Employers in the US are projected to have added about 190,000 jobs in October, following strong job growth in the previous months. However, hourly earnings are expected to rise at the slowest pace in over two years, reflecting increased labor force participation. The Federal Reserve is likely to keep interest rates steady due to moderating pay gains. The resilient labor market has supported consumer spending and economic growth, while easing recession concerns. Economists will also monitor a report on third-quarter employment costs for signs of cooler wage growth.

-- Employers in the US probably tempered their pace of hiring this month after beefing up payrolls by the most since the start of the year, consistent with a sturdy labor market that’s powering economic expansion.Israel Latest: Iranian Minister Warns US Over Support of Israel

Economists will also watch a report on third-quarter employment costs on Tuesday for signs of cooler wage growth. Labor costs are the biggest expense for employers, and any acceleration risks keeping inflation elevated. The government’s latest reading on productivity will also give an indication of how successful firms are in mitigating some of those increased costs.

A highlight for the week is the Bank of Japan’s policy meeting that wraps up on Tuesday. Most economists expect no change, but many flag the risk of a policy adjustment with the yen hovering around 150 to the dollar, long-term yields continuing to rise, and most recently, data showing Tokyo inflation unexpectedly quickened.

Elsewhere, Vietnam, Thailand, South Korea and Australia report trade data through the week, giving the latest snapshot on the state of global demand, while Indonesia and South Korea will also release inflation figures.While the Fed decision takes center stage, Europe will also await the outcomes of a trio of central bank meetings closer to home on Thursday.

Turning to the euro region, key data on Tuesday may show the economy stalled or even shrank in the third quarter under the cumulative weight of rate hikes. A changing of the guard in Rome and Frankfurt may draw some attentio as Bank of Italy Governor Ignazio Visco retires this week. He’ll be succeeded by ECB Executive Board member Fabio Panetta, who in turn will be replaced by Piero Cipollone, a senior official at the Italian central bank.

In Egypt on Thursday, investors will watch to see if the central bank raises rates to counter inflation that’s at a record high or holds for a second straight meeting. The decision has implications for the Egyptian pound, which is under pressure amid a dire shortage of foreign currency.In the region’s main event, Brazil’s central bank is locked in on delivering a third straight 50 basis-point rate cut that will take the Selic down to 12.25%.

Brazil’s September manufacturing PMI suggests that industrial output data for the same month reported this week will fall into the red as well. Inflation in Peru likely slowed for a ninth month in September, coming in just below 5%.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

CB's Lineup-Open Houses for Sunday, October 29th, 2023We made plans for you Sunday... Join Douglas Marsh, Claude St. Louis & Jeannie Leblanc at their respective Open Houses this Sunday October 29th, from 2-4 PM. For more information, contact Listing & Hosting Agents. We Look Forward to Seeing You There!

CB's Lineup-Open Houses for Sunday, October 29th, 2023We made plans for you Sunday... Join Douglas Marsh, Claude St. Louis & Jeannie Leblanc at their respective Open Houses this Sunday October 29th, from 2-4 PM. For more information, contact Listing & Hosting Agents. We Look Forward to Seeing You There!

Lire la suite »

Crypto AUM up 6.74% in October, the first monthly increase since JulyOctober was positive for the crypto ecosystem as the total AUM for digital asset products increased by 6.74% to $31.7 billion, the first monthly increase since July.

Crypto AUM up 6.74% in October, the first monthly increase since JulyOctober was positive for the crypto ecosystem as the total AUM for digital asset products increased by 6.74% to $31.7 billion, the first monthly increase since July.

Lire la suite »

Auto strikes to reduce US payrolls count in October -government reportExplore stories from Atlantic Canada.

Auto strikes to reduce US payrolls count in October -government reportExplore stories from Atlantic Canada.

