

Top IPO Arranger in Indonesia Sees Larger Deals as Polls LoomLarge initial public offerings are expected to return to Indonesia next year as the country’s upcoming polls are seen to reduce political uncertainty, according to its top IPO banker.

Lire la suite »

Chad's FACT rebel group ends ceasefire over alleged attack by juntaBy Mahamat Ramadane N'DJAMENA (Reuters) - Chadian rebel group the Front for Change and Concord in Chad (FACT) has announced an end to a ceasefire it ...

Chad's FACT rebel group ends ceasefire over alleged attack by juntaBy Mahamat Ramadane N'DJAMENA (Reuters) - Chadian rebel group the Front for Change and Concord in Chad (FACT) has announced an end to a ceasefire it ...

Lire la suite »

City's 2-tiered insurance system forces community group to close up shopCommunity associations say the city is dragging its feet on fixing a two-tiered insurance program that's led at least one group to close its doors.

City's 2-tiered insurance system forces community group to close up shopCommunity associations say the city is dragging its feet on fixing a two-tiered insurance program that's led at least one group to close its doors.

Lire la suite »

Insurance Australia Group forecasts lower double-digit growth in gross written premiumsIAG's forecast was issued on the back of an expectation of modest volume growth and an increase in customer numbers and is driven by the company's desire to cover claims inflation, higher reinsurance costs and an increased natural peril allowance. Australia's top general insurer posted cash earnings of A$452 million ($289.42 million) for the 12 months ended June 30, up from the A$213 million posted a year ago.

Insurance Australia Group forecasts lower double-digit growth in gross written premiumsIAG's forecast was issued on the back of an expectation of modest volume growth and an increase in customer numbers and is driven by the company's desire to cover claims inflation, higher reinsurance costs and an increased natural peril allowance. Australia's top general insurer posted cash earnings of A$452 million ($289.42 million) for the 12 months ended June 30, up from the A$213 million posted a year ago.

Lire la suite »