SVB Financial has decided to move for chapter 11 filing before a Southern New York district court The group reported a liquidity of around $2.2 billion in the filing On one hand, Bitcoin (BTC) and other cryptocurrencies have started to thrive in the market. On the other hand, the picture is quite the opposite as […]

. This, because the failed bank’s dealings are handled by the Federal Deposit Insurance Corporation . Due to this, the bank will not be participating in the financial group’s bankruptcy proceedings.

The Chapter 11 filing was registered in the United States bankruptcy court for the Southern District of New York. In a press release, the firm also claimed that SVB Securities and SVB Capital’s funds and general partner entities are not included in this filing as they are legally separate from the group.

As far as its present financial standing is concerned, the group said its current liquidity stands at around $2.2 billion. It added, “In addition to cash and its interests in SVB Capital and SVB Securities, SVB Financial Group has other valuable investment securities accounts and other assets for which it is also exploring strategic alternatives. SVB Financial Group’s funded debt is approximately $3.3 billion in aggregate principal amount of unsecured notes”with every passing day. The king coin breached the $27,000-level earlier today.

Other top cryptocurrencies such as Ethereum , Binance Coin , Cardano , and Polygon also recorded double-digit hikes in the past week. The altcoins have been on an uptrend ever since notable influencers voiced crypto might be aSubscribe to get it daily in your inbox.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

SVB Financial files for court-supervised reorganization under bankruptcy protectionThe move to seek bankruptcy protection comes after SVB Financial Group said on March 13 it was planning to explore strategic alternatives for its businesses

SVB Financial files for court-supervised reorganization under bankruptcy protectionThe move to seek bankruptcy protection comes after SVB Financial Group said on March 13 it was planning to explore strategic alternatives for its businesses

Lire la suite »

