Investors say this year’s U.S. stock market rally is strong enough to withstand another leg higher for bond yields. Find out more.

Some strategists see yields falling. Wouter Sturkenboom, chief investment strategist for Europe, the Middle East and Africa as well as Asia Pacific at Northern Trust Asset Management, expects the yield on the 10-year note to trade around four per cent by the end of the year.

Survey respondents also predict the yield on the 10-year Treasury inflation-protected securities will be lower five years from now, indicating that real interest rates, defined as nominal rates minus inflation, will come down. The sticking power of the U.S. stock rally in 2023 has taken several market participants by surprise, but bulls point to solid economic growth in the face of high interest rates as a sign of confidence. Outperforming tech names, bolstered by the frenzy for anything related to artificial intelligence, have helped sustain those gains.

“We should be concerned about loss-making parts of the tech sector, but I expect that the profitable tech companies, which are large and very significant earnings contributors to indexes, should be somewhat immune to higher yields,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA.Article content

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Lire la suite »

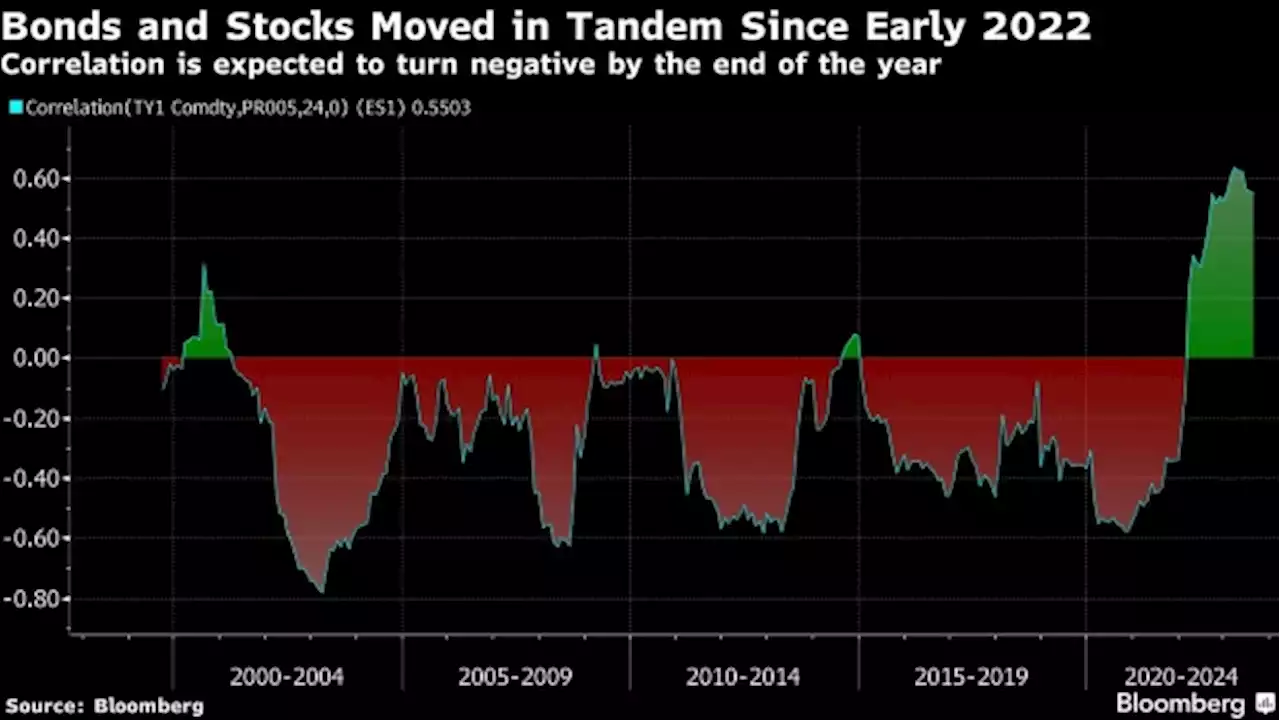

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors Say(Bloomberg) -- This year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.Most Read from BloombergMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWith the soft-landing narrative for the world’s biggest economy ga

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors Say(Bloomberg) -- This year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.Most Read from BloombergMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWith the soft-landing narrative for the world’s biggest economy ga

Lire la suite »

US Stock Investors’ Complacency is Worrying, JPMorgan Strategists WarnUS stock investors have gotten so confident that it’s concerning strategists at JPMorgan Chase & Co.

US Stock Investors’ Complacency is Worrying, JPMorgan Strategists WarnUS stock investors have gotten so confident that it’s concerning strategists at JPMorgan Chase & Co.

Lire la suite »

It could be time for investors to plant some seeds in these underappreciated sectorsThese 3 sectors are boasting annual yields as high as 9\u002D15%. Find out more.

It could be time for investors to plant some seeds in these underappreciated sectorsThese 3 sectors are boasting annual yields as high as 9\u002D15%. Find out more.

Lire la suite »

Paschi Drops With Investors Worried About Government’s Sale PlanBanca Monte dei Paschi di Siena SpA was the lead decliner on the Italian stock benchmark index amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

Paschi Drops With Investors Worried About Government’s Sale PlanBanca Monte dei Paschi di Siena SpA was the lead decliner on the Italian stock benchmark index amid concern by analysts and investors about the lack of a clear strategy for the state’s sale of its stake.

Lire la suite »

Oil prices slip as investors sour on ChinaBy 0933 GMT, Brent crude futures for November were down 51 cents at $88.49 a barrel, while U.S. West Texas Intermediate crude October futures edged 14 cents lower to $85.41

Oil prices slip as investors sour on ChinaBy 0933 GMT, Brent crude futures for November were down 51 cents at $88.49 a barrel, while U.S. West Texas Intermediate crude October futures edged 14 cents lower to $85.41

Lire la suite »