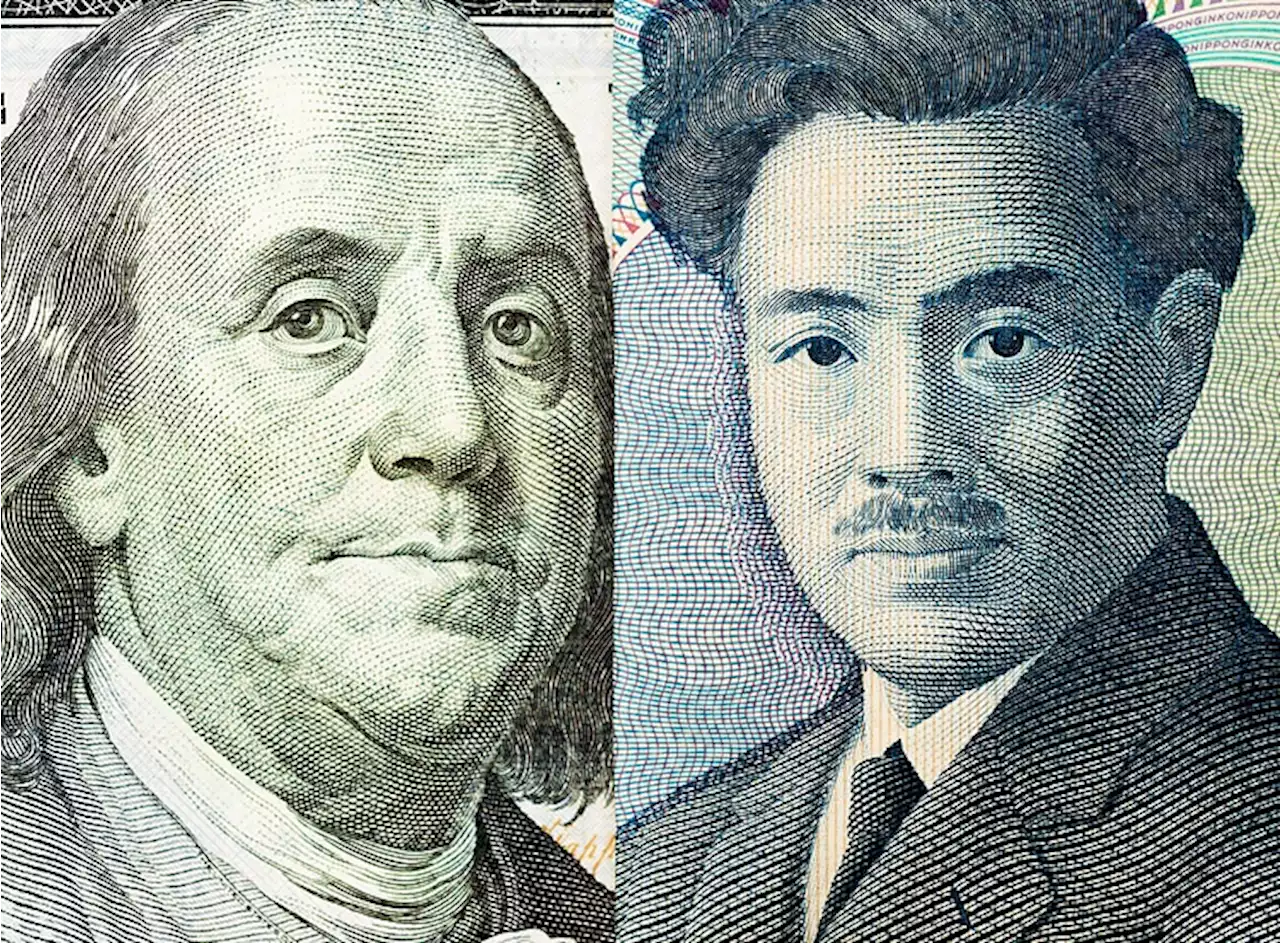

USD/JPY extended its gains early in the North American session after hitting a daily low of 148.86. However, positive data and high US Treasury bond y

Fed’s Kashkari remains hawkish, saying the risks of raising rates are tilted to the upside.USD/JPY

extended its gains early in the North American session after hitting a daily low of 148.86. However, positive data and high US Treasury bond yields keep the pair from falling below the 149.00 figure despite Japanese authorities' threats of intervention. The USD/JPY is trading at around 149.40s, gaining 0.27%.

