ICYMI: Tether reports $850 million net profit for second quarter in latest attestation report

disclosed

its indirect exposure to U.S. Treasuries and its exposure to the U.S. Treasuries that are collateralizing its overnight repo for the first time. By aggregating them together, the amount of Treasuries backing Tether’s stablecoins is about $72.5 billion, the company said.Tether has also disclosed a share buyback worth $115 million and other investments in energy-related initiatives financed from the profits of the second quarter.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Tether reports an $850 million increase in excess reserves in Q2Stablecoin issuer Tether said it had a net profit of $850 million in the second quarter in its latest attestation report.

Tether reports an $850 million increase in excess reserves in Q2Stablecoin issuer Tether said it had a net profit of $850 million in the second quarter in its latest attestation report.

Lire la suite »

Tether’s excess reserves up to $3.3B, holds $72.5B worth of US Treasury billsTether releases its Q2 report for 2023, increasing its excess reserves to $3.3 billion and revealing its exposure to United States Treasury Bills.

Tether’s excess reserves up to $3.3B, holds $72.5B worth of US Treasury billsTether releases its Q2 report for 2023, increasing its excess reserves to $3.3 billion and revealing its exposure to United States Treasury Bills.

Lire la suite »

Toddler drowns after parents tether her to catamaran while they cooked dinnerThe 13-month-old toddler, named Māhina Toki, died on Friday after falling from the catamaran Kalamari which was docked in Musket Cove in western Fiji.

Toddler drowns after parents tether her to catamaran while they cooked dinnerThe 13-month-old toddler, named Māhina Toki, died on Friday after falling from the catamaran Kalamari which was docked in Musket Cove in western Fiji.

Lire la suite »

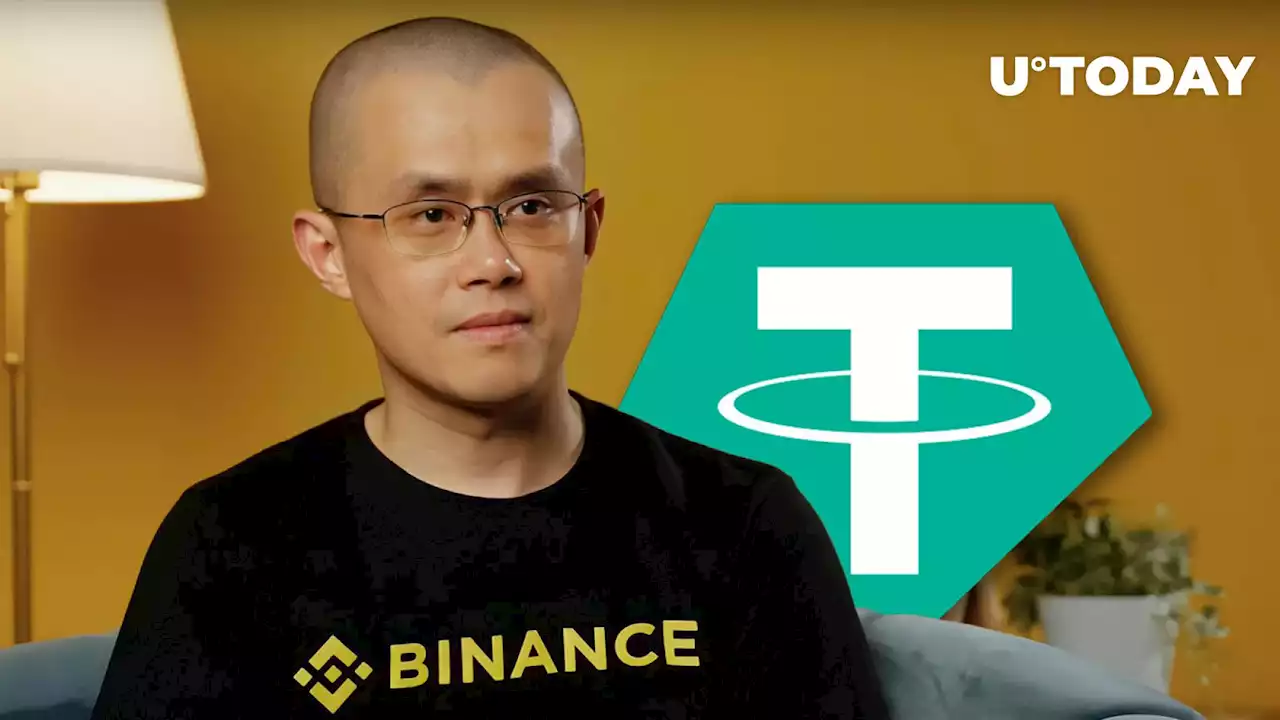

Binance CEO Criticizes Tether (USDT), Here's WhyChangpeng Zhao indicated main problems of stablecoin segment and explained what he does not like about largest of them

Binance CEO Criticizes Tether (USDT), Here's WhyChangpeng Zhao indicated main problems of stablecoin segment and explained what he does not like about largest of them

Lire la suite »

Tether Reports $3.3B in Excess Reserves in Q2, Up $850M for the QuarterRising interest rates make stablecoin issuance a profitable business. Tether_to reported an operating profit topping $1B in Q2, not that much less than that of asset management giant BlackRock over the same period. $BLK $USDT sndr_krisztian reports.

Tether Reports $3.3B in Excess Reserves in Q2, Up $850M for the QuarterRising interest rates make stablecoin issuance a profitable business. Tether_to reported an operating profit topping $1B in Q2, not that much less than that of asset management giant BlackRock over the same period. $BLK $USDT sndr_krisztian reports.

Lire la suite »

Pass the Stablecoin Bill NowThe choice isn’t stablecoins vs no stablecoins. It’s between regulated products with low fees that protect consumers, and offshore assets with low transparency and no oversight, says Austin Campbell.

Pass the Stablecoin Bill NowThe choice isn’t stablecoins vs no stablecoins. It’s between regulated products with low fees that protect consumers, and offshore assets with low transparency and no oversight, says Austin Campbell.

Lire la suite »