Bond investors can’t rely on credit ratings to give them a fair assessment of the climate risk they’re exposed to, and should brace for “trouble ahead,” according to the Institute for Energy Economics and Financial Analysis.

From within the big three credit ratings companies — Moody’s Investors Services, S&P Global Ratings and Fitch Ratings — warnings have already been issued, but these have gone largely unnoticed, IEEFA, a US-based nonprofit, said in a statement on Monday.

IEEFA notes that in June, S&P warned that climate change is becoming a “significant” driver affecting credit worthiness, but acknowledged that “very few climate-related rating actions” had taken place since early 2022; Fitch has warned that about 20% of corporates face downgrades next decade due to climate change, while Moody’s has said that credit risks linked to environmental, social and governance factors are rising.

In a recent analysis of an orderly energy transition by 2050, S&P Global Market Intelligence found that companies in five major carbon-intensive sectors –- airlines, automotive, metals and mining, oil and gas, and power generation –- faced a 31-54% downgrade risk. A disorderly transition, meanwhile, would raise the credit downgrade risk by a further 2%-20%, the analysis indicated.

IEEFA says rating companies could adopt near-term and forward-looking alternatives, for example, by forecasting future earnings or impact on cash flows from a climate risk perspective. And regulators should require credit rating committees to include non-voting independent climate specialists as members.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

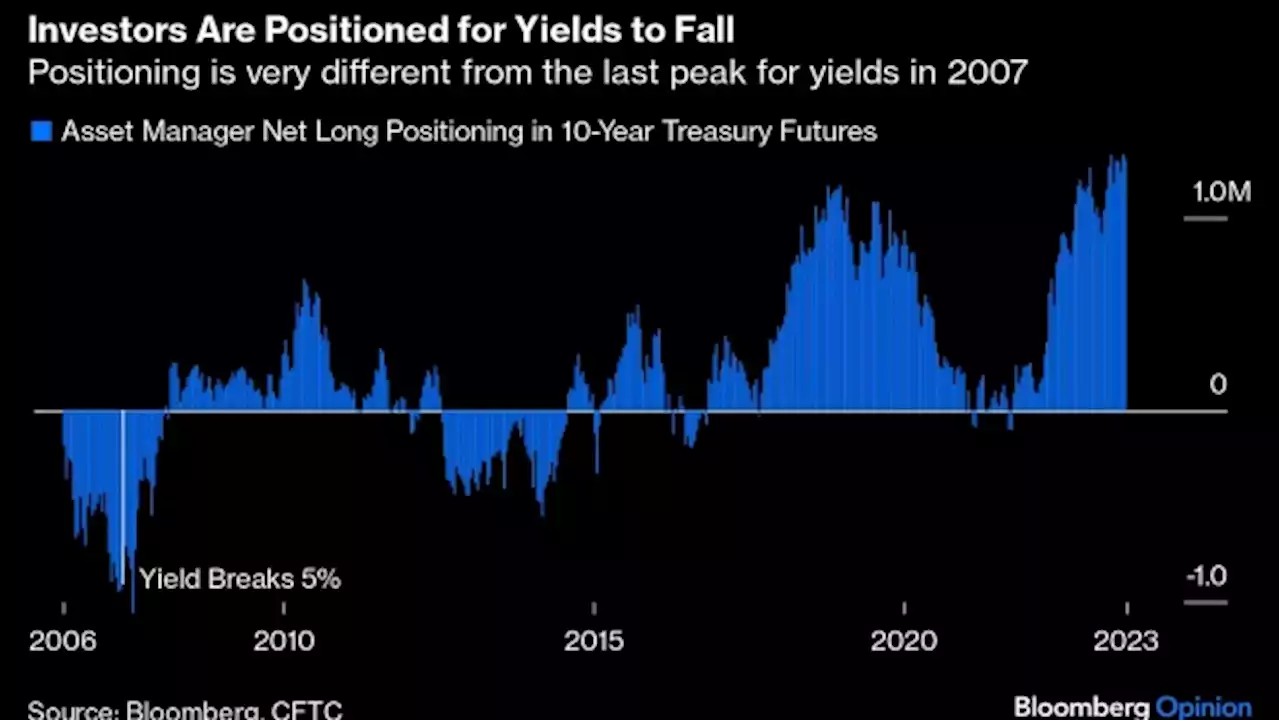

Bond Investors Brace for Supply Freight Train Before Fed ConfabThe highest long-term Treasury yields in years are headed for a major hearing next week as investors place their bids for two risky auctions — right before the Federal Reserve’s potentially game-changing annual gathering at Jackson Hole.

Bond Investors Brace for Supply Freight Train Before Fed ConfabThe highest long-term Treasury yields in years are headed for a major hearing next week as investors place their bids for two risky auctions — right before the Federal Reserve’s potentially game-changing annual gathering at Jackson Hole.

Lire la suite »

Mike Drew: When plans get thwarted, dust the trouble off and move alongPhotographer Mike Drew found changing colours in the forest as dry conditions across southern Alberta force nature to adapt.

Mike Drew: When plans get thwarted, dust the trouble off and move alongPhotographer Mike Drew found changing colours in the forest as dry conditions across southern Alberta force nature to adapt.

Lire la suite »

Bond Traders Bet Next Ecuador President Can Stave Off Default(Bloomberg) -- As Ecuadorians prepare to vote for a president Sunday amid its most violent election cycle in memory, investors are betting an unexpected rally in the country’s battered bonds isn’t finished. Most Read from BloombergVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkBiden’s Top Lawyer to Depart White House as Probes Ramp UpBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is K

Bond Traders Bet Next Ecuador President Can Stave Off Default(Bloomberg) -- As Ecuadorians prepare to vote for a president Sunday amid its most violent election cycle in memory, investors are betting an unexpected rally in the country’s battered bonds isn’t finished. Most Read from BloombergVietnam Tycoon Loses $18 Billion After EV Maker’s Shares SinkChina Evergrande Group Files Chapter 15 Bankruptcy in New YorkBiden’s Top Lawyer to Depart White House as Probes Ramp UpBitcoin Calm Shatters With Sudden Tumble, Mass LiquidationsJeremy Grantham Says Fed Is K

Lire la suite »

Bond Traders Bet Next Ecuador President Can Stave Off DefaultAs Ecuadorians prepare to vote for a president Sunday amid its most violent election cycle in memory, investors are betting an unexpected rally in the country’s battered bonds isn’t finished.

Bond Traders Bet Next Ecuador President Can Stave Off DefaultAs Ecuadorians prepare to vote for a president Sunday amid its most violent election cycle in memory, investors are betting an unexpected rally in the country’s battered bonds isn’t finished.

Lire la suite »

Bond Bulls at JPMorgan, Allianz Double Down on Bet Gone BadConvinced a recession in the US was near, some of the world’s most prominent money managers loaded up on government bonds this year in a bold bet that would atone for the punishing losses suffered in 2022.

Bond Bulls at JPMorgan, Allianz Double Down on Bet Gone BadConvinced a recession in the US was near, some of the world’s most prominent money managers loaded up on government bonds this year in a bold bet that would atone for the punishing losses suffered in 2022.

Lire la suite »

Bond vigilantes are 'saddling up.' Here's how concerned investors might take action over the ballooning federal deficit.'We've got the federal deficit widening when the economy is doing well. And I think the bond vigilantes are quite concerned about that.'

Bond vigilantes are 'saddling up.' Here's how concerned investors might take action over the ballooning federal deficit.'We've got the federal deficit widening when the economy is doing well. And I think the bond vigilantes are quite concerned about that.'

Lire la suite »