By Engen Tham, Julie Zhu and Clare Jim SHANGHAI/HONG KONG - In the beginning, Hui Ka Yan followed a simple formula. Borrow to buy land. Sell homes on ...

STORY CONTINUES BELOW THESE SALTWIRE VIDEOSSHANGHAI/HONG KONG - In the beginning, Hui Ka Yan followed a simple formula. Borrow to buy land. Sell homes on the site before they are built. Use the cash to pay lenders and finance the next real estate project.

Hitting up employees for funds, Reuters has found, was just one of a number of unusual practices employed by the company before it came to the brink of a messy collapse in 2021 under the weight of hundreds of billions of dollars of debt. This account of the rise and fall of Hui and Evergrande is based on interviews with more than 20 people who have worked with the tycoon or at his company. All spoke on condition of anonymity.

Companies accounting for 40% of Chinese home sales have defaulted since mid-2021, according to analyst estimates. Homes have been left unfinished. Suppliers haven’t been paid. And some of the millions of Chinese people who put their savings in property-linked wealth management products face the prospect of not getting their money back.

On Sunday, Evergrande reported losses of 33 billion yuan for the first half of the year, versus a 66.4 billion yuan loss in the same period a year earlier. Evergrande’s shares fell 79% on Monday after resuming trading following a 17-month suspension, wiping out $2.2 billion of the company’s market value.

China’s State Council Information Office, which handles media queries on behalf of the government, declined to comment on the property market and Evergrande’s fate. The housing authority and the finance ministry didn’t respond to comment requests.Hui was raised by his grandmother in a rural village in Henan province, according to a biography.

By 2013, Hui was riding high. He was elected a member of one of China’s most prestigious political bodies, the standing committee of the Chinese People’s Political Consultative Conference. That year, Guangzhou Evergrande, the soccer team the company had purchased control of three years earlier, won Asian soccer’s top club competition.

Some employees in Evergrande’s capital department pocketed lucrative bonuses for securing loans from banks or other lenders, with teams earning up to 1% of the amount borrowed, said a former employee and the person familiar with the company. The bonuses were then divided up among the team, the former employee said.In 2016, with China’s property prices on a tear, Evergrande overtook its main rival to become the nation’s number one developer by sales.

Management did cut some bonuses as a result, said the former employee, who had worked at HengTen. The person familiar with the company, who spoke of Hui’s dining habits in Hong Kong, said targets for purchasing financial products were widespread at Evergrande and also said staff would be penalized for not meeting their quotas.

Evergrande Wealth, a unit of Evergrande Group’s Evergrande Financial Holding Group, didn’t respond to requests for comment. China’s banking regulator also didn’t respond to requests for comment. Hui, who had already expanded into other businesses ranging from plastic surgery to life insurance, continued to invest in new ventures. By 2019, he was making a foray into electric cars.In early 2020, Hui publicly re-iterated a pledge to “significantly lower” his company’s debt. But keeping Evergrande afloat was about to get a lot more difficult.

One place the company sought funds from was so-called trust firms, as Reuters reported in 2020. Dubbed “shadow banks,” because they operate outside many of the rules that govern commercial banks, trust firms were keen to capitalize on the needs of an industry eager for credit. And they could charge far higher interest rates than the closely regulated banks.

Last year, three senior executives stepped down after an initial probe said they were involved in diverting the loans.Neither Hui nor the company responded to questions about whether Evergrande used special purpose vehicles to purchase and resell bonds or on the loan diversions. The company has said it was in talks with the property-services subsidiary about a repayment schedule and has adopted measures to address potential internal control weaknesses.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Special Report-Inside the downfall of embattled property developer China EvergrandeBy Engen Tham, Julie Zhu and Clare Jim SHANGHAI/HONG KONG - In the beginning, Hui Ka Yan followed a simple formula. Borrow to buy land. Sell homes on ...

Special Report-Inside the downfall of embattled property developer China EvergrandeBy Engen Tham, Julie Zhu and Clare Jim SHANGHAI/HONG KONG - In the beginning, Hui Ka Yan followed a simple formula. Borrow to buy land. Sell homes on ...

Lire la suite »

China hones anti-submarine capabilities amid South China Sea tensionsBEIJING (Reuters) - China's military said it had recently held intensive anti-submarine exercises in the strategically important South China Sea as ...

China hones anti-submarine capabilities amid South China Sea tensionsBEIJING (Reuters) - China's military said it had recently held intensive anti-submarine exercises in the strategically important South China Sea as ...

