The costs of inaction on global warming are potentially vast and often not sufficiently factored in to asset values. Read more.

Grains of truth

Food insecurity is exacerbated by water shortages. Agriculture accounts for about 70 per cent of freshwater consumption globally, although in regions such as Asia it can be higher. Already two billion people lack access to clean, safe drinking water. By 2030, demand for freshwater is forecast to exceed supply by 40 per cent. Areas that once took water for granted are coming to terms with shortages.

Of all the climate risks, flooding is most straightforward to analyze. But that does not mean it is priced in. Recently published research suggested that U.S.by between US$121 billion and US$237 billion. Once cyclones and chronic risks such as drought, heat and sea-level rises are factored in, San Francisco emerges as one of the areas most economically exposed, according to a Moody’s. Boise, Idaho, and Nashville, Tenn., are among the safest. Such forecasts provide an insight into likely migration patterns within the U.S. in the second half of this century. The consequences for the Bay Area’s sky-high real estate values and its tax base will be significant.

The wealthier the region, the better the chance of adequate defences. S&P Global Inc. recently upgraded Miami bonds to AA on this basis, even though the city expects the sea level to rise by up to 53 centimetres by 2070. “Water scarcity and the situation that has crystallized over the last couple of years are pushing the deployment of these technologies,” said José Díaz-Caneja, chief executive of Spanish conglomerate Acciona SA’s water business.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Change in the weather: Investors are underpricing risks of wildfires, flooding, heat wavesThe costs of inaction on global warming are potentially vast and often not sufficiently factored in to asset values. Read more.

Change in the weather: Investors are underpricing risks of wildfires, flooding, heat wavesThe costs of inaction on global warming are potentially vast and often not sufficiently factored in to asset values. Read more.

Lire la suite »

These are the 5 headlines you should read this morningThe latest on the wildfires in the Northwest Territories, tourism industry takes a hit due to wildfires in B.C., and FIFA Women’s World Cup wraps up.

These are the 5 headlines you should read this morningThe latest on the wildfires in the Northwest Territories, tourism industry takes a hit due to wildfires in B.C., and FIFA Women’s World Cup wraps up.

Lire la suite »

Turkish Investors Hunting for Inflation Hedge Rush Back to IPOsTurkish stock buyers are again piling into new share offerings by companies, lured by the promise of jumbo returns as they clamor for ways to shield against resurgent inflation.

Turkish Investors Hunting for Inflation Hedge Rush Back to IPOsTurkish stock buyers are again piling into new share offerings by companies, lured by the promise of jumbo returns as they clamor for ways to shield against resurgent inflation.

Lire la suite »

Bond Investors Warned of ‘Trouble Brewing’ Over Climate RiskBond investors can’t rely on credit ratings to give them a fair assessment of the climate risk they’re exposed to, and should brace for “trouble ahead,” according to the Institute for Energy Economics and Financial Analysis.

Bond Investors Warned of ‘Trouble Brewing’ Over Climate RiskBond investors can’t rely on credit ratings to give them a fair assessment of the climate risk they’re exposed to, and should brace for “trouble ahead,” according to the Institute for Energy Economics and Financial Analysis.

Lire la suite »

