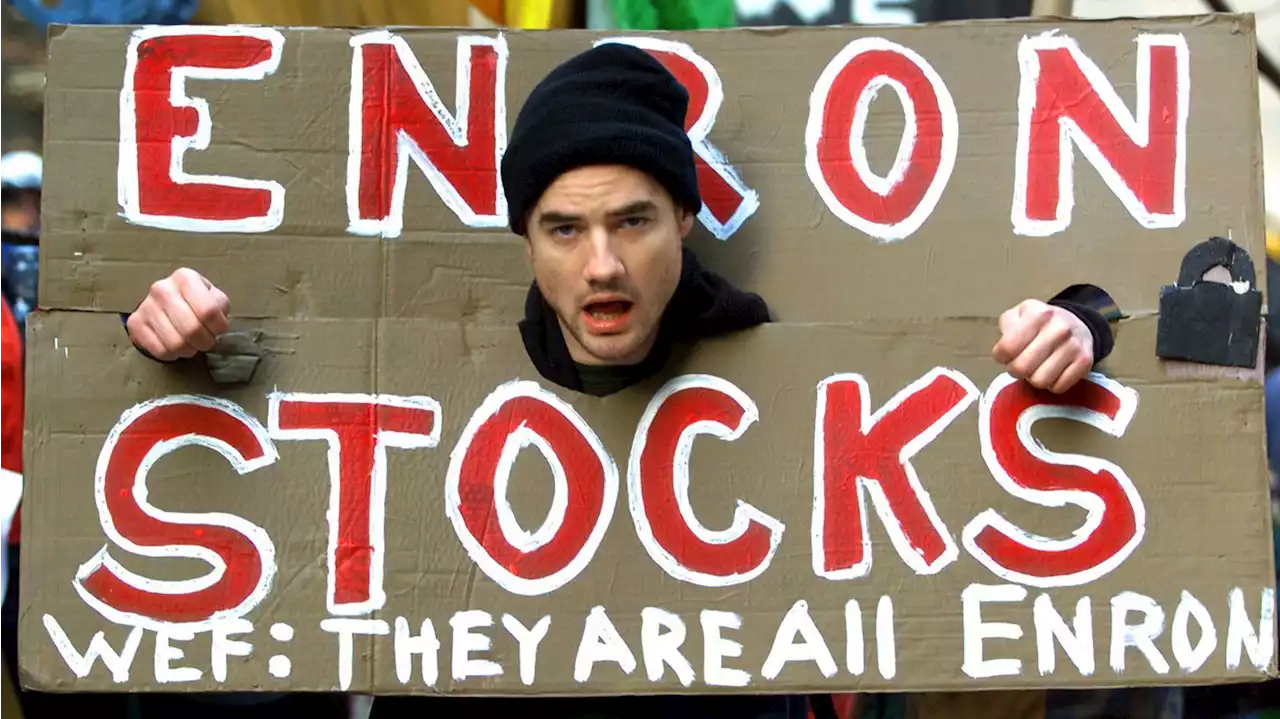

The new CEO of bankrupt crypto exchange FTX also helped clean up one of corporate America’s biggest collapses 20 years ago: Enron. History isn't repeating, per se, but it rhymes.

: “The smartest guys in the room. Not just financial error but — certainly from the reports — whiffs of fraud," he said. "Vast explosion of wealth that nobody quite understands where it comes from.”The Enron bankruptcy not only helped transform, for a time, the way Americans viewed public companies and the stock market but also led to the passage of the Sarbanes-Oxley Act in 2002, a law that tightened up accounting rules for public companies.

Those tighter rules made it harder for companies to go public, leading to fewer IPOs in the ensuing years and pushing companies to seek more capital from the private markets .The penalties that Enron executives and its accounting firm Arthur Andersen faced put them both out of business and destroyed thousands of jobs, leading to a notion in the U.S. that overly harsh penalties against corporations could hurtPublic sentiment and regulations.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Let’s enjoy this FTX bankruptcy filing togetherThe Enron cleanup guy says FTX is worse than Enron.

Let’s enjoy this FTX bankruptcy filing togetherThe Enron cleanup guy says FTX is worse than Enron.

Lire la suite »

Exec who cleaned up Enron calls FTX mess 'unprecedented'The man who had to clean up the mess at Enron says the situation at FTX is even worse, describing what he calls a “complete failure” of corporate control. The filing by John Ray III, the new CEO of the bankrupt cryptocurrency firm, lays out a damning description of FTX’s operations under its founder Sam Bankman-Fried, from a lack of security controls to business funds being used to buy employees homes and luxuries. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray said.

Exec who cleaned up Enron calls FTX mess 'unprecedented'The man who had to clean up the mess at Enron says the situation at FTX is even worse, describing what he calls a “complete failure” of corporate control. The filing by John Ray III, the new CEO of the bankrupt cryptocurrency firm, lays out a damning description of FTX’s operations under its founder Sam Bankman-Fried, from a lack of security controls to business funds being used to buy employees homes and luxuries. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray said.

Lire la suite »

FTX Advisers Find Only $740 Million in Crypto, While Liquidity Gap Stands at $8 BillionFTX funds were used to buy homes and personal items for FTX employees. crypto

FTX Advisers Find Only $740 Million in Crypto, While Liquidity Gap Stands at $8 BillionFTX funds were used to buy homes and personal items for FTX employees. crypto

Lire la suite »

FTX Was Worse Than Enron, New CEO Says | CoinMarketCapCryptonews Among the failures of the bankrupt FTX Group of companies were unsecured crypto keys, spending requests approved via emoji and records set to auto-delete 😶

FTX Was Worse Than Enron, New CEO Says | CoinMarketCapCryptonews Among the failures of the bankrupt FTX Group of companies were unsecured crypto keys, spending requests approved via emoji and records set to auto-delete 😶

Lire la suite »

Exec who cleaned up Enron calls FTX mess ‘unprecedented’The filing by John Ray III, the new CEO of the bankrupt cryptocurrency firm, lays out a damning description of FTX’s operations under its founder Sam Bankman-Fried, from a lack of security co…

Exec who cleaned up Enron calls FTX mess ‘unprecedented’The filing by John Ray III, the new CEO of the bankrupt cryptocurrency firm, lays out a damning description of FTX’s operations under its founder Sam Bankman-Fried, from a lack of security co…

Lire la suite »

New CEO says FTX mismanagement was worse than Enron: 'Complete failure'The new CEO of FTX said the company suffered a total management failure and that the mess at the cryptocurrency company is worse than any he's ever seen, including the historic scandal at Enron.

New CEO says FTX mismanagement was worse than Enron: 'Complete failure'The new CEO of FTX said the company suffered a total management failure and that the mess at the cryptocurrency company is worse than any he's ever seen, including the historic scandal at Enron.

Lire la suite »