(Bloomberg) -- A 36-hour rush of global monetary decisions may set the tone for the rest of the year as the world adjusts to a US push to keep interest rates high.Most Read from BloombergUltra-Rich Buy Ultra-Luxury Counseling to Get Kids Into HarvardMGM Resorts Hackers Broke In After Tricking IT Service DeskDisney Talks on ABC Sale Heat Up as Byron Allen Makes OfferCanada Postpones Trade Mission to India With Tensions On RiseA $188 Billion Exodus Shows China’s Heft Fading in World MarketsStartin

Starting with the Federal Reserve on Wednesday and ending with the Bank of Japan two days later, monetary policy will be determined at key meetings across half of the Group of 20.

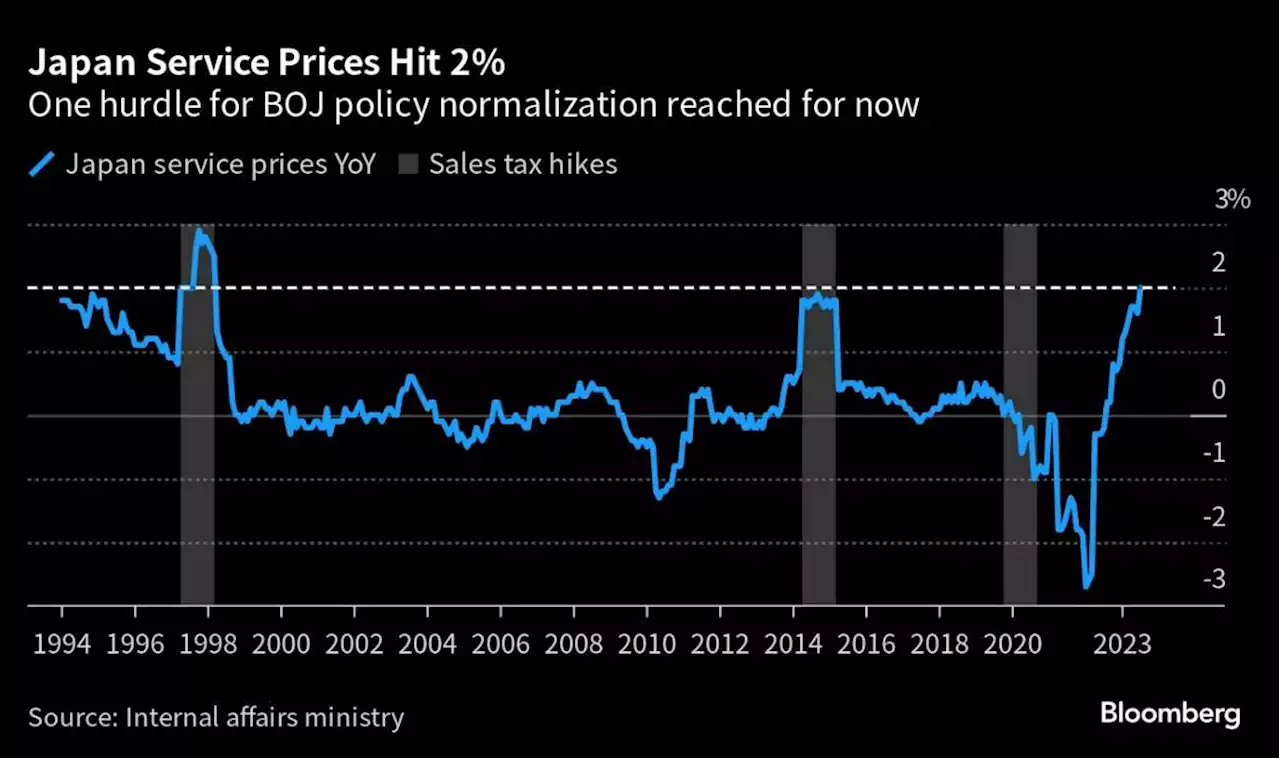

Setting the tone for all of them will be new projections from the Paris-based OECD on Tuesday. With weak demand from China depressing global trade, and the outlines of a stagflationary scenario forming in Europe, the apparent resilience of the US economy could prove the only bright spot. While economists surveyed by Bloomberg expect no change at Friday’s meeting, they’ll closely scrutinize any comments on the future of negative rates after Ueda recently touched on the possibility of scrapping them.