USD/JPY advances steadily due to divergence in monetary policy but threats of intervention are halting the rally The financial markets narrative continues to be set by expectations of further tightening by the US Federal Reserve. Sentiment remains fragile, though the latest Durable Goods Orders beating estimates are giving a leg-up to the Greenback , which would likely continue to print gains across the board. Durable Goods in August were expected to drop -0.5% but rose 0.2% and crushed last month’s -5.6% plunge. Excluding Transports, orders rose by 0.4% MoM, above estimates and July’s 0.1% increase.

On the Japanese front, the Bank of Japan minutes for the July meeting showed that some members felt it was essential to explain that YCC tweaks are not a sign of ending accommodative posture while emphasizing they’re unsure if inflation will be sustainably above the 2% target. Meanwhile, the swaps market has begun to price in a possible rate hike for December and January, with odds at 70% for the former and 85% for the latter.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

USD/JPY eyes 150.00 on BoJ Ueda’s dovish commentary and resilient US DollarThe USD/JPY pair faces a less-confident resistance near 149.20 but is expected to resume its upside move toward the crucial resistance of 150.00. The

USD/JPY eyes 150.00 on BoJ Ueda’s dovish commentary and resilient US DollarThe USD/JPY pair faces a less-confident resistance near 149.20 but is expected to resume its upside move toward the crucial resistance of 150.00. The

Lire la suite »

USD/JPY: There is certainly a chance of a break above the 150 levelUSD/JPY has moved steadily higher since July. Economists at MUFG Bank analyze the pair’s outlook. Increased volatility and higher trading ranges are l

USD/JPY: There is certainly a chance of a break above the 150 levelUSD/JPY has moved steadily higher since July. Economists at MUFG Bank analyze the pair’s outlook. Increased volatility and higher trading ranges are l

Lire la suite »

USD/JPY: High chance of intervention but only after a break above the 150 levelUSD/JPY has broken above the 149 level. Economists at MUFG Bank analyze Yen’s outlook. Opposition to currency weakness remains firm We continue to see

USD/JPY: High chance of intervention but only after a break above the 150 levelUSD/JPY has broken above the 149 level. Economists at MUFG Bank analyze Yen’s outlook. Opposition to currency weakness remains firm We continue to see

Lire la suite »

USD/JPY extends winning streak despite hopes of BoJ’s stealth interventionThe USD/JPY extended its upside to near 149.20 on Wednesday. The asset continues to attract bids as the US Dollar is resilient amid deepening global s

USD/JPY extends winning streak despite hopes of BoJ’s stealth interventionThe USD/JPY extended its upside to near 149.20 on Wednesday. The asset continues to attract bids as the US Dollar is resilient amid deepening global s

Lire la suite »

USD/JPY soars as BoJ keeps dovish stance, US bond yields climbthe US Dollar (USD) rises sharply against the Japanese Yen (JPY) following last week’s Bank of Japan’s (BoJ) decision to hold rates unchanged while de

Lire la suite »

USD/JPY Price Analysis: Holds ground above 149.00 aligned to high since NovemberUSD/JPY hovers slightly below the high since November, trading around 149.10 psychological level during the Asian session on Wednesday. Market caution

USD/JPY Price Analysis: Holds ground above 149.00 aligned to high since NovemberUSD/JPY hovers slightly below the high since November, trading around 149.10 psychological level during the Asian session on Wednesday. Market caution

Lire la suite »