In a time of geopolitical chaos and inflation, Simon Mikhailovich’s extreme wealth preservation strategies don’t seem so paranoid.

extreme wealth preservation strategies don’t seem so paranoid.The question is asked by Simon Mikhailovich, a Russian émigré and entrepreneur who is in the business of selling a certain kind of safety. His New York City–based Bullion Reserve has wealthy families as clients. On their behalf his firm buys gold bricks from refineries, has them picked up by Loomis armored trucks and delivers them to guarded warehouses located on two continents.

Aren’t most financial assets backstopped? Don’t we have a Federal Deposit Insurance Corporation for bank accounts and the Securities Investor Protection Corporation for brokerage accounts? Mikhailovich scoffs. Their reserves are adequate to cover one institution, if that institution is small enough to fail. They would be overwhelmed by a system-wide failure.

An atavistic urge lies behind this man’s affection for the yellow metal. A century ago his ancestors fled pogroms in Ukraine and settled in Leningrad , where they were able to buy food because they had brought gold coins with them. Just to ask for an exit visa was a risky business. Applicants had to begin the process by quitting their jobs; those whose visas were denied were left destitute. Mikhailovich, then a teenager, would wait in visa offices, watching some families emerge with papers, others in tears. Abuse from the officials was part of the process. They screamed at him.Traitor to what? Mikhailovich’s birth certificate said he wasn’t exactly a Russian. He was something different. A Jew.

The pair built the CDO work into a money manager with 19 employees overseeing $2 billion. It prospered in the financial crisis of 2008 with the help of some short sales. The money that Lehman owed them on a winning trade turned into a bankruptcy claim they sold for pennies on the dollar. Bullion Reserve’s selling proposition: Some of your assets should be off the grid. Grids, whether of the electrical variety or of the financial variety that relies on the electrical one, are unstable. A failure at any node can propagate across the whole network. That explains why New York went dark in 2003.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

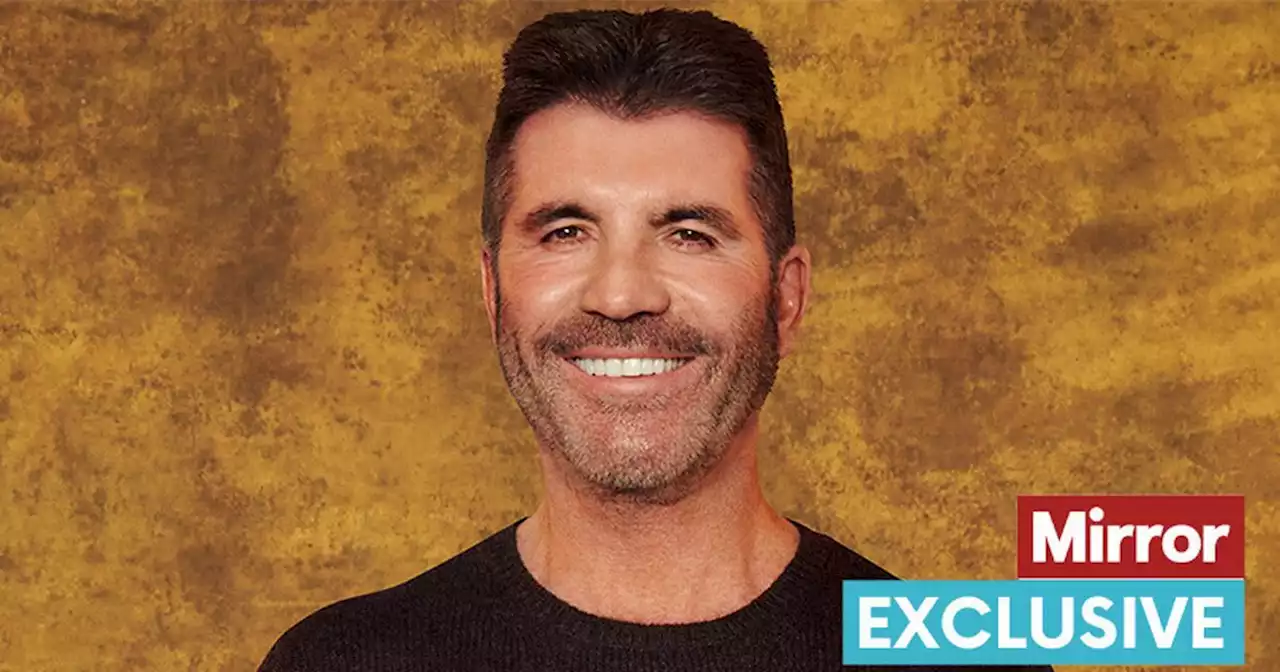

Simon Cowell vows to cut three things out of diet forever after big weight lossBritain's Got Talent judge, Simon Cowell, lost four inches off his waist after embarking on a health kick before the Coronavirus pandemic, and then sticking to it during lockdown

Simon Cowell vows to cut three things out of diet forever after big weight lossBritain's Got Talent judge, Simon Cowell, lost four inches off his waist after embarking on a health kick before the Coronavirus pandemic, and then sticking to it during lockdown

Lire la suite »

Simon Cowell declares '65 is the new 40' ahead of Britain's Got Talent's returnSimon Cowell has admitted cutting sugar, dairy and gluten from his diet has given him more energy, after his horror crash in 2020, and says '65 is the new 40' ahead of the return of Britain's Got Talent tomorrow

Simon Cowell declares '65 is the new 40' ahead of Britain's Got Talent's returnSimon Cowell has admitted cutting sugar, dairy and gluten from his diet has given him more energy, after his horror crash in 2020, and says '65 is the new 40' ahead of the return of Britain's Got Talent tomorrow

Lire la suite »

Simon: Alyssa Nakken, SF Giants not just setting example for girls — it’s for boys, tooA coach is only as effective as the players are receptive to their coaching — no matter their gender, race or anything else.

Simon: Alyssa Nakken, SF Giants not just setting example for girls — it’s for boys, tooA coach is only as effective as the players are receptive to their coaching — no matter their gender, race or anything else.

Lire la suite »

How Pandemic Profiteers Got Rich Off Taxpayer Money While Millions SufferedIn an excerpt from his book Pandemic, Inc., J. David McSwane details how greedy capitalists took advantage of a discombobulated government during the height of Covid-19

How Pandemic Profiteers Got Rich Off Taxpayer Money While Millions SufferedIn an excerpt from his book Pandemic, Inc., J. David McSwane details how greedy capitalists took advantage of a discombobulated government during the height of Covid-19

Lire la suite »

Crypto-mining could raise Texas electricity bills if deployed badlySupporters say mining cryptocurrencies in Texas could help the electricity grid, but not...

Crypto-mining could raise Texas electricity bills if deployed badlySupporters say mining cryptocurrencies in Texas could help the electricity grid, but not...

Lire la suite »

Tesla Owners Are Taking Over California Again This SummerTesla owners in California are taking over again this summer. August 6th may seem far off, but tickets are available

Tesla Owners Are Taking Over California Again This SummerTesla owners in California are taking over again this summer. August 6th may seem far off, but tickets are available

Lire la suite »