Company could be valued at $4 billion to $5 billion

New Era Cap LLC, a supplier of major U.S. sports league headware, has kicked off preparations for an initial public offering in New York that could value it at $4 billion to $5 billion, according to people familiar with the matter.

The company’s earnings before interest, taxes, depreciation and amortization may reach or surpass $300 million in 2023, the sources added.Kevin R. Wilson, executive vice president and chief financial officer of New Era, said the company “is always considering alternatives to position the company financially for future growth, but we have no strategic plans to share at this time. We don’t comment on speculation,” .

New Era was started in 1920 in Buffalo, New York, by German-American businessman Ehrhardt Koch, who borrowed $5,000 from his aunt to launch a business focused on making men’s fitted caps, known as Gatsby or Ivy League caps, that would match men’s suits. New Era’s apparel products are currently sold in over 1,000 retail stores worldwide in more than 125 countries, according to the company.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

NFL-Backed New Era Cap Secures $600 Million Term Loan Amid IPO SpeculationFor over a century, New Era Cap has reined as one of the most recognizable names in hatmaking.

NFL-Backed New Era Cap Secures $600 Million Term Loan Amid IPO SpeculationFor over a century, New Era Cap has reined as one of the most recognizable names in hatmaking.

Lire la suite »

Factbox-U.S IPO market poised for strong finish in 2023 amid a flurry of listingsU.S. investors are awaiting a slew of initial public offerings (IPO) in coming months, hoping to ride the recent rally in equity markets. British chip-designer Arm Holdings, owned by Japan's Softbank Group, launched what is expected to be this year's biggest IPO that could raise about $5 billion and value the company at as much as $52 billion. The company publicly filed its IPO with U.S. Securities and Exchange Commission (SEC) last month and kicked off its IPO roadshow this week in Baltimore, where influential asset manager T Rowe Price is headquartered.

Factbox-U.S IPO market poised for strong finish in 2023 amid a flurry of listingsU.S. investors are awaiting a slew of initial public offerings (IPO) in coming months, hoping to ride the recent rally in equity markets. British chip-designer Arm Holdings, owned by Japan's Softbank Group, launched what is expected to be this year's biggest IPO that could raise about $5 billion and value the company at as much as $52 billion. The company publicly filed its IPO with U.S. Securities and Exchange Commission (SEC) last month and kicked off its IPO roadshow this week in Baltimore, where influential asset manager T Rowe Price is headquartered.

Lire la suite »

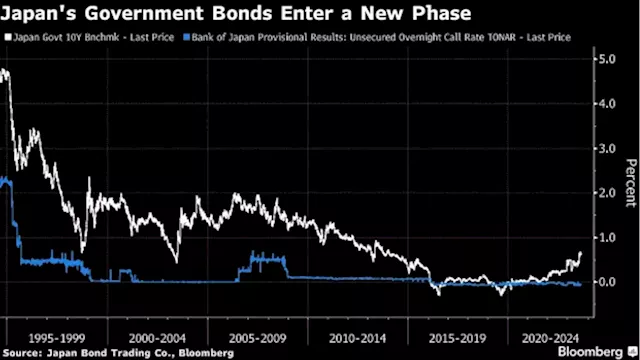

SMFG Market Head Sees New Era With Japan Yield as High as 2%A banker who has spent more than three decades watching Japanese government bonds is bracing for the possibility that long-term yields hit levels unseen in a generation as the central bank moves away from negative rates.

SMFG Market Head Sees New Era With Japan Yield as High as 2%A banker who has spent more than three decades watching Japanese government bonds is bracing for the possibility that long-term yields hit levels unseen in a generation as the central bank moves away from negative rates.

Lire la suite »

Taxes look certain to rise in new era of big government spendingCountries are spending heavily on defence, welfare and the green transition, and with debt already high, taxes look certain to rise. Read on

Taxes look certain to rise in new era of big government spendingCountries are spending heavily on defence, welfare and the green transition, and with debt already high, taxes look certain to rise. Read on

Lire la suite »

Taxes look certain to rise in new era of big government spendingCountries are spending heavily on defence, welfare and the green transition, and with debt already high, taxes look certain to rise. Read on

Taxes look certain to rise in new era of big government spendingCountries are spending heavily on defence, welfare and the green transition, and with debt already high, taxes look certain to rise. Read on

Lire la suite »

Biden to focus on World Bank reform, new funding at G20 in New DelhiWASHINGTON (Reuters) - U.S. President Joe Biden will focus on reforming the World Bank and urging other multilateral development banks to boost lending ...

Biden to focus on World Bank reform, new funding at G20 in New DelhiWASHINGTON (Reuters) - U.S. President Joe Biden will focus on reforming the World Bank and urging other multilateral development banks to boost lending ...

Lire la suite »