Traders are worried that the US bond market’s recent selloff may have further to go.

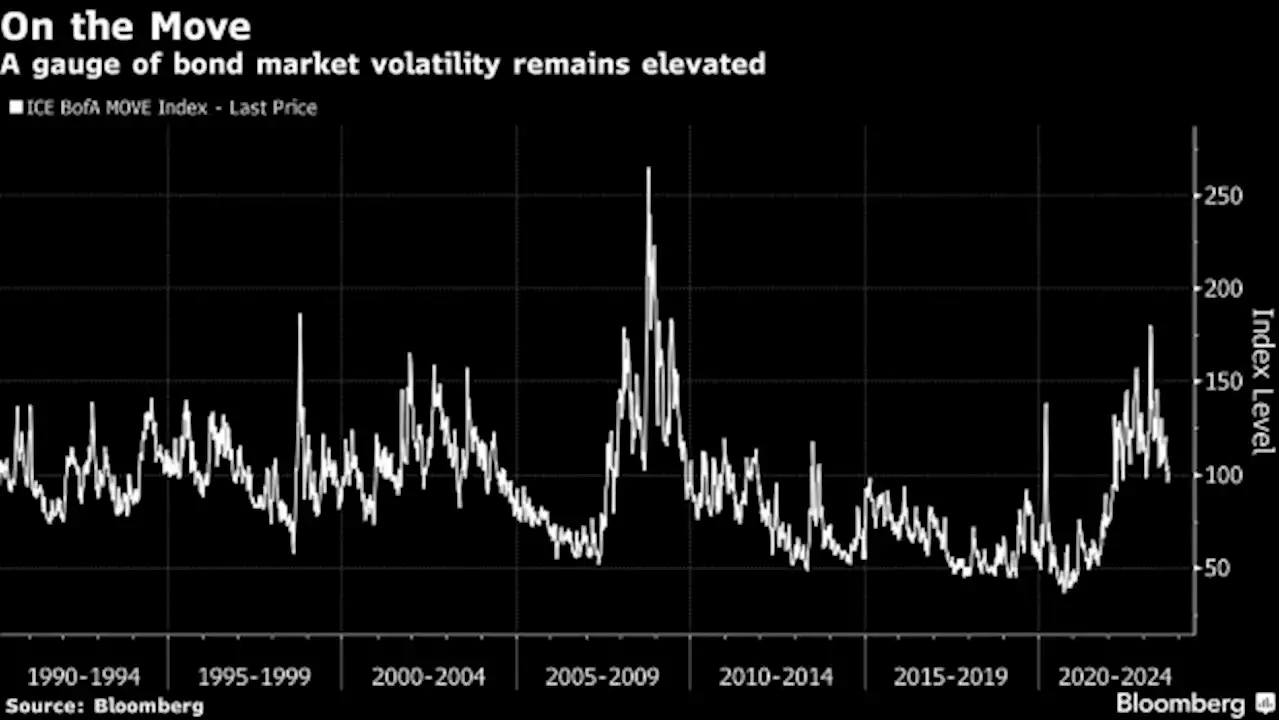

The cost of insurance against a continued push higher in Treasury yields — most notably in the long-end of the curve — has jumped to the highest since last September, options trading shows.