Lire la suite »

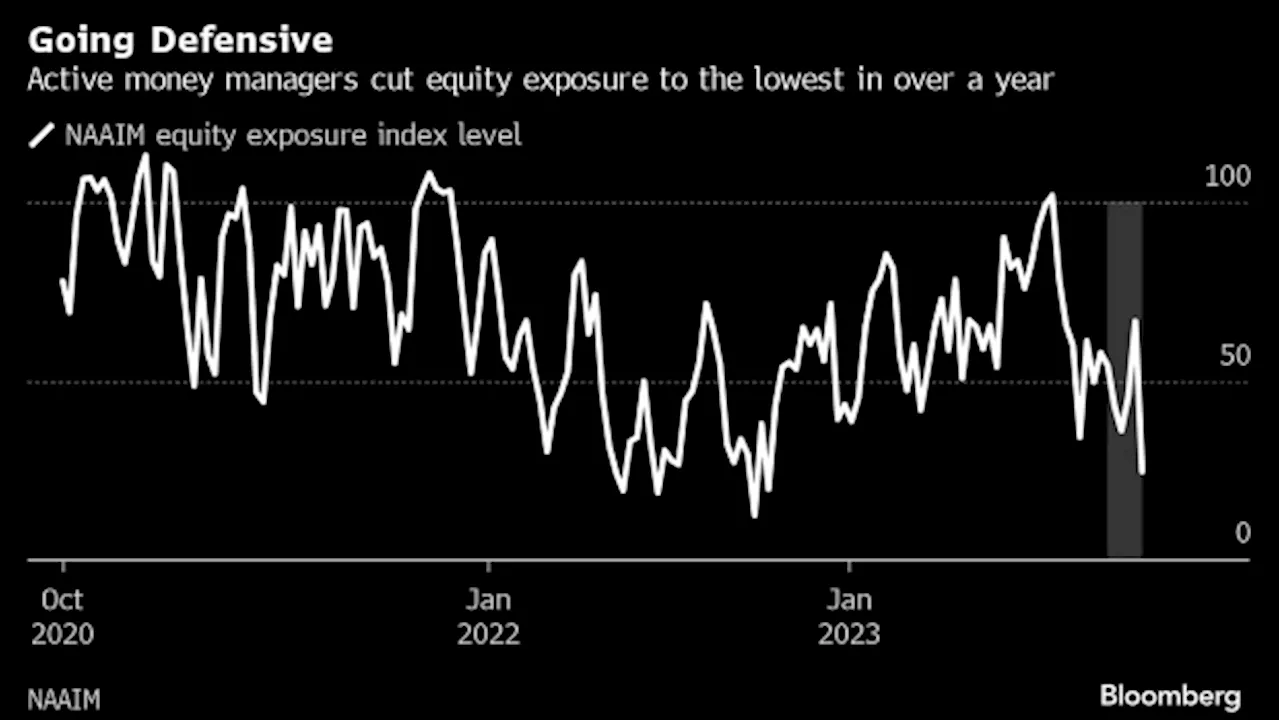

Worst October for Stocks in Five Years Has Investors Exiting MarketThe VIX is at 20, stocks are on the brink of their worst October in five years, and every other day the bond market throws a fit.

Worst October for Stocks in Five Years Has Investors Exiting MarketThe VIX is at 20, stocks are on the brink of their worst October in five years, and every other day the bond market throws a fit.

Lire la suite »

Digital asset investment products make a fantastic comeback in OctoberThe average daily volume of digital asset investment products surged by a whopping 44.3% to $230 million in October.

Digital asset investment products make a fantastic comeback in OctoberThe average daily volume of digital asset investment products surged by a whopping 44.3% to $230 million in October.

Lire la suite »

Friday's Charts for Gold, Silver and Platinum and Palladium, October 27Get the Big Picture view on gold, silver and other precious metals markets with Kitco Senior Analyst. With thorough analysis, get a sense of today's market as well as where it may be heading. Be in the lead.

Friday's Charts for Gold, Silver and Platinum and Palladium, October 27Get the Big Picture view on gold, silver and other precious metals markets with Kitco Senior Analyst. With thorough analysis, get a sense of today's market as well as where it may be heading. Be in the lead.

Lire la suite »