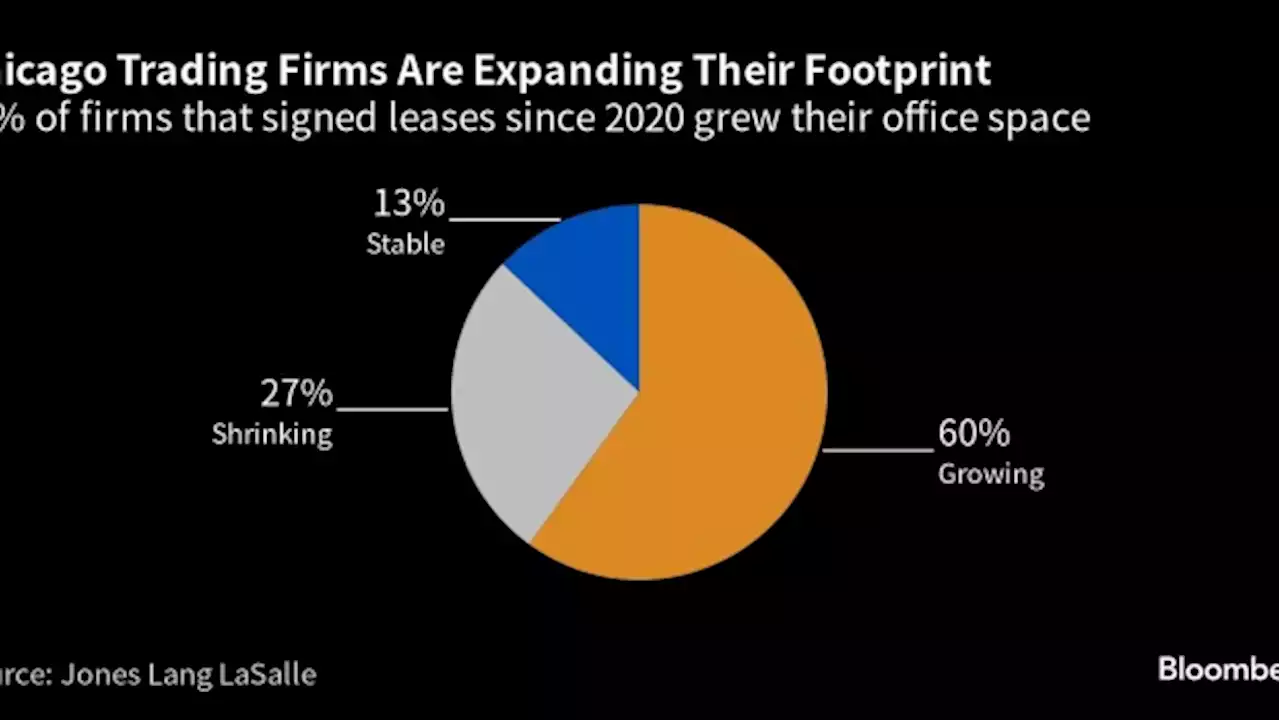

Chicago’s top trading firms are questioning their commitment to the city in the face of proposed taxes and rising crime. That’s not stopping some of them expanding their footprint.

Optiver, a market maker employing about 400 people in the city, has just moved into One Prudential Plaza in downtown Chicago. The space — a third bigger than its previous office — can house as many as 600 people, allowing the Dutch firm to grow and host 70 interns in the city every year.

Trading firms currently occupy more than 3.5 million square feet in the city, equivalent to 60 football fields. In the past three years, they’ve added about 700,000 square feet, and that doesn’t include the trading divisions of large banks such as JPMorgan Chase & Co. Those bonds have weakened recently. Ken Griffin’s Citadel quit the city last year for Miami, citing out-of-control crime and fiscal problems. In April, the city elected progressive Brandon Johnson as mayor and he’s already facing a budget gap of more than $500 million.