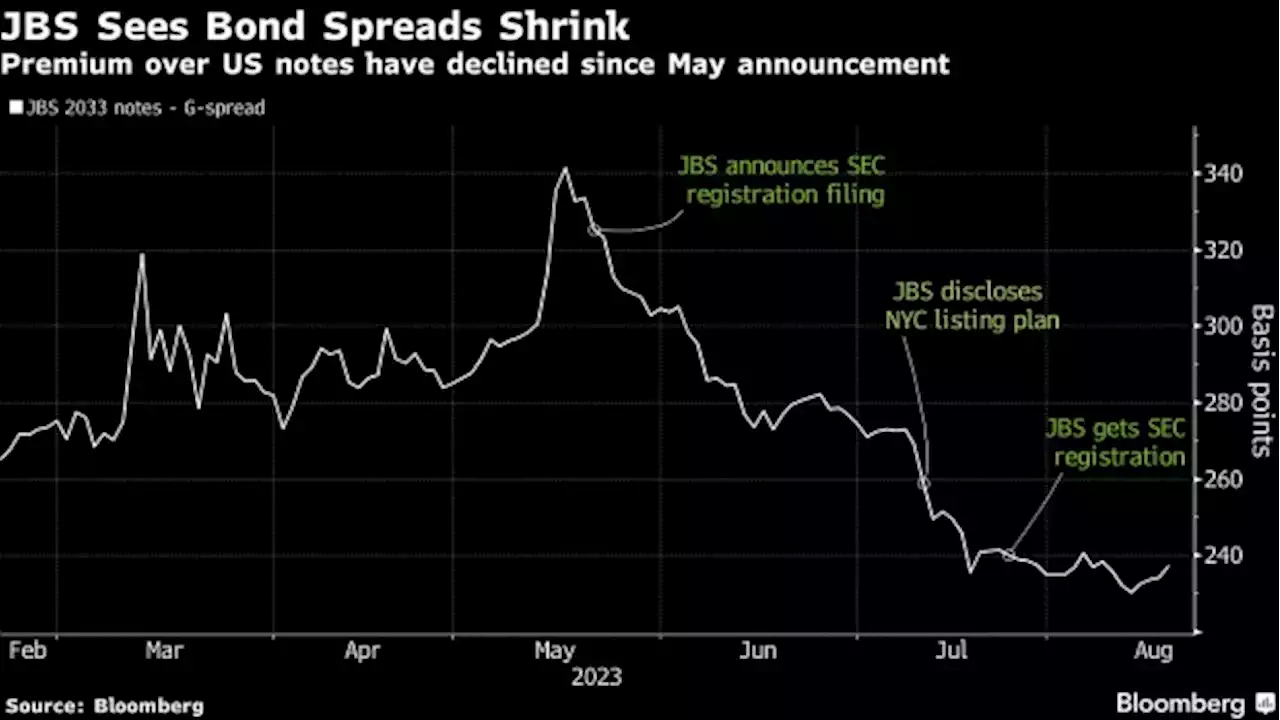

JBS Push for Extra US Scrutiny Is Paying Off With Meat Packer's Debt InvestorsJBS SA’s decision to submit its business to increased US scrutiny appears to be paying off with debt investors, as the bonds of the world’s largest meat packer are largely outperforming those of its peers.

JBS Push for Extra US Scrutiny Is Paying Off With Meat Packer's Debt InvestorsJBS SA’s decision to submit its business to increased US scrutiny appears to be paying off with debt investors, as the bonds of the world’s largest meat packer are largely outperforming those of its peers.

Lire la suite »

Why investors don't need to worry too much about China's economyHong Kong's Hang Sang Index fell to its lowest level since 2021. Yahoo Finance Senior Columnist Rick Newman explains that while the outlook for China's economy looks grim, U.S. investors may not have to worry much about the impact. Citing research from Capital Economics, Newman explains that 'the effect of China's economy on the global economy and on global financial markets is typically somewhat overstated.' Newman notes that investors should remain observant of American companies with heavy exposure to China such as Apple (AAPL) and Tesla (TSLA).

Why investors don't need to worry too much about China's economyHong Kong's Hang Sang Index fell to its lowest level since 2021. Yahoo Finance Senior Columnist Rick Newman explains that while the outlook for China's economy looks grim, U.S. investors may not have to worry much about the impact. Citing research from Capital Economics, Newman explains that 'the effect of China's economy on the global economy and on global financial markets is typically somewhat overstated.' Newman notes that investors should remain observant of American companies with heavy exposure to China such as Apple (AAPL) and Tesla (TSLA).

Lire la suite »