Just six months after mounting an emergency rescue of stricken rival Credit Suisse, UBS Group AG is poised for its best quarterly share-price gain in 14 years. And most analysts reckon there’s more to come.

Shares in the Zurich-based lender have jumped 25% in the third quarter, the steepest advance since the same period of 2009. The gains have been accompanied by a slew of increased price targets, which imply the stock has a further 13% of upside in the coming year. That’s a contrast with the turbulence seen in March, when UBS was tasked with taking over its troubled former rival Credit Suisse.

Analyst optimism is based around rapid momentum in integrating Credit Suisse assets, surging inflows into the wealth division and the potential resumption of share buybacks. UBS Chief Executive Officer Sergio Ermotti said this week he’s seeing “good momentum” in regaining funds clients had pulled from Credit Suisse.UBS shares have risen 33% year-to-date, far outstripping gains on the pan-European Stoxx benchmark’s banking subindex.

Meanwhile, second-quarter underlying profit for the combined UBS-Credit Suisse business came in at $1.1 billion, while its wealth-management business recorded $16 billion in client inflows over the second quarter, the highest for the period in more than a decade.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

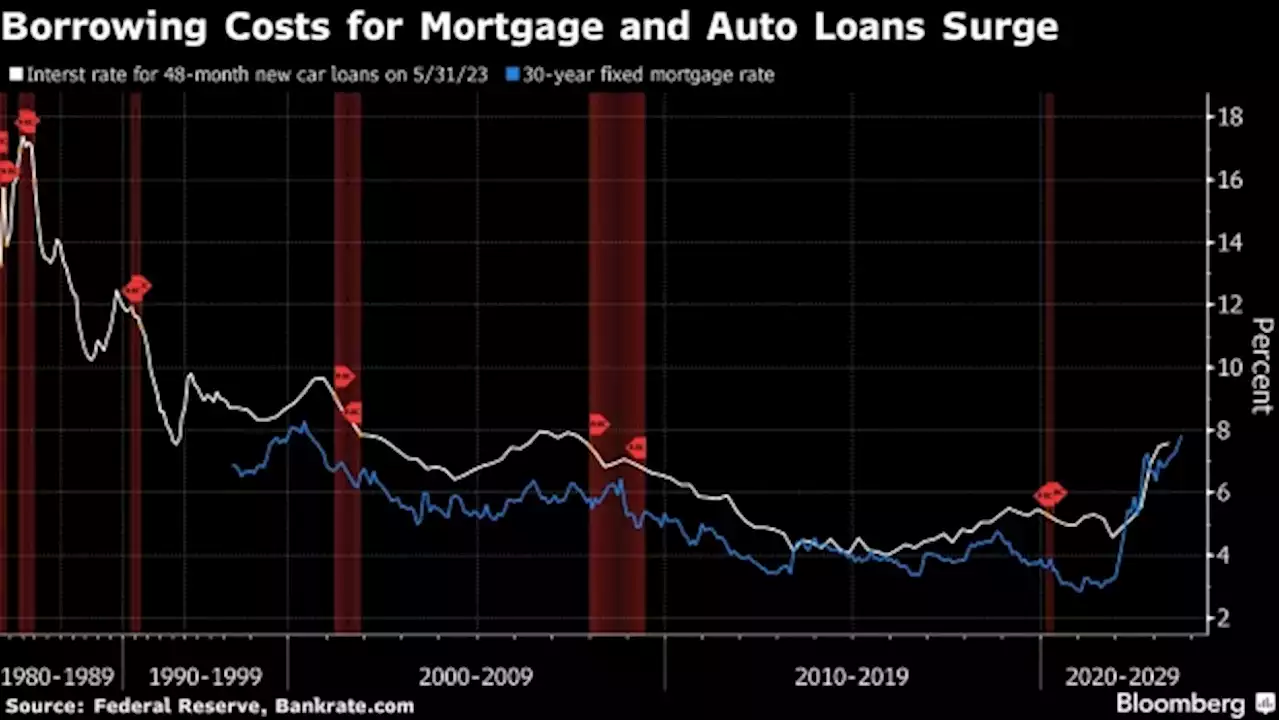

Stock futures tick higher after steep selloff: Stock market news todayStocks looked set to take a breather on Wednesday from steep losses fueled by concerns about economic impact of 'higher for longer' rates.

