Terra’s UST and LUNA collapse led to many other stablecoins dropping their dollar peg, and it also caught the attention of analysts and regulators who question the “stability” of stablecoins. elenahoolu investigates.

) and USDT are the most traded asset-backed stablecoins. Although they are all over-collateralized by fiat reserves and cryptocurrencies, USDC and USDT are centralized while DAI is decentralized.

DAI is minted when users borrow against their locked collateral and destroyed when loans are repaid. If DAI’s price is below $1, then TRFM increases the borrowing rate to decrease DAI’s supply as less people will want to borrow, aiming to increase the price of DAI back to $1 . The recent Terra debacle and the lack of transparency of their reserves triggered fresh concerns about USDT. The price reacted violently with a brief devaluation from $1 to $0.95. Although USDT’s price has recovered and repegged closely back to $1, the concerns are still there.

A similar imbalance is observed in the DAI/USDC/USDT/sUSD 4pool. It is interesting to see that sUSD and USDT both spiked in proportion around May 12 during the peak of the stablecoin fear. But sUSD has quickly reverted back to the equal portion of 25% and has even dropped in percentage since while USDT remains as the highest proportion in the pool.The Curve 3pool has a daily trading volume of $395 million and $1.4 billion total value locked .

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

In Light of UST and LUNA Crash: G7 Countries to Discuss Crypto Regulations (Report)The Group of Seven (G7) members could touch upon the topic of cryptocurrency regulations during their meeting this week in Germany.

In Light of UST and LUNA Crash: G7 Countries to Discuss Crypto Regulations (Report)The Group of Seven (G7) members could touch upon the topic of cryptocurrency regulations during their meeting this week in Germany.

Lire la suite »

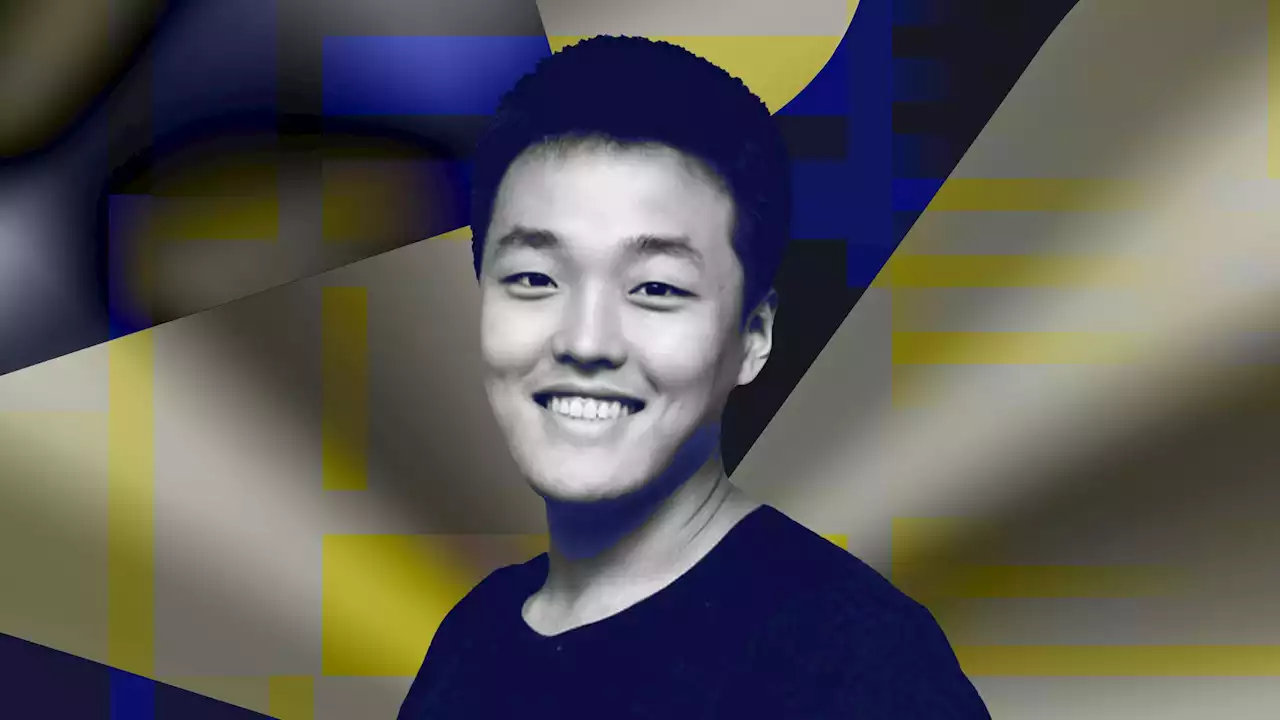

Major Korean law firm decides to sue Do Kwon after UST collapseLKB & Partners, one of the top law firms in Korea, has reportedly decided to sue Terraform Labs founder Do Kwon after UST's sudden collapse.

Major Korean law firm decides to sue Do Kwon after UST collapseLKB & Partners, one of the top law firms in Korea, has reportedly decided to sue Terraform Labs founder Do Kwon after UST's sudden collapse.

Lire la suite »

Terraform Labs’ legal team resigns after UST collapseThe in-house legal team at Terraform Labs resigned shortly after the collapse of Terra’s algorithmic stablecoin.

Terraform Labs’ legal team resigns after UST collapseThe in-house legal team at Terraform Labs resigned shortly after the collapse of Terra’s algorithmic stablecoin.

Lire la suite »

South Korea Launches 'Emergency' Investigation Into Collapse of LUNA and UST – Regulation Bitcoin NewsSouth Korea's top financial regulators have launched an emergency investigation into the collapse of $UST and $LUNA. crypto cryptocurrency terra terrausd

South Korea Launches 'Emergency' Investigation Into Collapse of LUNA and UST – Regulation Bitcoin NewsSouth Korea's top financial regulators have launched an emergency investigation into the collapse of $UST and $LUNA. crypto cryptocurrency terra terrausd

Lire la suite »

Terra's Do Kwon Could be Summoned to Testify to Korean Authorities on UST-LUNA Fiasco (Report)South Korean authorities could reportedly summon Terra's co-founder - Do Kwon - following the UST and LUNA fiasco.

Terra's Do Kwon Could be Summoned to Testify to Korean Authorities on UST-LUNA Fiasco (Report)South Korean authorities could reportedly summon Terra's co-founder - Do Kwon - following the UST and LUNA fiasco.

Lire la suite »

US congress research agency weighs in on UST crash, notes gaps in regulationThe CRS analysis highlighted that in traditional finance, scenarios like such are guarded by measures like bank deposit insurance and liquidity facilities.

US congress research agency weighs in on UST crash, notes gaps in regulationThe CRS analysis highlighted that in traditional finance, scenarios like such are guarded by measures like bank deposit insurance and liquidity facilities.

Lire la suite »