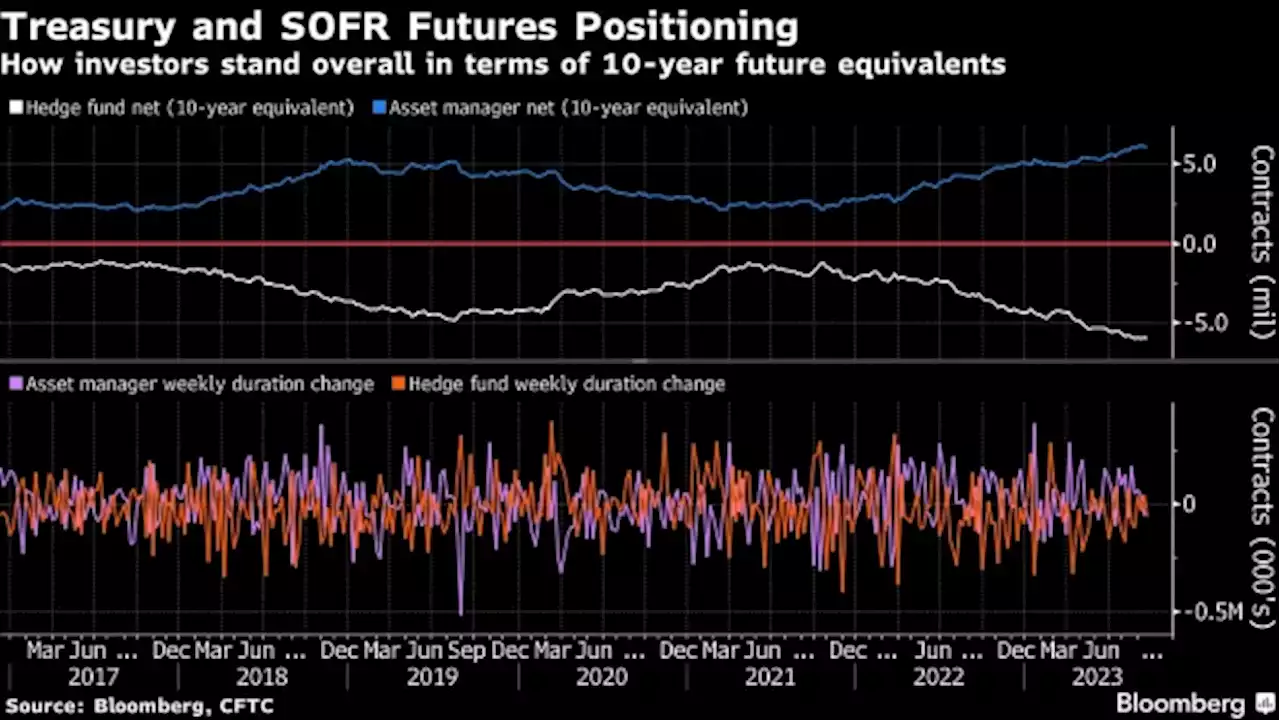

There’s been a pick-up in demand for 10-year options covering the risk that yields will push over 4.85% or more by the end of October, up from roughly 4.55% now. Meanwhile, JPMorgan Chase & Co.’s latest Treasury client survey reports that short positions rose to the highest levels in five weeks, while futures positioning data shows that hedge funds extended short bets and asset managers trimmed long positions in bonds.

The moves reflect the increasingly bearish sentiment toward the bond market since policymakers at the Federal Reserve last week signaled they’re likely to keep interest rates elevated well into 2024. That has pushed yields higher as traders recalibrate expectations.The skew shown on premium paid for hedging a selloff in long-bond futures rose to 250 basis points by the end of trading on Monday, the highest since September 2022 and up from around 80 basis points two weeks ago.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Bond Traders Roiled by Fed See US Shutdown as Next Big Wild CardTo judge by recent history, a US government shutdown won’t be a huge event for the bond market. If anything, it could even provide a little short-term relief, since Treasuries usually rally when investors need somewhere to hide.

Bond Traders Roiled by Fed See US Shutdown as Next Big Wild CardTo judge by recent history, a US government shutdown won’t be a huge event for the bond market. If anything, it could even provide a little short-term relief, since Treasuries usually rally when investors need somewhere to hide.

Lire la suite »

Foreign Investors Fuel Philippine Stocks Selloff That's Worst in Southeast AsiaOverseas investors continue to shun Philippine equities, unloading more than $370 million in a 24-day selling streak that helped sink the Philippine Stock Exchange Index to a 3.5% slump, the worst in Southeast Asia. Withdrawals in the five-week period through Friday pushed this year’s outflow to more than $552 million.

Foreign Investors Fuel Philippine Stocks Selloff That's Worst in Southeast AsiaOverseas investors continue to shun Philippine equities, unloading more than $370 million in a 24-day selling streak that helped sink the Philippine Stock Exchange Index to a 3.5% slump, the worst in Southeast Asia. Withdrawals in the five-week period through Friday pushed this year’s outflow to more than $552 million.

Lire la suite »

Shares drop as 'higher-for-longer' rate outlook rattles investorsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Shares drop as 'higher-for-longer' rate outlook rattles investorsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

Treasuries Extend Selloff, Pushing 10-Year Yield to 16-Year High(Bloomberg) -- US Treasuries extended their decline, driving 10- and 30-year yields to new multiyear highs, on expectations the Federal Reserve will hold interest rates high and the supply of new bonds will keep rising as the federal government contends with mounting deficits.Most Read from BloombergIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn BanknotesIndia-Canada Clash Should Be a Wake-Up CallStocks Edge Up, Bonds Sink as Fed Talk Digested: Markets WrapChinese Gold Buyi

Treasuries Extend Selloff, Pushing 10-Year Yield to 16-Year High(Bloomberg) -- US Treasuries extended their decline, driving 10- and 30-year yields to new multiyear highs, on expectations the Federal Reserve will hold interest rates high and the supply of new bonds will keep rising as the federal government contends with mounting deficits.Most Read from BloombergIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn BanknotesIndia-Canada Clash Should Be a Wake-Up CallStocks Edge Up, Bonds Sink as Fed Talk Digested: Markets WrapChinese Gold Buyi

Lire la suite »

Aptos traders can monitor these two price levels for the next moveThe spot CVD remained in a downtrend and did not support the idea of hefty demand for Aptos and questioned the idea of a rally for the token.

Aptos traders can monitor these two price levels for the next moveThe spot CVD remained in a downtrend and did not support the idea of hefty demand for Aptos and questioned the idea of a rally for the token.

Lire la suite »

Why traders aren't buying the Fed's 'higher-for-longer' visionIt's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon. Financial markets respond with bets to the contrary. Forecasts published on Wednesday by the U.S. central bank showed that a majority of its policymakers see the Fed's benchmark overnight interest rate ending this year at 5.6%, which implies one more interest rate hike in the next three months.

Why traders aren't buying the Fed's 'higher-for-longer' visionIt's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon. Financial markets respond with bets to the contrary. Forecasts published on Wednesday by the U.S. central bank showed that a majority of its policymakers see the Fed's benchmark overnight interest rate ending this year at 5.6%, which implies one more interest rate hike in the next three months.

Lire la suite »