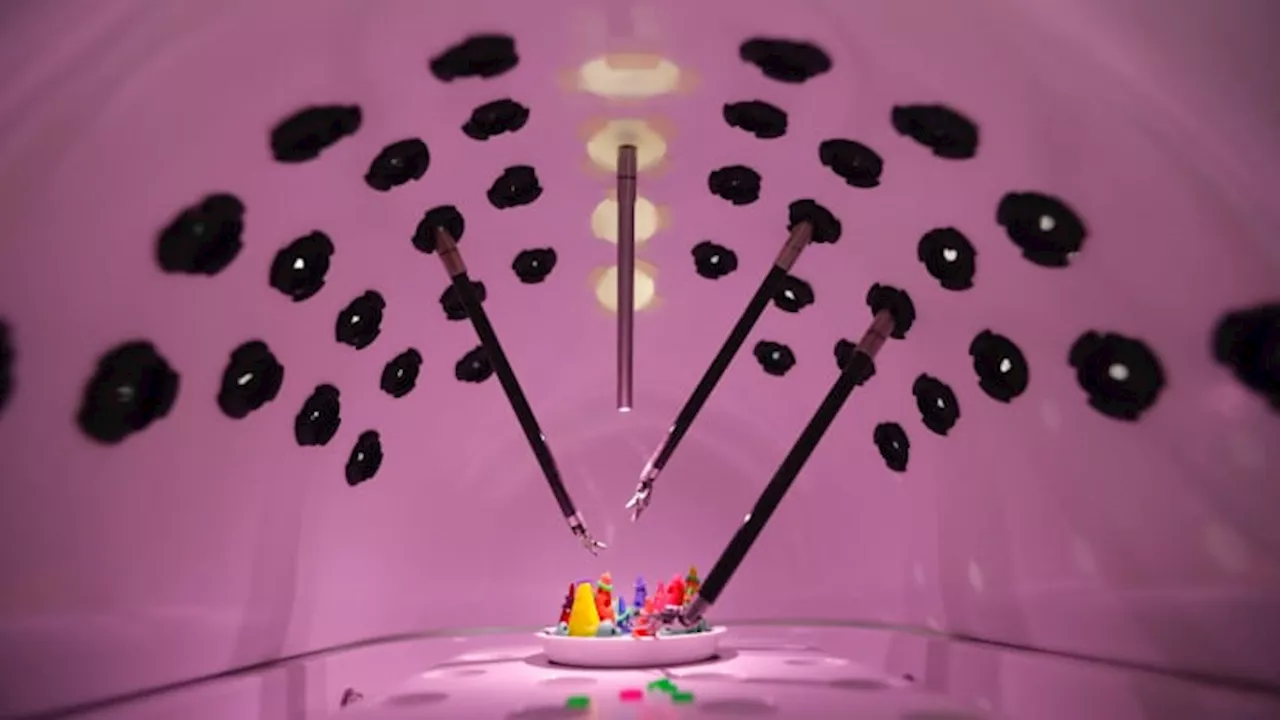

Intuitive Surgical (ISRG) is scheduled to report earnings Thursday after the bell.

Right now the options market is implying a move of greater than 6.6%. This is above the 10-plus year average earnings related move of 5.5%, but below the 7.2% earnings moves seen over the most recent two years. Intuitive is up over 42% over the past 12 months, but only 3.8% of those gains came this year. The consensus view is for 1.42 in adjusted EPS on just under $1.8 billion in revenue, according to FactSet, which would be increases of 19% and 13.5% respectively year-over-year.

mountain Intuitive Surgical , 12 months Call volume was slightly above the 20-day average and put volume slightly below. That combined with Wednesday's outperformance suggests that investors are leaning slightly bullish into earnings. The most active contract, the October $285 calls, traded 445 contracts at an average price of $6.26/contract. Buyers of those calls are risking about 2.3% of the current stock price on a bullish bet that the stock could rally through week's end.

would need to move 5.9% higher over the next two days just to break even on those calls, and they have a relatively low 32% probability of profit for the buyer. That said at over 44 times forward earnings, a relatively high 1.

Click here for the full disclaimer.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

Lire la suite »

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

Lire la suite »

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

European stocks set for muted open as traders track earnings, inflation dataEuropean markets are set for a cautious open as traders monitor corporate earnings and developments in the Middle East, along with key inflation data.

Lire la suite »

European stocks cautious as traders track earnings, inflation dataEuropean markets were slightly lower on Wednesday as traders monitored corporate earnings and developments in the Middle East, along with key inflation data.

European stocks cautious as traders track earnings, inflation dataEuropean markets were slightly lower on Wednesday as traders monitored corporate earnings and developments in the Middle East, along with key inflation data.

Lire la suite »

European stocks retreat as traders track earnings, inflation dataEuropean markets were slightly lower on Wednesday as traders monitored corporate earnings and developments in the Middle East, along with key inflation data.

European stocks retreat as traders track earnings, inflation dataEuropean markets were slightly lower on Wednesday as traders monitored corporate earnings and developments in the Middle East, along with key inflation data.

Lire la suite »

US Dollar weaker as traders flip-flop between geopolitical tensions and disappointing economic dataThe US Dollar (USD) is being torn in two camps this week. On the one hand, traders appreciate the Greenback as the situation in the Middle-East grows

US Dollar weaker as traders flip-flop between geopolitical tensions and disappointing economic dataThe US Dollar (USD) is being torn in two camps this week. On the one hand, traders appreciate the Greenback as the situation in the Middle-East grows

Lire la suite »