(Bloomberg) -- The Bank of Japan is widely expected to keep its monetary stimulus unchanged Friday, with traders focusing on any remarks Governor Kazuo Ueda might make on negative interest rates or the correlation between currencies and policy as the yen trades near a 10-month low.Most Read from Bloomberg‘Dead Space’ Co-Creator Departs Startup After Newest Game FlopsPassalacqua in Italy’s Lake Como Is Named Best Hotel in the WorldVegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the Mak

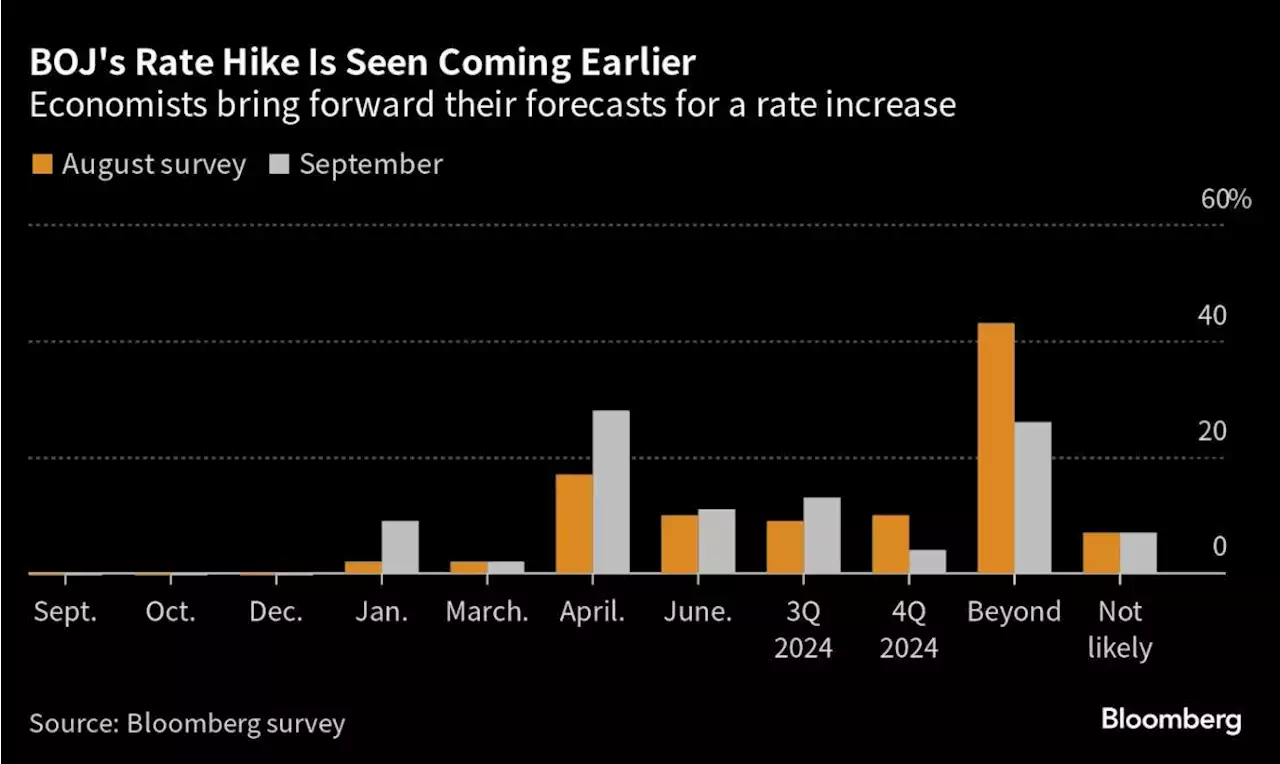

All 46 economists surveyed by Bloomberg predict no adjustments to the interest rate or yield curve control after the bank tweaked its YCC settings at the last gathering in July.

Japan’s currency weakened to a fresh 10-month low Thursday, with the dollar rising as high as 148.46 after the Federal Reserve held interest rates steady and telegraphed one more increase before year-end in quarterly projections. The weakness prompted Chief Cabinet Secretary Hirokazu Matsuno to warn that Japan wouldn’t rule out any options to curb excessive moves.