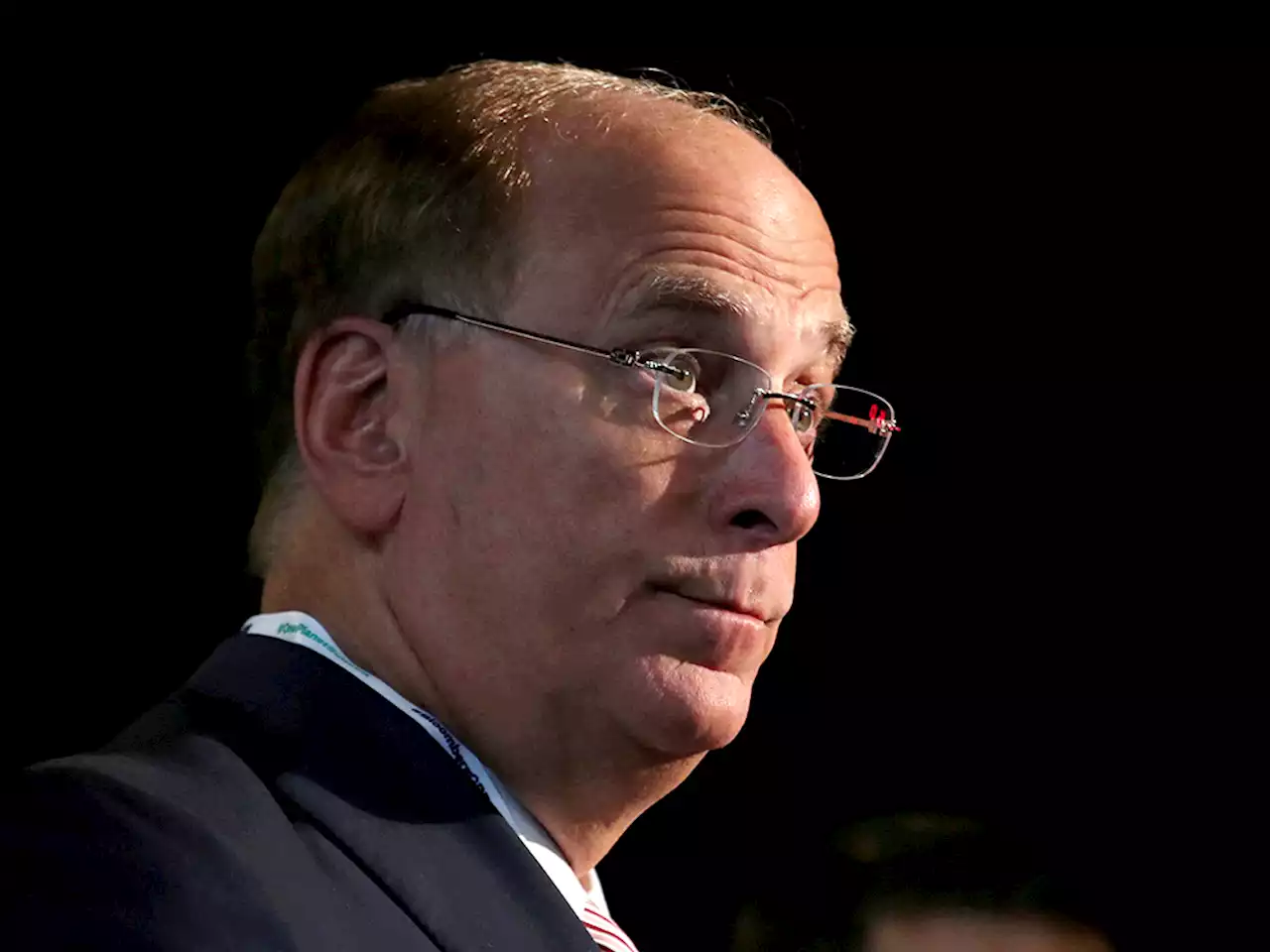

BlackRock's Larry Fink warns 'more seizures and shutdowns coming' in wake of SVB failureBlackRock\u0027s CEO warned more pain is coming in the U.S. financial system following the failure of Silicon Valley Bank. Read on.

BlackRock's Larry Fink warns 'more seizures and shutdowns coming' in wake of SVB failureBlackRock\u0027s CEO warned more pain is coming in the U.S. financial system following the failure of Silicon Valley Bank. Read on.

Lire la suite »

Tech sectors expect collapse of SVB to have 'chilling' effect on investmentsMembers of Canada\u0027s technology sector say they\u0027re worried the collapse of the Silicon Valley Bank will have a chilling effect on investments in their industry.

Tech sectors expect collapse of SVB to have 'chilling' effect on investmentsMembers of Canada\u0027s technology sector say they\u0027re worried the collapse of the Silicon Valley Bank will have a chilling effect on investments in their industry.

Lire la suite »

Canadian tech sector expects collapse of SVB to have 'chilling' effect on investmentsMembers of Canada's technology sector say they're worried the collapse of the Silicon Valley Bank will have a chilling effect on investments in the already-hampered sector.

Canadian tech sector expects collapse of SVB to have 'chilling' effect on investmentsMembers of Canada's technology sector say they're worried the collapse of the Silicon Valley Bank will have a chilling effect on investments in the already-hampered sector.

Lire la suite »

OSFI takes permanent control of SVB's Canadian branch assets - BNN BloombergThe Office of the Superintendent of Financial Institutions announced it's taking permanent control of Silicon Valley Bank's Canadian assets in order to protect creditors, according to a press release.

OSFI takes permanent control of SVB's Canadian branch assets - BNN BloombergThe Office of the Superintendent of Financial Institutions announced it's taking permanent control of Silicon Valley Bank's Canadian assets in order to protect creditors, according to a press release.

Lire la suite »

OSFI takes permanent control of SVB's Canadian branch assets - BNN BloombergThe Office of the Superintendent of Financial Institutions announced it's taking permanent control of Silicon Valley Bank's Canadian assets in order to protect creditors, according to a press release.

OSFI takes permanent control of SVB's Canadian branch assets - BNN BloombergThe Office of the Superintendent of Financial Institutions announced it's taking permanent control of Silicon Valley Bank's Canadian assets in order to protect creditors, according to a press release.

Lire la suite »