Investors will struggle to find attractive options, but there are still profitable securities out there

It hasn’t been a great year for the stock markets. Better than 2022, sure, but that’s not setting a very high bar.

Second quarter results showed a decline in revenue and profit compared to last year, due mainly to lower sales volumes. But the first six months of the fiscal year were very strong. Revenue was $1.2-billion, up 22 per cent from the first half of 2022. Adjusted net earnings were $112-million compared to $89-million last year.

So, we have a situation where demand is on the rise, which means the price of uranium is likely to move higher. But production problems may limit Cameco’s ability to take full advantage of the situation. Investors should monitor the situation closely. The stock has a history of volatility.) provides mortgage lending services through its wholly owned subsidiary, Equitable Bank, to individuals and businesses in Canadian urban markets, with a focus on entrepreneurs and new Canadians.

This company has done well for our readers since it was first recommended over a decade ago. But history tells us the share price is vulnerable if we have a recession, so some caution is in order.) is one of the largest property/casualty insurers and reinsurers in North America. Its CEO, Prem Watsa, is often called the “Warren Buffett of Canada” because of his value-based investment approach.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Will Bitcoin surprise investors in Q4 2023?As per a latest analysis, BTC’s price is in a descending wedge pattern - a bullish signal. Will Q4 2023 be in the king coin's favor?

Will Bitcoin surprise investors in Q4 2023?As per a latest analysis, BTC’s price is in a descending wedge pattern - a bullish signal. Will Q4 2023 be in the king coin's favor?

Lire la suite »

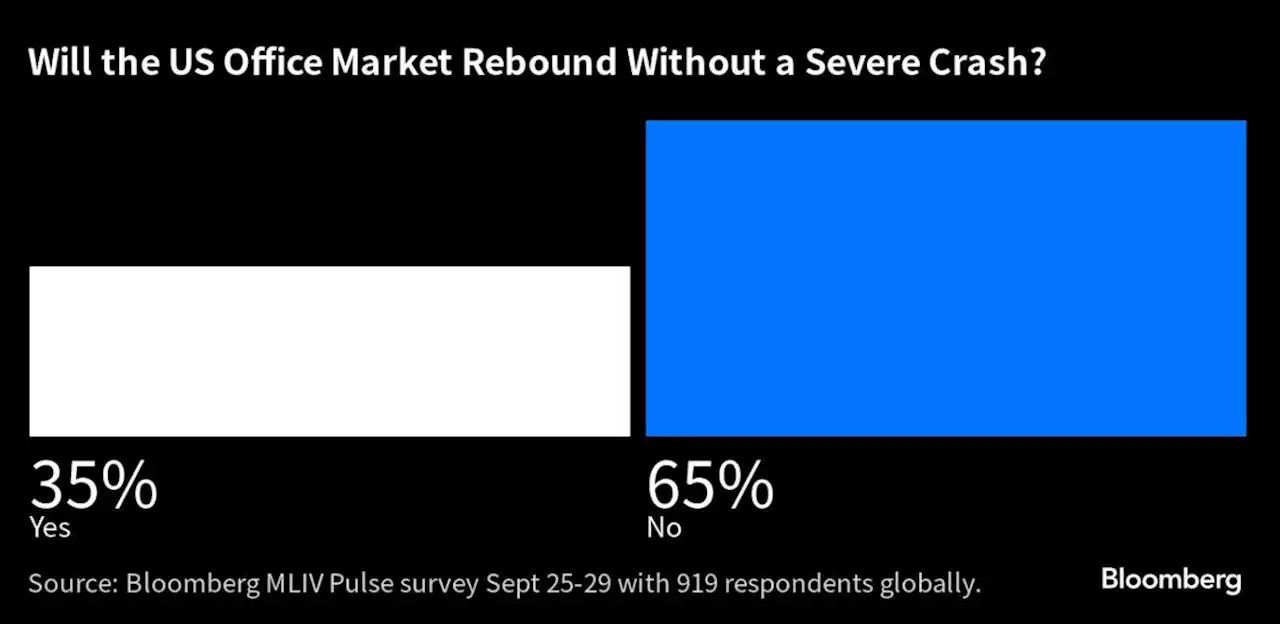

Severe Crash Is Coming for US Office Properties, Investors SayCommercial real estate prices are seen declining until the second half of 2024 or longer.

Severe Crash Is Coming for US Office Properties, Investors SayCommercial real estate prices are seen declining until the second half of 2024 or longer.

Lire la suite »

Severe Crash Is Coming for US Office Properties, Investors Say(Bloomberg) -- Office prices in the US are due for a crash, and the commercial real estate market faces at least another nine months of declines, according to Bloomberg’s latest Markets Live Pulse survey.Most Read from BloombergOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineMcCarthy to Face Far-Right Attempt to Oust Him as House SpeakerSenate Voting on Bill to Avert US Government ShutdownMarket Stress Rises Over Wild Week Ah

Severe Crash Is Coming for US Office Properties, Investors Say(Bloomberg) -- Office prices in the US are due for a crash, and the commercial real estate market faces at least another nine months of declines, according to Bloomberg’s latest Markets Live Pulse survey.Most Read from BloombergOnce Unthinkable Bond Yields Now the New Normal For MarketsCongress Averts US Government Shutdown Hours Before DeadlineMcCarthy to Face Far-Right Attempt to Oust Him as House SpeakerSenate Voting on Bill to Avert US Government ShutdownMarket Stress Rises Over Wild Week Ah

Lire la suite »

Futures mixed as investors await more data, comments from Fed officialsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Futures mixed as investors await more data, comments from Fed officialsKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

Vietnam Says Developer Cheated 42,000 Investors of $1.2 BillionVietnam police are seeking assistance from investors in an ongoing investigation into real estate firm Van Thinh Phat Holdings Group that allegedly defrauded and appropriated more than 30 trillion dong ($1.2 billion), according to a statement on the government’s website.

Vietnam Says Developer Cheated 42,000 Investors of $1.2 BillionVietnam police are seeking assistance from investors in an ongoing investigation into real estate firm Van Thinh Phat Holdings Group that allegedly defrauded and appropriated more than 30 trillion dong ($1.2 billion), according to a statement on the government’s website.

Lire la suite »

Analysts’ forecast returns and recommendations for all stocks in the S&P/TSX Composite IndexStorm clouds may soon part for investors

Analysts’ forecast returns and recommendations for all stocks in the S&P/TSX Composite IndexStorm clouds may soon part for investors

Lire la suite »