New Zealand also has GDP data due Thursday that’s likely to show a return to growth as the country readies for an election next month.A multitude of rate decisions across the region will keep investors busy. Most come on Thursday in the wake of the Fed. The same applies to Norges Bank, which signaled a likely move this month but might then change tack to keep monetary policy at the tighter level it will then have reached.

On the same day, policymakers in South Africa are likely to look beyond an expected quickening in consumer-price growth and maintain the benchmark interest rate at 8.25% for a second straight meeting.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Russia raises key interest rate again as inflation and exchange rate worries continueMOSCOW (AP) — The Central Bank of Russia raised its key lending rate by one percentage point to 13% on Friday, a month after imposing an even larger hike, as concerns about inflation persist and the ruble continues to struggle against the dollar. The increase comes as annualized inflation rose in September to 5.5% and the bank said it expected it would reach 6%-7% by the end of the year. “Inflationary pressure in the Russian economy remains high. Significant pro-inflationary risks have crystalli

Russia raises key interest rate again as inflation and exchange rate worries continueMOSCOW (AP) — The Central Bank of Russia raised its key lending rate by one percentage point to 13% on Friday, a month after imposing an even larger hike, as concerns about inflation persist and the ruble continues to struggle against the dollar. The increase comes as annualized inflation rose in September to 5.5% and the bank said it expected it would reach 6%-7% by the end of the year. “Inflationary pressure in the Russian economy remains high. Significant pro-inflationary risks have crystalli

Lire la suite »

World Cup bronze medallist Canada moves to No. 6 in FIBA men's world rankingsCanada soared nine spots to No. 6 in the world in the FIBA men's world after winning the basketball World Cup bronze in the updated list that was released Friday.

World Cup bronze medallist Canada moves to No. 6 in FIBA men's world rankingsCanada soared nine spots to No. 6 in the world in the FIBA men's world after winning the basketball World Cup bronze in the updated list that was released Friday.

Lire la suite »

Feds drop GST from new rental builds | Watch News Videos OnlineWatch Feds drop GST from new rental builds Video Online, on GlobalNews.ca

Feds drop GST from new rental builds | Watch News Videos OnlineWatch Feds drop GST from new rental builds Video Online, on GlobalNews.ca

Lire la suite »

Feds won't fund Calgary housing strategy unless city agrees to axe certain zoning rulesMore than a hundred Calgarians are making their opinions on the city’s housing strategy known Thursday — as a proposed plan to create more housing and improve affordability hangs in the balance.

Feds won't fund Calgary housing strategy unless city agrees to axe certain zoning rulesMore than a hundred Calgarians are making their opinions on the city’s housing strategy known Thursday — as a proposed plan to create more housing and improve affordability hangs in the balance.

Lire la suite »

“It Will Move The Needle”: The Industry Reacts To Feds Removal Of GST On New RentalsFor years, the real estate development industry has identified GST as a simple change that would go a long way towards helping rental development.

“It Will Move The Needle”: The Industry Reacts To Feds Removal Of GST On New RentalsFor years, the real estate development industry has identified GST as a simple change that would go a long way towards helping rental development.

Lire la suite »

Feds Holding Funding Until Calgary Ends Exclusionary ZoningMinister of Housing Sean Fraser sent a letter to Calgary Mayor Jyoti Gondek on Thursday.

Feds Holding Funding Until Calgary Ends Exclusionary ZoningMinister of Housing Sean Fraser sent a letter to Calgary Mayor Jyoti Gondek on Thursday.

Lire la suite »