California’s licensed cannabis businesses are getting a tax cut — and they are disappointed about it.

serve the state’s legal market, along with 481 permitted retail delivery services. That’s nowhere close to the 3,000 unlicensed retailers and delivery services that were estimated to operate in California as of 2020, according to a market analysis by Marijuana Business Daily.strict testing and packaging regulations make it hard to compete with their underground competitors, who offer nearly identical items at steep discounts.

Wiener, a veteran lawmaker who has recently become more involved in cannabis legislation, said he “very reluctantly” voted for the bill, mostly because of the new tax credits it establishes for employers who offer competitive wages and benefits and businesses that get fee waivers through social equity programs. Qualifying retailers would also be allowed to keep a portion of the excise taxes they’re required to pay to the state, effectively dropping their tax rate to 12 percent.

Reducing taxes on the cannabis industry has proven to be a minefield for the administration. That’s because a wide range of non-cannabis organizations directly benefit from cannabis tax revenues, including childcare and health programs represented by the powerful Service Employees International Union — one of Newsom’s top supporters.

The new law has received a positive reception from cannabis farmers, who will not only see their tax burden disappear, but will now also have more viable products to sell.

“I’ve always been somewhat skeptical that eliminating the cultivation tax would immediately bolster the economic viability of cultivation sites,” Nevedal said, while stressing that she is more hopeful than before.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Dems want to tax high earners to protect Medicare solvencySenate Democrats want to boost taxes on some high earners and use the money to extend the solvency of Medicare, the latest step in the party's election-year attempt to craft a scaled-back version of the economic package that collapsed last year, Democratic aides told The Associated Press. Democrats expect to submit legislative language on their Medicare plan to the Senate's parliamentarian in the next few days, the aides said. It was yet another sign that Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.Va., could be edging toward a compromise the party hopes to push through Congress this summer over solid Republican opposition.

Dems want to tax high earners to protect Medicare solvencySenate Democrats want to boost taxes on some high earners and use the money to extend the solvency of Medicare, the latest step in the party's election-year attempt to craft a scaled-back version of the economic package that collapsed last year, Democratic aides told The Associated Press. Democrats expect to submit legislative language on their Medicare plan to the Senate's parliamentarian in the next few days, the aides said. It was yet another sign that Majority Leader Chuck Schumer, D-N.Y., and Sen. Joe Manchin, D-W.Va., could be edging toward a compromise the party hopes to push through Congress this summer over solid Republican opposition.

Lire la suite »

NJ property tax relief: Here's how much you'll get back this yearThe New Jersey budget provides $2 billion in property tax relief. Here is how much you will get if you are a homeowner or a renter.

NJ property tax relief: Here's how much you'll get back this yearThe New Jersey budget provides $2 billion in property tax relief. Here is how much you will get if you are a homeowner or a renter.

Lire la suite »

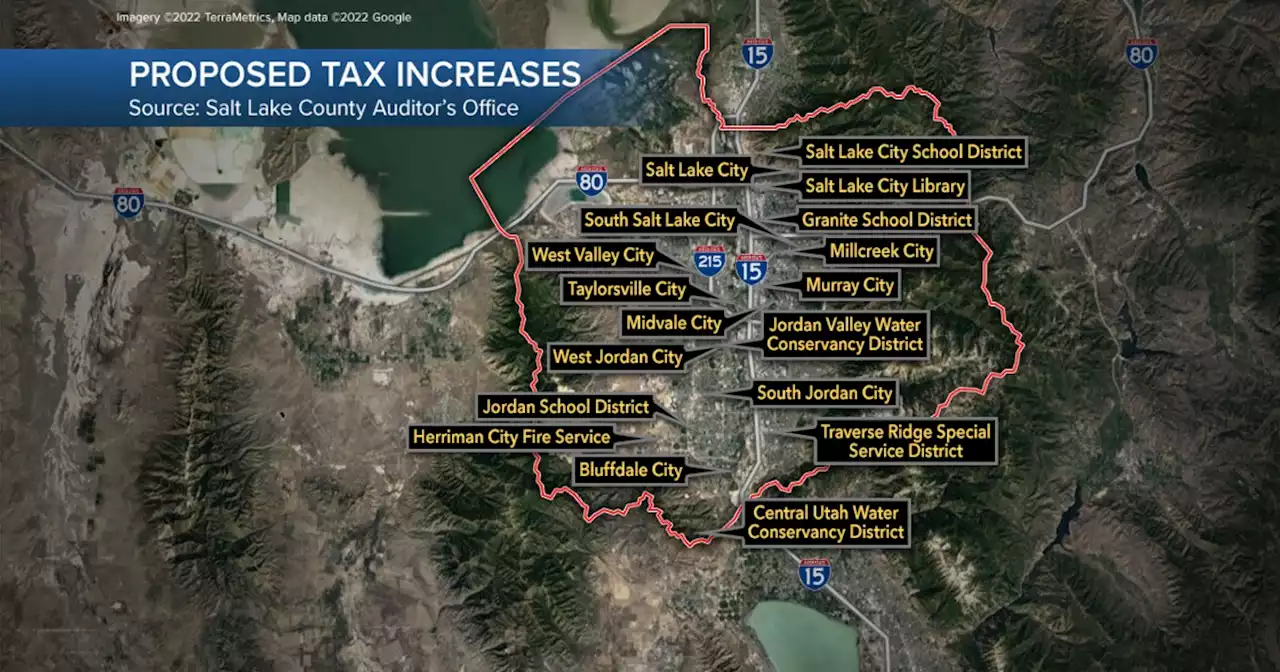

23 different property tax hikes proposed in Salt Lake CountySalt Lake County Auditor Chris Harding is getting ready to send out property tax notices to residents.

23 different property tax hikes proposed in Salt Lake CountySalt Lake County Auditor Chris Harding is getting ready to send out property tax notices to residents.

Lire la suite »

U.S. Treasury to end 1979 treaty with global minimum tax holdout HungaryThe U.S. Treasury on Friday said it was moving to terminate a 1979 tax treaty with Hungary in the wake of Budapest's decision to block the European Union's implementation of a new, 15% global minimum tax.

U.S. Treasury to end 1979 treaty with global minimum tax holdout HungaryThe U.S. Treasury on Friday said it was moving to terminate a 1979 tax treaty with Hungary in the wake of Budapest's decision to block the European Union's implementation of a new, 15% global minimum tax.

Lire la suite »

Here's how much special session on abortion, tax relief, will cost taxpayersLegislators will vote on whether to send money back to Hoosiers in the form of a refund and on abortion restrictions during the special session.

Here's how much special session on abortion, tax relief, will cost taxpayersLegislators will vote on whether to send money back to Hoosiers in the form of a refund and on abortion restrictions during the special session.

Lire la suite »