Finance has also led a push for workers to return to the office. In Chicago, offices are just 53% full, according to security firm Kastle Systems.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

City of London Watchdogs to Ask Firms for Diversity Plans(Bloomberg) -- UK regulators want to boost diversity and inclusion in the financial services sector by requiring firms to set targets and making clear that a banker’s private behavior can be relevant to determining their suitability to work in the industry. Most Read from BloombergIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn BanknotesChinese Gold Buying Is Driving a Paradigm Shift in BullionIndia-Canada Clash Should Be a Wake-Up CallBonds Fall, Dollar Rallies as Hawkish F

City of London Watchdogs to Ask Firms for Diversity Plans(Bloomberg) -- UK regulators want to boost diversity and inclusion in the financial services sector by requiring firms to set targets and making clear that a banker’s private behavior can be relevant to determining their suitability to work in the industry. Most Read from BloombergIndians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn BanknotesChinese Gold Buying Is Driving a Paradigm Shift in BullionIndia-Canada Clash Should Be a Wake-Up CallBonds Fall, Dollar Rallies as Hawkish F

Lire la suite »

Russian rouble firms against euro, steady vs dollar(Reuters) - The rouble firmed against the euro on Monday while trading little changed against the dollar, in a week when companies' need for roubles to ...

Russian rouble firms against euro, steady vs dollar(Reuters) - The rouble firmed against the euro on Monday while trading little changed against the dollar, in a week when companies' need for roubles to ...

Lire la suite »

US hits Chinese, Russian firms over Moscow military aidBy David Shepardson and Alexandra Alper WASHINGTON (Reuters) - U.S. President Joe Biden's administration on Monday imposed new trade restrictions on 11 ...

US hits Chinese, Russian firms over Moscow military aidBy David Shepardson and Alexandra Alper WASHINGTON (Reuters) - U.S. President Joe Biden's administration on Monday imposed new trade restrictions on 11 ...

Lire la suite »

US hits Chinese, Russian firms over Moscow military aidBy David Shepardson and Alexandra Alper WASHINGTON (Reuters) - U.S. President Joe Biden's administration on Monday imposed new trade restrictions on 11 ...

US hits Chinese, Russian firms over Moscow military aidBy David Shepardson and Alexandra Alper WASHINGTON (Reuters) - U.S. President Joe Biden's administration on Monday imposed new trade restrictions on 11 ...

Lire la suite »

Three-quarters of firms globally are not ready for new ESG rules, KPMG findsThree-quarters of companies globally are not ready to have their environmental, social and governance (ESG) data audited externally months before new regulations kick in, according to a new report from KPMG published on Tuesday. Stricter European Union, U.S. and global rules are being introduced, mostly in time for the 2024 reporting season, to replace a patchwork of voluntary private sector practices for listed companies to make climate-related disclosures. Regulators say external auditing of sustainability-related data - while not as extensive as financial auditing - is crucial for giving investors information free of misleading environmental claims, known as greenwashing.

Three-quarters of firms globally are not ready for new ESG rules, KPMG findsThree-quarters of companies globally are not ready to have their environmental, social and governance (ESG) data audited externally months before new regulations kick in, according to a new report from KPMG published on Tuesday. Stricter European Union, U.S. and global rules are being introduced, mostly in time for the 2024 reporting season, to replace a patchwork of voluntary private sector practices for listed companies to make climate-related disclosures. Regulators say external auditing of sustainability-related data - while not as extensive as financial auditing - is crucial for giving investors information free of misleading environmental claims, known as greenwashing.

Lire la suite »

South Korea to allow foreign financial firms to trade won onshoreSEOUL (Reuters) - South Korea said on Tuesday it will begin accepting applications starting Oct. 18 from foreign financial institutions for permits to ...

South Korea to allow foreign financial firms to trade won onshoreSEOUL (Reuters) - South Korea said on Tuesday it will begin accepting applications starting Oct. 18 from foreign financial institutions for permits to ...

Lire la suite »