Stock futures tick higher after steep selloff: Stock market news todayStocks looked set to take a breather on Wednesday from steep losses fueled by concerns about economic impact of 'higher for longer' rates.

Lire la suite »

CarMax quarterly revenue slips on slow used vehicle demand(Reuters) - CarMax on Thursday posted lower quarterly revenue amid tepid demand for preowned vehicles. The company posted second-quarter net revenue of ...

CarMax quarterly revenue slips on slow used vehicle demand(Reuters) - CarMax on Thursday posted lower quarterly revenue amid tepid demand for preowned vehicles. The company posted second-quarter net revenue of ...

Lire la suite »

Nike misses quarterly sales estimates as demand tapers(Reuters) - Nike missed Wall Street estimates for first-quarter sales on Thursday, fanning fears that demand for its sneakers is tapering amid tight ...

Nike misses quarterly sales estimates as demand tapers(Reuters) - Nike missed Wall Street estimates for first-quarter sales on Thursday, fanning fears that demand for its sneakers is tapering amid tight ...

Lire la suite »

Nike misses quarterly sales estimates as demand tapersU.S. consumers have sharply cut back on discretionary spending, which has also prompted wholesalers to place fewer orders, denting business in North America, the company's largest market. While Nike's wholesale business has been under pressure for a few quarters now, weakness is also hitting its direct-to-consumer business, which the company has heavily invested in, as it faces growing competition from newer sneaker brands such as On Running and Hoka. Nike's total revenue rose to $12.94 billion in the first quarter, from $12.69 billion a year earlier.

Nike misses quarterly sales estimates as demand tapersU.S. consumers have sharply cut back on discretionary spending, which has also prompted wholesalers to place fewer orders, denting business in North America, the company's largest market. While Nike's wholesale business has been under pressure for a few quarters now, weakness is also hitting its direct-to-consumer business, which the company has heavily invested in, as it faces growing competition from newer sneaker brands such as On Running and Hoka. Nike's total revenue rose to $12.94 billion in the first quarter, from $12.69 billion a year earlier.

Lire la suite »

Long-Bond Yields Poised for Biggest Quarterly Jump Since 2009Yields on 30-year Treasuries are on track to log their largest quarterly jump since 2009, stoking anxiety that the bond rout of the past few months could reverberate across financial markets.

Long-Bond Yields Poised for Biggest Quarterly Jump Since 2009Yields on 30-year Treasuries are on track to log their largest quarterly jump since 2009, stoking anxiety that the bond rout of the past few months could reverberate across financial markets.

Lire la suite »

Analysis-Global bond investors fear more declines after vicious quarterly selloffFiscal concerns and worries over a prolonged period of elevated interest rates sent government bonds tumbling in the third quarter, and some investors believe more weakness is in store. U.S. and German government bond yields were set to end September with their biggest quarterly rises in a year, disappointing fund managers who were hoping for relief from the historic losses bonds suffered in 2022, when the U.S. Federal Reserve and other central banks raised interest rates to contain surging inflation. While bond yields - which move inversely to prices - appeared to be topping out earlier this year, renewed hawkishness from central banks has sent them soaring again in recent weeks.

Analysis-Global bond investors fear more declines after vicious quarterly selloffFiscal concerns and worries over a prolonged period of elevated interest rates sent government bonds tumbling in the third quarter, and some investors believe more weakness is in store. U.S. and German government bond yields were set to end September with their biggest quarterly rises in a year, disappointing fund managers who were hoping for relief from the historic losses bonds suffered in 2022, when the U.S. Federal Reserve and other central banks raised interest rates to contain surging inflation. While bond yields - which move inversely to prices - appeared to be topping out earlier this year, renewed hawkishness from central banks has sent them soaring again in recent weeks.

Lire la suite »