Friday marks the one-year anniversary since Japan’s first yen-buying intervention in 24 years. A year ago, then-BOJ chief Haruhiko Kuroda pledged after a board meeting to continue with easing. That helped fuel a further slide in the yen that prompted the government to buy the currency. At the same time, if Ueda sends strong signals on normalizing policy, yields on 10-year government bonds could hover closer to the bank’s de-facto ceiling at 1%, a development that would likely force the BOJ to buy more bonds, exacerbating the side effects of yield control. The 10-year yield touched 0.745% Thursday, the highest since 2013.

How Ueda characterizes the chances of a rate hike in early 2024 will be under close scrutiny. While he is likely to cite the possibilities of moving both early or late, traders will look for any emphasis in either direction.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

BOJ Meets With Yen and Ueda’s View on Rates in Focus: Day GuideThe Bank of Japan is widely expected to keep its monetary stimulus unchanged Friday, with traders focusing on any remarks Governor Kazuo Ueda might make on negative interest rates or the correlation between currencies and policy as the yen trades near a 10-month low.

BOJ Meets With Yen and Ueda’s View on Rates in Focus: Day GuideThe Bank of Japan is widely expected to keep its monetary stimulus unchanged Friday, with traders focusing on any remarks Governor Kazuo Ueda might make on negative interest rates or the correlation between currencies and policy as the yen trades near a 10-month low.

Lire la suite »

BOJ Speculation Shifts to Negative Rate Policy From Yield CapInvestors keeping an eye on Bank of Japan policy have shifted their attention to the possible end of the central bank’s negative interest rate following the loosening of guide rails around bond yields.

BOJ Speculation Shifts to Negative Rate Policy From Yield CapInvestors keeping an eye on Bank of Japan policy have shifted their attention to the possible end of the central bank’s negative interest rate following the loosening of guide rails around bond yields.

Lire la suite »

Japan may intervene on yen again, BOJ should ditch easy policyBy Tetsushi Kajimoto TOKYO (Reuters) - Japan could intervene again to support the yen if it declines further, former top currency diplomat Takehiko ...

Japan may intervene on yen again, BOJ should ditch easy policyBy Tetsushi Kajimoto TOKYO (Reuters) - Japan could intervene again to support the yen if it declines further, former top currency diplomat Takehiko ...

Lire la suite »

JPMorgan Sees BOJ Negative Rates, Yield Control Gone by Mid-2024The Bank of Japan’s yield curve control and negative interest rate policy will likely be removed by mid-2024, and Japanese stocks will continue to rally from the government’s wage hiking efforts, according to JPMorgan Securities Japan Co.’s Rie Nishihara.

JPMorgan Sees BOJ Negative Rates, Yield Control Gone by Mid-2024The Bank of Japan’s yield curve control and negative interest rate policy will likely be removed by mid-2024, and Japanese stocks will continue to rally from the government’s wage hiking efforts, according to JPMorgan Securities Japan Co.’s Rie Nishihara.

Lire la suite »

BOJ Speculation Moves to Negative Rate Policy From Yield Cap(Bloomberg) -- Investors keeping an eye on Bank of Japan policy have shifted their attention to the possible end of the central bank’s negative interest rate following the loosening of guide rails around bond yields.Most Read from BloombergVegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the MakingTrudeau’s Murder Claim Risks Upending US Courtship of IndiaF-35 Debris Found After a $100 Million Fighter Jet Went MissingIndia, Canada Trade Diplomatic Blows Over Murder AllegationsWhile no

BOJ Speculation Moves to Negative Rate Policy From Yield Cap(Bloomberg) -- Investors keeping an eye on Bank of Japan policy have shifted their attention to the possible end of the central bank’s negative interest rate following the loosening of guide rails around bond yields.Most Read from BloombergVegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the MakingTrudeau’s Murder Claim Risks Upending US Courtship of IndiaF-35 Debris Found After a $100 Million Fighter Jet Went MissingIndia, Canada Trade Diplomatic Blows Over Murder AllegationsWhile no

Lire la suite »

BOJ will end negative interest rates in 2024, most economists say: Reuters pollBy Kantaro Komiya TOKYO (Reuters) - The Bank of Japan will end its negative interest rate policy next year, the majority of economists said in a ...

BOJ will end negative interest rates in 2024, most economists say: Reuters pollBy Kantaro Komiya TOKYO (Reuters) - The Bank of Japan will end its negative interest rate policy next year, the majority of economists said in a ...

Lire la suite »