With Apple shares trading at premium to the market, UBS says the risk/reward is unfavorable.

UBS downgraded Apple shares to neutral from buy late Monday, saying iPhone demand is likely to remain under pressure despite growth in emerging markets. Apple shares closed Monday at a record high of $183.79. The stock has gained more than 41% since the start of the year. "At 29x our [next 12 months] EPS forecast of $6.

Vogt increased his price target to $190, but said the potential shareholder return doesn't justify a buy rating, especially given its "softer fundamentals." The analyst expects to see iPhone unit growth fall 1% to 2% in the second half of this year. Meanwhile, Mac revenue could drop between 3% and 5%. Apple has seen recent strength in iPhone sales in emerging markets, but the size of the total addressable market outside the U.S.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

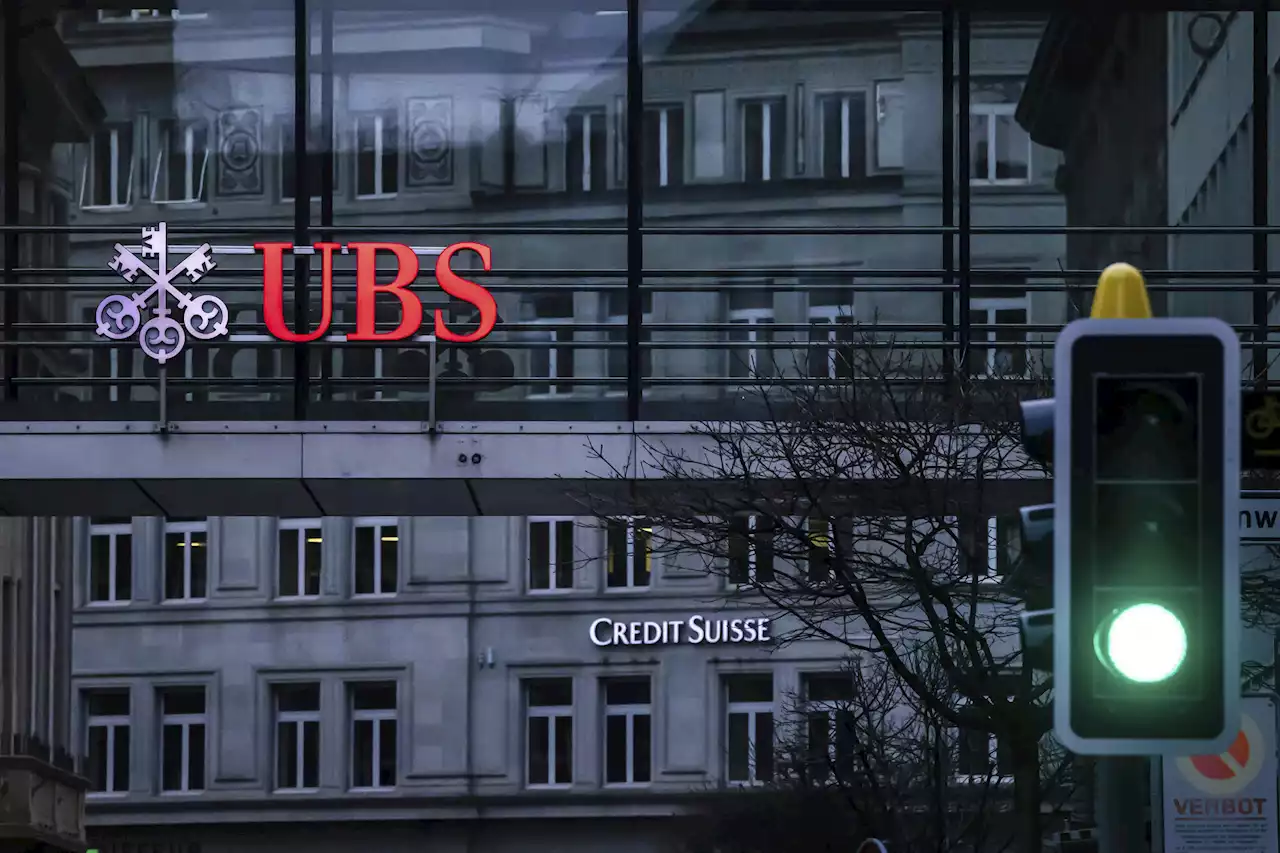

UBS to impose restrictions on Credit Suisse bankers after takeover complete, FT saysUBS AG is set to impose tight restrictions on Credit Suisse bankers, including a ban on new clients from high-risk countries and on complex financial products, the Financial Times said on Sunday, citing people with knowledge of the matter.

UBS to impose restrictions on Credit Suisse bankers after takeover complete, FT saysUBS AG is set to impose tight restrictions on Credit Suisse bankers, including a ban on new clients from high-risk countries and on complex financial products, the Financial Times said on Sunday, citing people with knowledge of the matter.

Lire la suite »

UBS says it has completed the takeover of stricken rival Credit SuisseSwiss bank UBS released an open letter Monday saying that it had formally completed the takeover of its rival Credit Suisse.

UBS says it has completed the takeover of stricken rival Credit SuisseSwiss bank UBS released an open letter Monday saying that it had formally completed the takeover of its rival Credit Suisse.

Lire la suite »

UBS completes Credit Suisse takeover to become wealth management behemothUBS on Monday said it had completed its emergency takeover of embattled local rival Credit Suisse , creating a giant Swiss bank with a balance sheet of $1.6 trillion and greater muscle in wealth management.

UBS completes Credit Suisse takeover to become wealth management behemothUBS on Monday said it had completed its emergency takeover of embattled local rival Credit Suisse , creating a giant Swiss bank with a balance sheet of $1.6 trillion and greater muscle in wealth management.

Lire la suite »

UBS says its takeover of Credit Suisse is now completeUBS announced the finalization of the deal for its rival Credit Suisse in an open letter to Swiss and other international newspapers.

UBS says its takeover of Credit Suisse is now completeUBS announced the finalization of the deal for its rival Credit Suisse in an open letter to Swiss and other international newspapers.

Lire la suite »

Explainer: UBS has Swiss mountain to climb with Credit SuisseWith its Credit Suisse takeover officially wrapped up, UBS must now make good on its promise that the government-orchestrated rescue will deliver both for shareholders and Swiss taxpayers.

Explainer: UBS has Swiss mountain to climb with Credit SuisseWith its Credit Suisse takeover officially wrapped up, UBS must now make good on its promise that the government-orchestrated rescue will deliver both for shareholders and Swiss taxpayers.

Lire la suite »

UBS completes takeover of Credit Suisse in deal meant to stem global financial turmoilUBS says it has completed its takeover of embattled rival Credit Suisse. The announcement comes nearly three months after the Swiss government hastily arranged a rescue deal to combine the country’s two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil. A statement from the bank on Monday said that “UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.” UBS had said last week that it expected to complete the acquisition worth 3 billion Swiss francs ($3.3 billion) as early as Monday.

UBS completes takeover of Credit Suisse in deal meant to stem global financial turmoilUBS says it has completed its takeover of embattled rival Credit Suisse. The announcement comes nearly three months after the Swiss government hastily arranged a rescue deal to combine the country’s two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil. A statement from the bank on Monday said that “UBS has completed the acquisition of Credit Suisse today, crossing an important milestone.” UBS had said last week that it expected to complete the acquisition worth 3 billion Swiss francs ($3.3 billion) as early as Monday.

Lire la suite »