bitcoin's dollar-denominated price on coinbase trades at a significant premium to prices on other exchanges, including binance. The premium stems from the discount in the dollar-pegged stablecoin $USDC. godbole17 reports

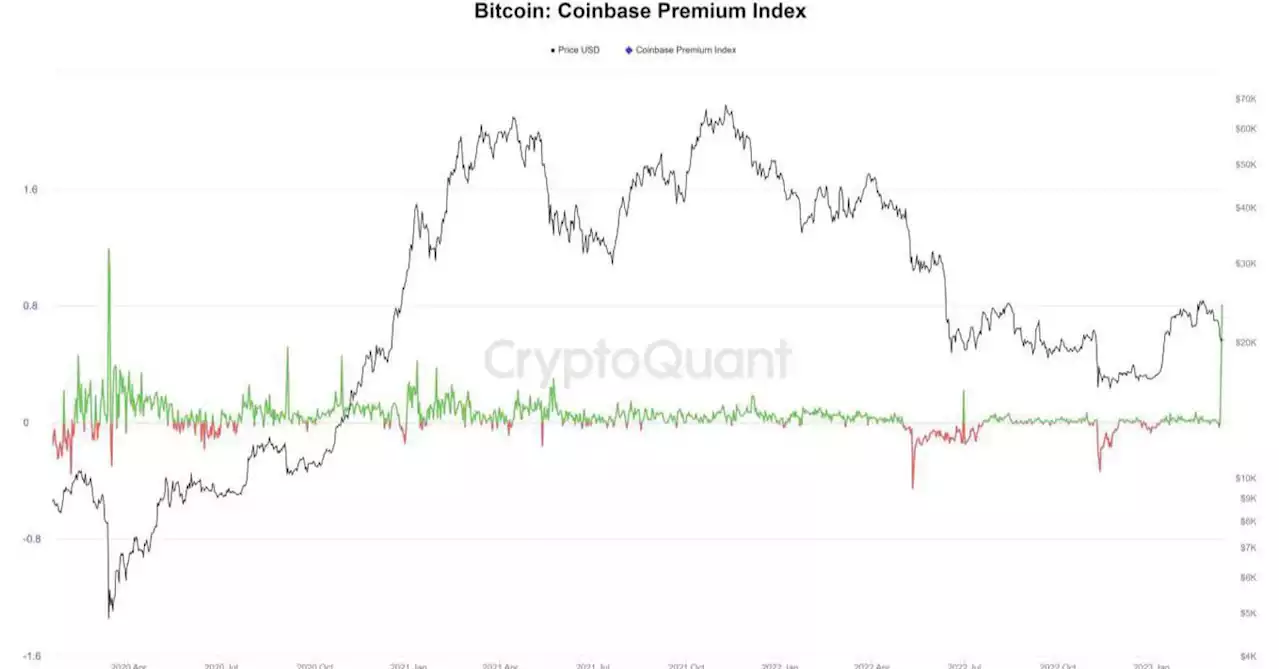

Data tracked by analytics firm CryptoQuant shows bitcoin's Coinbase Premium Index – which measures the spread between BTC's U.S. dollar-denominated price on U.S.-based Coinbase and BTC's tether-denominated price on offshore giant Binance – rose to 0.8, the highest since March 2020.to represent stronger buying pressure from stateside institutions and sophisticated traders.

This time, however, the premium likely represents the discount or flight from USDC. Bitcoin's price on Coinbase became sensitive to USDC volatility since the exchange in July last year merged its order book – consisting of USDC as the base currency – with the USD order book . Supporting the argument that bitcoin's current dollar-denominated price on Coinbase stems from the USDC discount is the fact that the BTC/USDT pair on Coinbase trades pretty much in line with prices on other offshore exchanges.

"Because USDC is trading below its peg, BTC appears more expensive on Coinbase," pseudonymous DeFi researcher Ignas told CoinDesk."Therefore, the spot market for BTC needs to be adjusted to reflect the current USDC price." USDC fell as low as $0.90 late Friday, deviating from its 1:1 dollar peg after its issuer, Circle Internet Financial,

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Binance Adds BNB/USDC, BTC/USDC & ETH/USDC Trading Pairs | Binance SupportFellow Binancians, Binance will open trading for the BNB/USDC, BTC/USDC and ETH/USDC trading pairs at 2023-03-12 06:30 (UTC) . Start Trading on Binance Spot Now! Notes: Where any discrepancy ari...

Binance Adds BNB/USDC, BTC/USDC & ETH/USDC Trading Pairs | Binance SupportFellow Binancians, Binance will open trading for the BNB/USDC, BTC/USDC and ETH/USDC trading pairs at 2023-03-12 06:30 (UTC) . Start Trading on Binance Spot Now! Notes: Where any discrepancy ari...

Lire la suite »

Coinbase Pauses Conversions Between USDC and US Dollars as Banking Crisis Roils CryptoCoinbase has paused conversions between USDC and US dollars for the weekend. It says it will resume conversions once banks reopen Monday. realDannyNelson reports

Coinbase Pauses Conversions Between USDC and US Dollars as Banking Crisis Roils CryptoCoinbase has paused conversions between USDC and US dollars for the weekend. It says it will resume conversions once banks reopen Monday. realDannyNelson reports

Lire la suite »

Bitcoin price spikes to '$26K' in USDC terms — How high can the BTC short squeeze go?Bitcoin brushes aside USDC depeg as BTC price returns above $20,000.

Bitcoin price spikes to '$26K' in USDC terms — How high can the BTC short squeeze go?Bitcoin brushes aside USDC depeg as BTC price returns above $20,000.

Lire la suite »

Scrutiny Falls on $43B USDC Stablecoin’s Cash Reserves at Failed Silicon Valley BankCircle’s USDC, the second largest stablecoin with $43 billion market capitalization, held an undisclosed part of its $9.8 billion cash reserves at failed Silicon Valley Bank. sndr_krisztian reports

Scrutiny Falls on $43B USDC Stablecoin’s Cash Reserves at Failed Silicon Valley BankCircle’s USDC, the second largest stablecoin with $43 billion market capitalization, held an undisclosed part of its $9.8 billion cash reserves at failed Silicon Valley Bank. sndr_krisztian reports

Lire la suite »

Crypto Wallets Withdraw $902M USDC From Centralized Exchanges in Past 24 Hours Amid SVB, Silvergate ShutdownsThe shutdowns of Silicon Valley Bank and Silvergate are causing ripple effects in the crypto sector, with many now looking at the impact on USDC issuer Circle, which held reserves in those banks. reports

Crypto Wallets Withdraw $902M USDC From Centralized Exchanges in Past 24 Hours Amid SVB, Silvergate ShutdownsThe shutdowns of Silicon Valley Bank and Silvergate are causing ripple effects in the crypto sector, with many now looking at the impact on USDC issuer Circle, which held reserves in those banks. reports

Lire la suite »