While higher interest rates can juice profits for a slew of lenders, a senior TD Securities strategist warns that the relentless jump in borrowing costs threatens to create fresh problems for the banking sector.

The yield on two-year Treasuries rising to 5% this week represents the “pain trade for a lot of the banks” heading into the fall, said Gennadiy Goldberg, TD’s head of US rates strategy, in a Tuesday interview on Bloomberg Television.

The banking crisis this spring exemplified the risk of higher-than-expected rates. The demise of SVB Financial Group came about in large part because its balance sheet was burdened by long-term loans whose value plummeted as yields rose on the back of Federal Reserve interest-rate hikes. “At what point does the economy effectively break under the weight of real rates? I don’t think we are there yet,” he added. “But I still think that the market is ignoring a lot of this interest-rate pass through at their own peril.”

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Canadian dollar holds near two-and-a-half-month low as U.S. yields climbLoonie at 73.80 U.S. cents

Canadian dollar holds near two-and-a-half-month low as U.S. yields climbLoonie at 73.80 U.S. cents

Lire la suite »

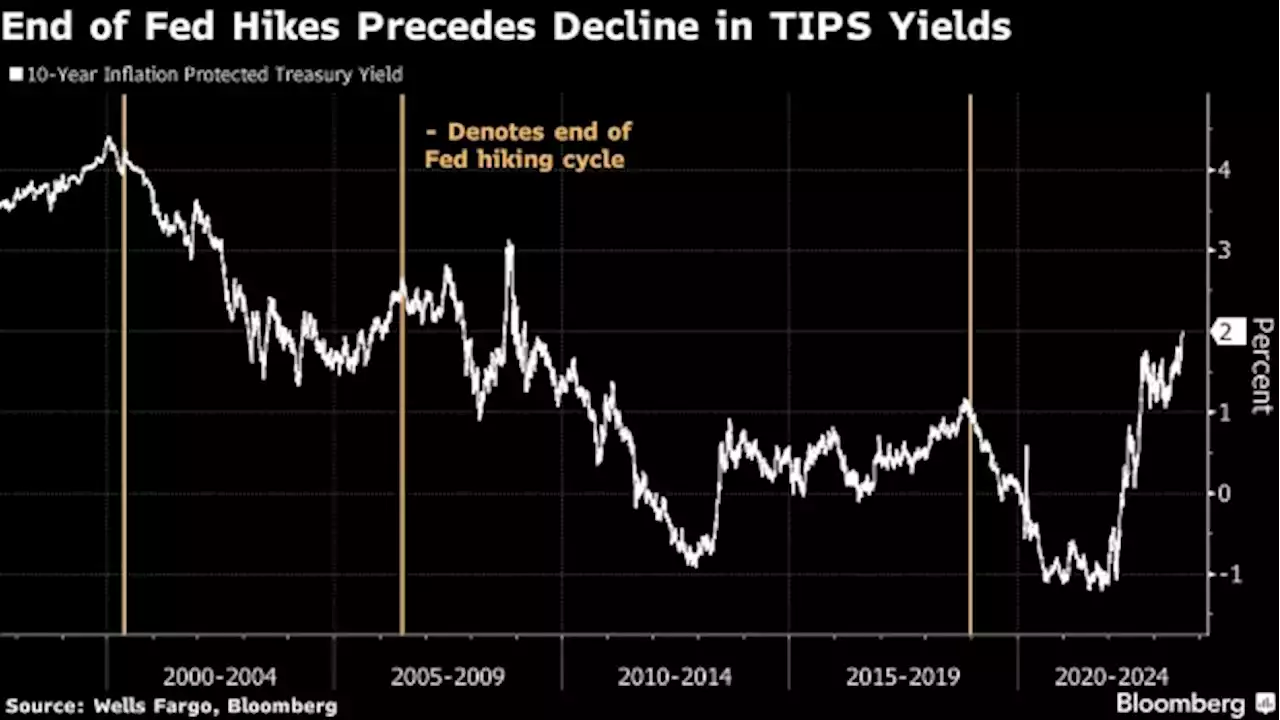

Wells Fargo Strategists Recommend 10-Year TIPS With Yields Hitting 2%It’s a good time to buy inflation-protected Treasury debt after yields on the benchmark exceeded 2%, according to strategists at Wells Fargo & Co.

Wells Fargo Strategists Recommend 10-Year TIPS With Yields Hitting 2%It’s a good time to buy inflation-protected Treasury debt after yields on the benchmark exceeded 2%, according to strategists at Wells Fargo & Co.

Lire la suite »

Treasury 10-Year Real Yield Tops 2% for First Time Since 2009The yield on 10-year inflation-protected Treasuries exceeded 2% for the first time since 2009, extending its ascent from year-to-date lows near 1%.

Treasury 10-Year Real Yield Tops 2% for First Time Since 2009The yield on 10-year inflation-protected Treasuries exceeded 2% for the first time since 2009, extending its ascent from year-to-date lows near 1%.

Lire la suite »

Skyrocketing yields in the spotlightA look at the day ahead in European and global markets from Tom Westbrook Bond selling extended on Tuesday to drive 10-year Treasury yields to fresh ...

Skyrocketing yields in the spotlightA look at the day ahead in European and global markets from Tom Westbrook Bond selling extended on Tuesday to drive 10-year Treasury yields to fresh ...

Lire la suite »

China cuts 1-year lending benchmark but keeps 5-year unchangedChina cut its one-year benchmark lending rate on Monday, as expected, as authorities seek to ramp up efforts to stimulate credit demand, but surprised markets by keeping the five-year rate unchanged. The one-year loan prime rate (LPR) was lowered by 10 basis points to 3.45% from 3.55% previously, while the five-year LPR was left at 4.20%. Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages.

China cuts 1-year lending benchmark but keeps 5-year unchangedChina cut its one-year benchmark lending rate on Monday, as expected, as authorities seek to ramp up efforts to stimulate credit demand, but surprised markets by keeping the five-year rate unchanged. The one-year loan prime rate (LPR) was lowered by 10 basis points to 3.45% from 3.55% previously, while the five-year LPR was left at 4.20%. Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages.

Lire la suite »

China cuts 1-year lending benchmark but keeps 5-year unchangedSHANGHAI (Reuters) - China cut its one-year benchmark lending rate on Monday, as expected, as authorities seek to ramp up efforts to stimulate credit ...

China cuts 1-year lending benchmark but keeps 5-year unchangedSHANGHAI (Reuters) - China cut its one-year benchmark lending rate on Monday, as expected, as authorities seek to ramp up efforts to stimulate credit ...

Lire la suite »