By Divya Chowdhury and Lisa Pauline Mattackal (Reuters) - The U.S. Federal Reserve is unlikely to provide clear signals on whether it will pause ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOSWatch on - The U.S. Federal Reserve is unlikely to provide clear signals on whether it will pause interest rate hikes or consider cutting rates, barring severe economic weakness or disinflation, former central bankers said on Tuesday.

"If wants to do its job, it almost surely has to keep in the state of 'nobody quite knows whether it's paused or not'," said Raghuram Rajan, former governor of the Reserve Bank of India. Powell's Jackson Hole presentation was effective because it left the bank's policy options open, said Dennis Lockhart, former president of the Atlanta Fed.

The Fed's economic projections earlier this year showed one more expected rate increase by end-2023 and rate cuts beginning in 2024, but both Rajan and Lockhart saw cuts as unlikely barring sustained economic weakness or disinflation.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Futures edge higher as focus shifts to inflation, jobs dataStocks ended a volatile session higher on Friday after Fed Chair Jerome Powell at the Jackson Hole meet said the U.S. central bank may need to raise interest rates further to ensure inflation is contained. The personal consumption expenditures price index, the Fed's preferred inflation gauge, is set to be released on Thursday and the non-farm pay rolls data is due on Friday. 'While our base case is that the Fed has already reached the end of its tightening cycle, views on the Fed could continue to shift in response to data over coming weeks,' Mark Haefele, chief investment officer at UBS Global Wealth Management, said.

Futures edge higher as focus shifts to inflation, jobs dataStocks ended a volatile session higher on Friday after Fed Chair Jerome Powell at the Jackson Hole meet said the U.S. central bank may need to raise interest rates further to ensure inflation is contained. The personal consumption expenditures price index, the Fed's preferred inflation gauge, is set to be released on Thursday and the non-farm pay rolls data is due on Friday. 'While our base case is that the Fed has already reached the end of its tightening cycle, views on the Fed could continue to shift in response to data over coming weeks,' Mark Haefele, chief investment officer at UBS Global Wealth Management, said.

Lire la suite »

Emerging-Market Rally Runs Into Doubts Over China and Fed PolicyA rally in emerging markets faded as doubts over China’s commitment to revive its faltering economy and confusion over the US Federal Reserve’s next steps kept sentiment in check.

Emerging-Market Rally Runs Into Doubts Over China and Fed PolicyA rally in emerging markets faded as doubts over China’s commitment to revive its faltering economy and confusion over the US Federal Reserve’s next steps kept sentiment in check.

Lire la suite »

Stock market today: Global shares mostly rise after Fed chief's speechTOKYO (AP) — Global shares were mostly higher Monday, as investors were relieved by the head of the Federal Reserve indicating it will “proceed carefully” on interest rates. France's CAC 40 added 0.8% in early trading to 7,288.58. Germany's DAX rose 0.6% to 15,730.05. Trading was closed in Britain for a bank holiday. U.S. shares were set to drift higher with Dow futures up 0.3% at 34,464.00. S&P 500 futures rose 0.2% to 4,423.50. Japan's benchmark Nikkei 225 added 1.7% to finish at 32,169.99. Au

Stock market today: Global shares mostly rise after Fed chief's speechTOKYO (AP) — Global shares were mostly higher Monday, as investors were relieved by the head of the Federal Reserve indicating it will “proceed carefully” on interest rates. France's CAC 40 added 0.8% in early trading to 7,288.58. Germany's DAX rose 0.6% to 15,730.05. Trading was closed in Britain for a bank holiday. U.S. shares were set to drift higher with Dow futures up 0.3% at 34,464.00. S&P 500 futures rose 0.2% to 4,423.50. Japan's benchmark Nikkei 225 added 1.7% to finish at 32,169.99. Au

Lire la suite »

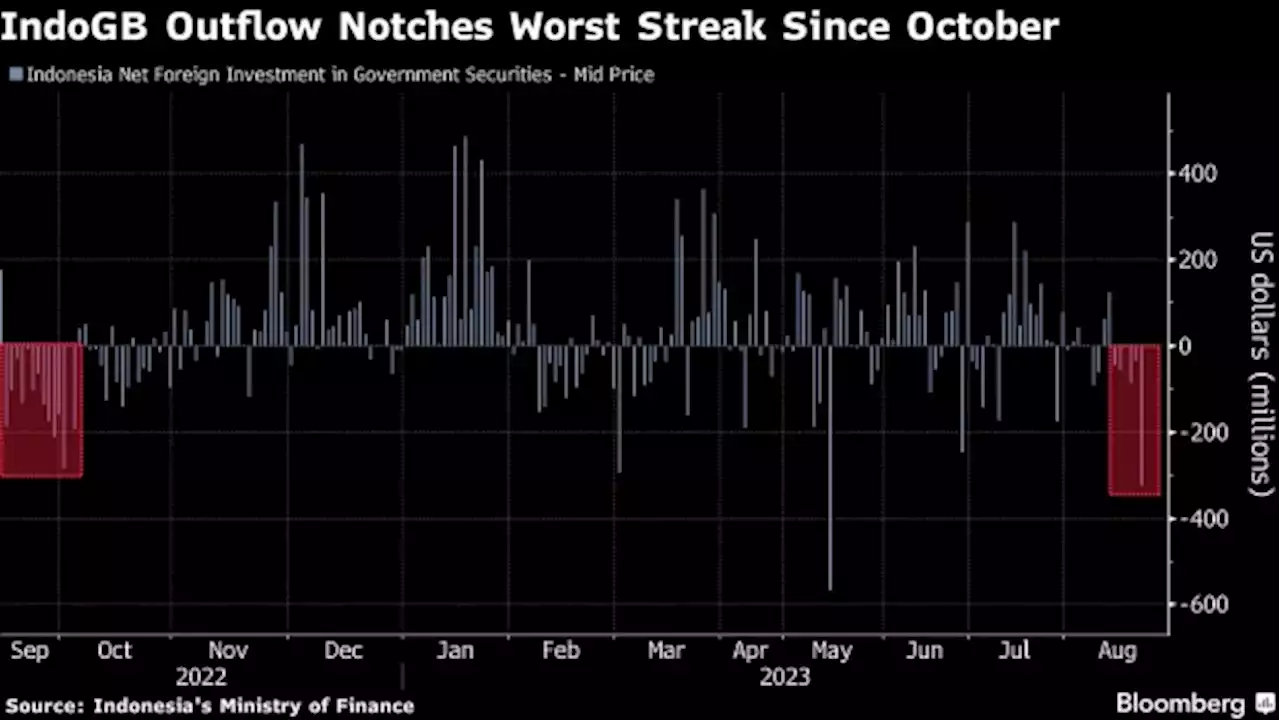

Hawkish Fed Gives Indonesia Longest Fund Outflows Since OctoberForeign investors notched their longest selling stretch of Indonesian debt in 10 months as a surge in US Treasury yields made investors turn away from assets in the emerging market.

Hawkish Fed Gives Indonesia Longest Fund Outflows Since OctoberForeign investors notched their longest selling stretch of Indonesian debt in 10 months as a surge in US Treasury yields made investors turn away from assets in the emerging market.

Lire la suite »

Major Gulf markets mixed as Fed rate bets offset higher oil pricesMarket News

Major Gulf markets mixed as Fed rate bets offset higher oil pricesMarket News

Lire la suite »

Major Gulf bourses fall on Fed chair's hawkish toneKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Major Gulf bourses fall on Fed chair's hawkish toneKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »