To judge by recent history, a US government shutdown won’t be a huge event for the bond market. If anything, it could even provide a little short-term relief, since Treasuries usually rally when investors need somewhere to hide.

Less than four months after resolving a standoff over the debt limit that threatened to push the US into default, the dysfunction in Washington is taking center stage on Wall Street again. And that’s complicating the lives of analysts and investors already trying to gauge the Federal Reserve’s interest-rate path as the US economy defies gloomy forecasts, inflation remains stubbornly elevated and growth sputters elsewhere around the world.

Yet that doesn’t mean it won’t be consequential. A shutdown could muddy the outlook if it delays the release of key data reports — like the monthly employment and inflation figures due in the first half of October — or if it slows the economy as government workers go unpaid. It would also underscore the political unpredictability that’s already driven Fitch Ratings and S&P Global Ratings to strip the US of their top grades.

This time around, that could take some of the short-term pressure off the market. Yields have risen since the Fed last week indicated that rates are likely to remain high well into next year as the economy exhibits surprising strength. The selloff continued Monday, when 30-year yields rose as much as 15 basis points to 4.67%, the highest since 2011.

Gennadiy Goldberg and Molly McGown of TD Securities said in a note to clients that they expect a shutdown to buoy Treasuries, particularly shorter-term ones, by sapping risk-taking sentiment. “Overall, we view the shutdown as one of the many headwinds the economy faces this fall,” they wrote.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Why traders aren't buying the Fed's 'higher-for-longer' visionIt's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon. Financial markets respond with bets to the contrary. Forecasts published on Wednesday by the U.S. central bank showed that a majority of its policymakers see the Fed's benchmark overnight interest rate ending this year at 5.6%, which implies one more interest rate hike in the next three months.

Why traders aren't buying the Fed's 'higher-for-longer' visionIt's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon. Financial markets respond with bets to the contrary. Forecasts published on Wednesday by the U.S. central bank showed that a majority of its policymakers see the Fed's benchmark overnight interest rate ending this year at 5.6%, which implies one more interest rate hike in the next three months.

Lire la suite »

Why traders aren't buying the Fed's 'higher-for-longer' visionBy Ann Saphir (Reuters) - It's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon.

Why traders aren't buying the Fed's 'higher-for-longer' visionBy Ann Saphir (Reuters) - It's a now-familiar dance: Federal Reserve officials signal to the world that interest rates are not dropping anytime soon.

Lire la suite »

Why traders aren't buying the Fed's 'higher-for-longer' visionKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Why traders aren't buying the Fed's 'higher-for-longer' visionKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

Fed doves, Fed hawks: US central bankers in their words(Reuters) - The labels “dove” and “hawk” have long been used by central bank watchers to describe the monetary policy leanings of policymakers, with a ...

Fed doves, Fed hawks: US central bankers in their words(Reuters) - The labels “dove” and “hawk” have long been used by central bank watchers to describe the monetary policy leanings of policymakers, with a ...

Lire la suite »

Fed doves, Fed hawks: US central bankers in their wordsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Fed doves, Fed hawks: US central bankers in their wordsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

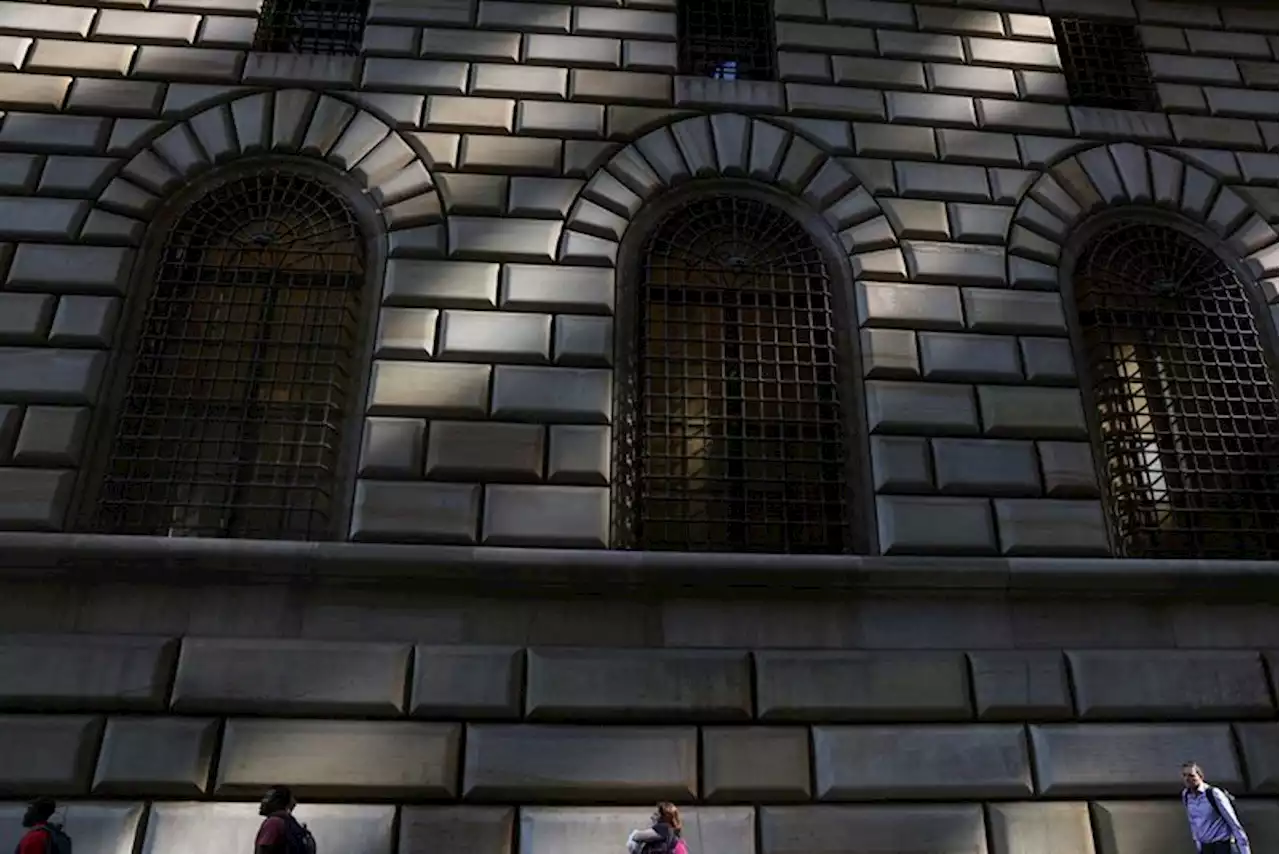

Judge dismisses suit against New York Fed over COVID-19 firingsA judge on Monday dismissed a lawsuit accusing the Federal Reserve Bank of New York of illegally firing two longtime employees who claimed religious objections in refusing to be vaccinated against COVID-19. U.S. District Judge Lewis Liman in Manhattan ruled against Lori Gardner-Alfred and Jeanette Diaz, who spent a respective 35 years and 27 years at the New York Fed and had been senior executive specialists before their March 2022 dismissals. The New York Fed began requiring COVID-19 vaccines for all employees in August 2021.

Judge dismisses suit against New York Fed over COVID-19 firingsA judge on Monday dismissed a lawsuit accusing the Federal Reserve Bank of New York of illegally firing two longtime employees who claimed religious objections in refusing to be vaccinated against COVID-19. U.S. District Judge Lewis Liman in Manhattan ruled against Lori Gardner-Alfred and Jeanette Diaz, who spent a respective 35 years and 27 years at the New York Fed and had been senior executive specialists before their March 2022 dismissals. The New York Fed began requiring COVID-19 vaccines for all employees in August 2021.

Lire la suite »