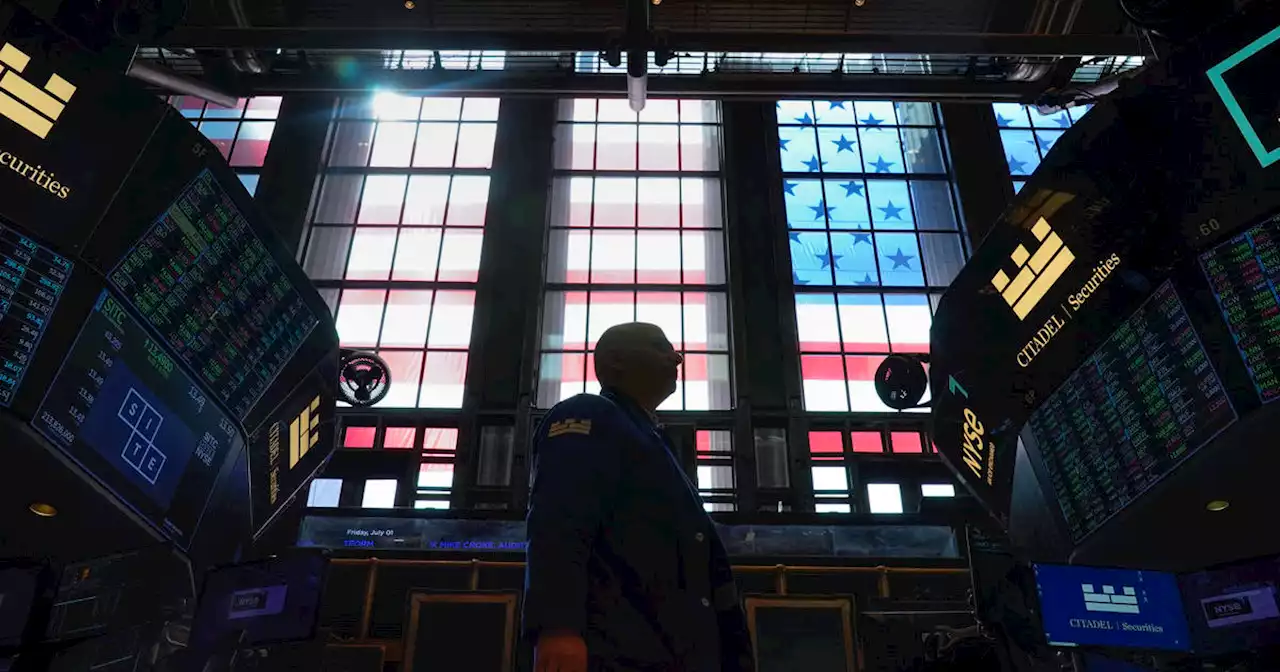

Samsung's well-received update buoys chipmakers, setting Wall Street up for more gains on Thursday.

US stock futures edged higher, leaving Wall Street on course for a fourth consecutive day of gains, with chipmakers expected to lead the rally.

How are stock-index futures trading On Wednesday, the Dow Jones Industrial Average DJIA rose 70 points, or 0.23%, to 31038, the S&P 500 SPX increased 14 points, or 0.36%, to 3845, and the Nasdaq Composite COMP gained 40 points, or 0.35%, to 11362. Meanwhile, equity investors appear to have decided that the latest Federal Reserve minutes, released on Wednesday, contained little to be concerned about.

In Asia, the Shanghai Composite SHCOMP rose 0.3% despite lingering concerns about Beijing’s zero-COVID 19 policy.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

The Wolf of Wall Street: Investors Will 'Almost Certainly' Profit by Hodling BTC for 3 yearsJordan Belfort would be 'shocked' if holding BTC for 3-5 years does not turn out to be a profitable investment strategy.

The Wolf of Wall Street: Investors Will 'Almost Certainly' Profit by Hodling BTC for 3 yearsJordan Belfort would be 'shocked' if holding BTC for 3-5 years does not turn out to be a profitable investment strategy.

Lire la suite »

Asia-Pacific Markets Poised to Open Lower After Wall Street Staged a ComebackFutures in the Asia-Pacific pointed to a lower open in the region despite Wall Street recovering most of its losses by the close.

Asia-Pacific Markets Poised to Open Lower After Wall Street Staged a ComebackFutures in the Asia-Pacific pointed to a lower open in the region despite Wall Street recovering most of its losses by the close.

Lire la suite »

Politico reports 'recession talk surges' from Washington to Wall Street despite Biden's reassurancesDespite President Joe Biden's repeated reassurances, talk of a recession is surging in Washington and on Wall Street, Politico reported Monday.

Politico reports 'recession talk surges' from Washington to Wall Street despite Biden's reassurancesDespite President Joe Biden's repeated reassurances, talk of a recession is surging in Washington and on Wall Street, Politico reported Monday.

Lire la suite »

Breakingviews - Lower China tariffs means more Wall Street crumbsPresident Joe Biden is leaning toward dropping some of the tariffs applied to $350 billion worth of Chinese goods. Unless he drops them all — which would alienate worker unions he needs for re-election — it won’t do much to cool inflation given much of it is driven by rising costs of energy, groceries and labour, which aren’t purchased from China for the most part.

Breakingviews - Lower China tariffs means more Wall Street crumbsPresident Joe Biden is leaning toward dropping some of the tariffs applied to $350 billion worth of Chinese goods. Unless he drops them all — which would alienate worker unions he needs for re-election — it won’t do much to cool inflation given much of it is driven by rising costs of energy, groceries and labour, which aren’t purchased from China for the most part.

Lire la suite »

Wall Street ends up as investors absorb Fed minutesWall Street put a seesaw day behind it to close higher on Wednesday, as investors digested new clues on the U.S. central bank's approach to rate policy and its inflation fight detailed in the minutes from the latest Federal Reserve meeting. After a brutal selloff in global equity markets in the first half of the year, nervous investors are keeping a close watch on central bank actions as they try to assess the impact of aggressive rate hikes on global growth. They got their latest data point on Wednesday afternoon, when the minutes of the June 14-15 policy meeting detailed how the U.S. central bank was prompted to make an outsized interest rate increase.

Wall Street ends up as investors absorb Fed minutesWall Street put a seesaw day behind it to close higher on Wednesday, as investors digested new clues on the U.S. central bank's approach to rate policy and its inflation fight detailed in the minutes from the latest Federal Reserve meeting. After a brutal selloff in global equity markets in the first half of the year, nervous investors are keeping a close watch on central bank actions as they try to assess the impact of aggressive rate hikes on global growth. They got their latest data point on Wednesday afternoon, when the minutes of the June 14-15 policy meeting detailed how the U.S. central bank was prompted to make an outsized interest rate increase.

Lire la suite »

U.S. stocks bounce around as turbulent trading persists on Wall StreetMajor indexes have been swinging between sharp losses and gains on a daily — and sometimes hourly — basis. The broader market, though, is still mired in a deep slump that has dragged the S&P 500 into a bear market, over 20% below its most recent high.

U.S. stocks bounce around as turbulent trading persists on Wall StreetMajor indexes have been swinging between sharp losses and gains on a daily — and sometimes hourly — basis. The broader market, though, is still mired in a deep slump that has dragged the S&P 500 into a bear market, over 20% below its most recent high.

Lire la suite »