Bond markets are flashing a recession signal that suggests the Fed may be about to step in to quickly cut rates

Bond markets are flashing a major recession signal, and it suggests an incoming downturn may be steep enough for the Federal Reserve to step in and quickly cut interest rates, according to DataTrek.

In a note on Wednesday, the research firm pointed to the recent surge in yields on short-term Treasuries, with the iShares 1-3 Year Treasury exchange traded fund moving up 2 standard deviations in recent days. There have only been three cases when short-term Treasuries had jumped by that amount, the firm said:August 2007 and September 2008, in the midst of the Great Financial Crisis.

"The default scenario baked into asset prices is based on the Fed pivoting - quickly - to lowering policy rates. That can only mean a recession is close at hand, one that would reduce inflation and be steep/deep enough to force the Fed to act," DataTrek's co-founder Nicholas Colas said. Central bankers have raised interest rates aggressively over the past year to lower inflation, with the fed funds target rate at 4.75-5%, the highest rates have been since 2007.

But since inflation is still well-above the 2% target, the Fed would only pull back on interest rates if the economy slips into a downturn, Colas previously has said, adding that he didn't see the US going through the next

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

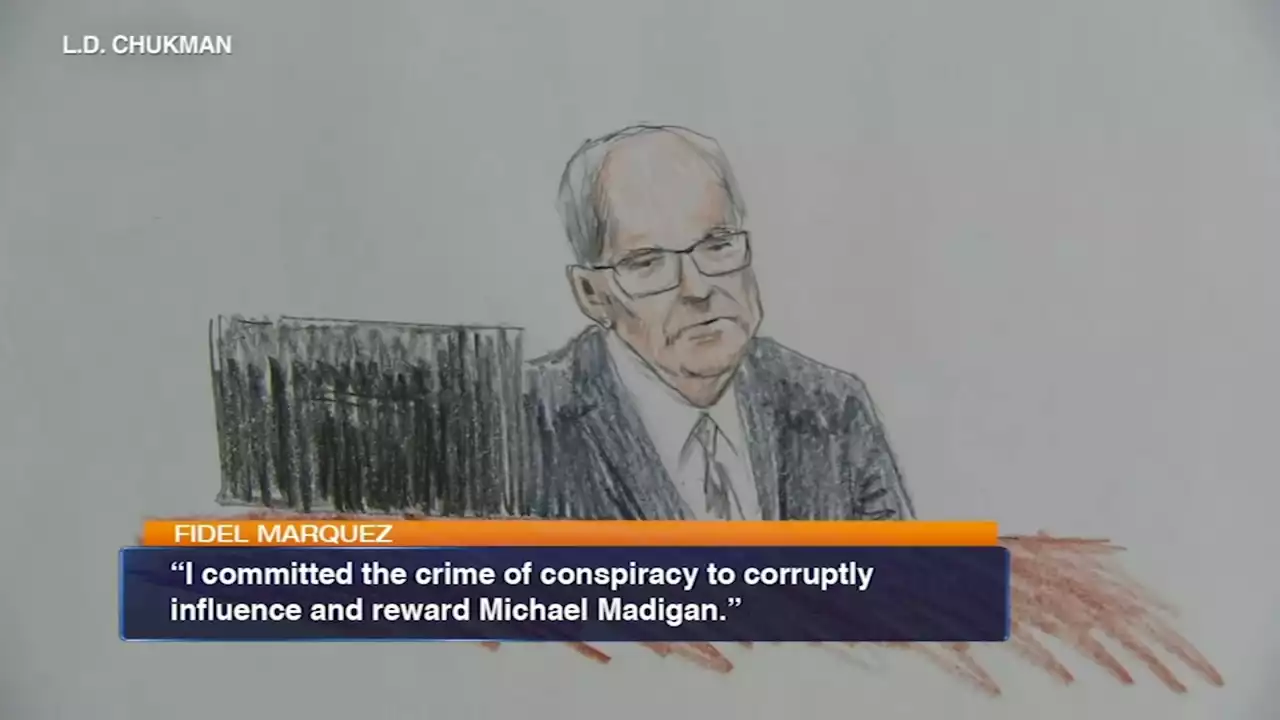

ComEd Four trial: Former ComEd executive and fed's star witness Fidel Marquez testifies'I committed the crime of conspiracy to corruptly influence and reward Michael Madigan,' former ComEd exec Fidel Marquez testified.

ComEd Four trial: Former ComEd executive and fed's star witness Fidel Marquez testifies'I committed the crime of conspiracy to corruptly influence and reward Michael Madigan,' former ComEd exec Fidel Marquez testified.

Lire la suite »

Fed’s Jeffereson: Some components of inflation have proved persistent, lowering them will take timeFed’s Jeffereson: Some components of inflation have proved persistent, lowering them will take time – by anilpanchal7 Fed RiskAversion NewsTrading Banks Inflation

Fed’s Jeffereson: Some components of inflation have proved persistent, lowering them will take timeFed’s Jeffereson: Some components of inflation have proved persistent, lowering them will take time – by anilpanchal7 Fed RiskAversion NewsTrading Banks Inflation

Lire la suite »

Jeremy Siegel says the Fed's economic outlook is 'absurd'The Fed's economic outlook is 'absurd' and there's no way to lower inflation while stabilizing the banking system, Wharton Professor Jeremy Siegel says

Lire la suite »

Banking turmoil is good for stocks as Fed pumps more cash: fund managerThe banking turmoil is a win for stocks as the Fed is opening the cash spigot, a top fund manager says

Lire la suite »

USD/CHF eyes downside below 0.9150 as hopes for a stable Fed policy soarThe USD/CHF pair looks vulnerable above the immediate cushion of 0.9150 in the Asian session. The Swiss franc asset is expected to break down the afor

USD/CHF eyes downside below 0.9150 as hopes for a stable Fed policy soarThe USD/CHF pair looks vulnerable above the immediate cushion of 0.9150 in the Asian session. The Swiss franc asset is expected to break down the afor

Lire la suite »