USD/CAD has extended losses for the second successive session, trading around 1.3640 during the Asian hours on Wednesday.

USD/CAD edges lower due to a weaker US Dollar amid improved risk appetite. Fed Chair Jerome Powell has anticipated for a sustained decrease in inflation, indicating less confidence in the disinflation outlook. The higher WTI price contributes support for the Canadian Dollar. The decline of the pair could be attributed to the weaker US Dollar as investors digested higher-than-expected US Producer Price Index data for April while awaiting the Consumer Price Index report scheduled for Wednesday.

The Bank of Canada is anticipated to implement four consecutive rate cuts in 2024, with an additional reduction of 100 basis points in 2025. While hawkish remarks from the Fed officials suggest maintaining the higher rates for longer. Regarding commodities, the rise in crude Oil prices could bolster the Canadian Dollar , undermining the USD/CAD pair. Canada's status as the largest oil exporter to the United States, and the largest oil consumer, contributes to this dynamic.

Majors Macroeconomics Canada WTI

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

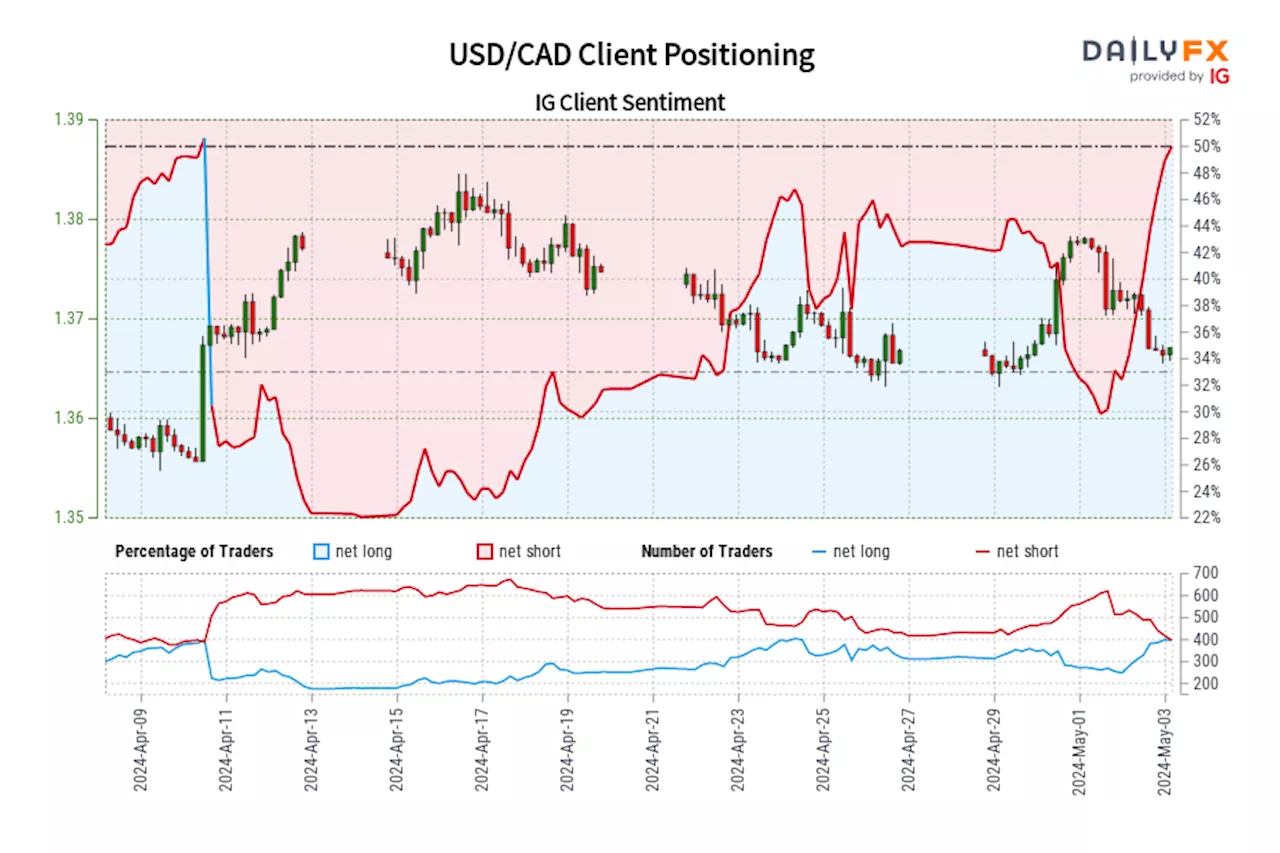

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Apr 10, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

USD/CAD IG Client Sentiment: Our data shows traders are now net-long USD/CAD for the first time since Apr 10, 2024 when USD/CAD traded near 1.37.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CAD-bearish contrarian trading bias.

Lire la suite »

USD/CAD falls to near 1.3700 amid higher crude Oil prices, risk-on moodUSD/CAD extends its losses for the second successive day, hovering around 1.3710 during the European session on Thursday.

USD/CAD falls to near 1.3700 amid higher crude Oil prices, risk-on moodUSD/CAD extends its losses for the second successive day, hovering around 1.3710 during the European session on Thursday.

Lire la suite »

USD/CAD falls sharply to 1.3800 despite multiple tailwindsThe USD/CAD pair dipped to round-level support of 1.3800 in Wednesday’s early American session.

USD/CAD falls sharply to 1.3800 despite multiple tailwindsThe USD/CAD pair dipped to round-level support of 1.3800 in Wednesday’s early American session.

Lire la suite »

USD/CAD falls sharply to 1.3630 as strong Canadian Employment numbersThe USD/CAD pair faces a sharp sell-off to 1.3630 in Friday’s early New York session as Statistics Canada has posted strong Canadian Employment data.

USD/CAD falls sharply to 1.3630 as strong Canadian Employment numbersThe USD/CAD pair faces a sharp sell-off to 1.3630 in Friday’s early New York session as Statistics Canada has posted strong Canadian Employment data.

Lire la suite »

USD/CAD retreats from 1.3700 as US Dollar falls sharply, US Inflation in focusThe USD/CAD pair falls back sharply while attempting to recapture the round-level resistance of 1.3700 in Monday’s American session.

USD/CAD retreats from 1.3700 as US Dollar falls sharply, US Inflation in focusThe USD/CAD pair falls back sharply while attempting to recapture the round-level resistance of 1.3700 in Monday’s American session.

Lire la suite »

USD/CAD Price Analysis: Corrects to 1.3730 ahead of US Retail Sales dataThe USD/CAD pair drops to 1.3730 in Monday’s European session.

USD/CAD Price Analysis: Corrects to 1.3730 ahead of US Retail Sales dataThe USD/CAD pair drops to 1.3730 in Monday’s European session.

Lire la suite »