Lire la suite »

Tuesday’s analyst upgrades and downgradesInside the Market’s roundup of some of today’s key analyst actions

Tuesday’s analyst upgrades and downgradesInside the Market’s roundup of some of today’s key analyst actions

Lire la suite »

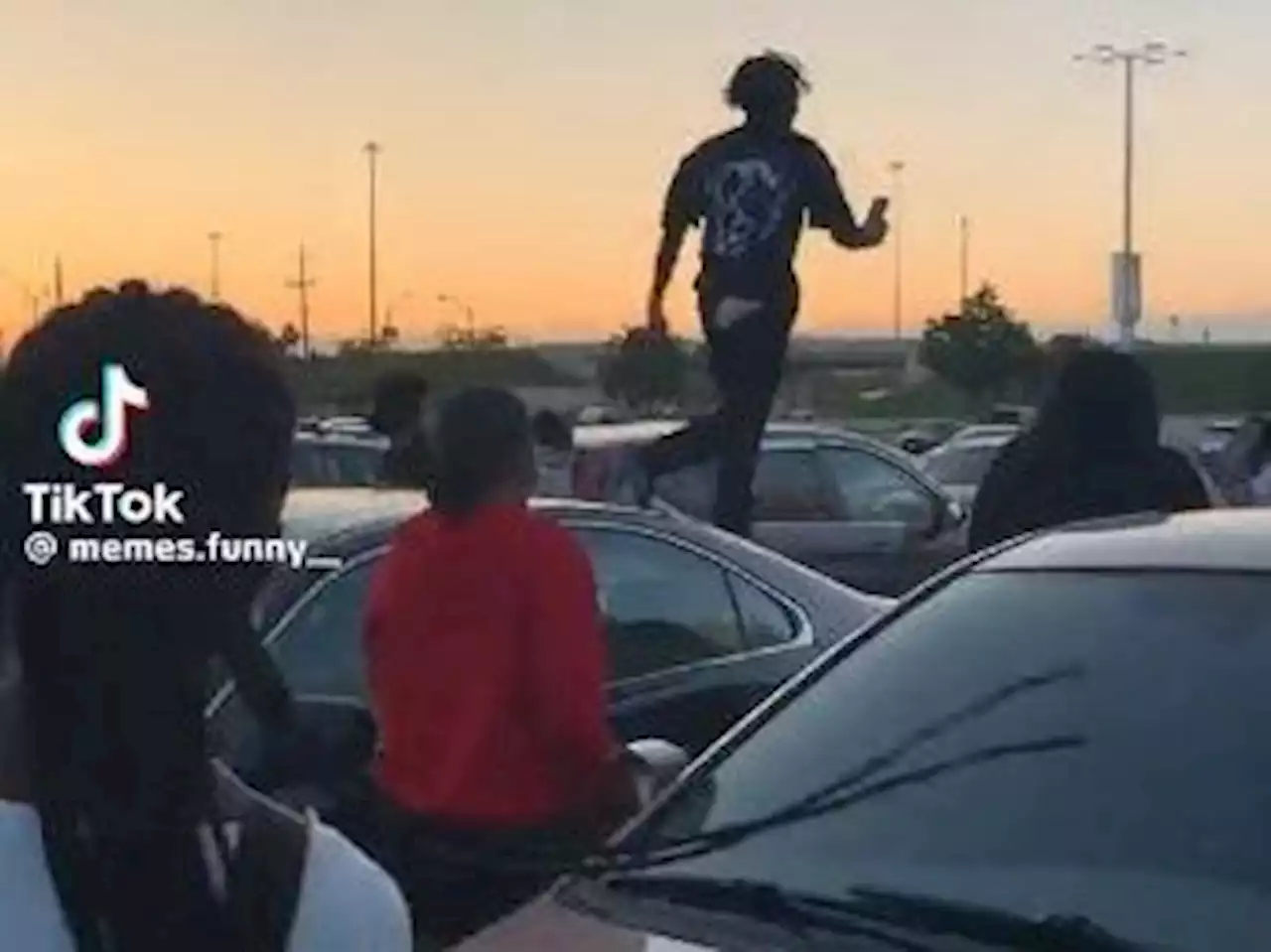

Chaotic scene at Yorkdale mall captured on videoVideo footage shows a horde of young people running wildly inside Yorkdale Shopping Centre.

Chaotic scene at Yorkdale mall captured on videoVideo footage shows a horde of young people running wildly inside Yorkdale Shopping Centre.

Lire la suite »

Inside The $68M Court-Approved Sale Of Coromandel Properties' Southview GardensCoromandel Properties had plans to redevelop the Southview Gardens property into four six-storey buildings with over 1,100 rental units.

Inside The $68M Court-Approved Sale Of Coromandel Properties' Southview GardensCoromandel Properties had plans to redevelop the Southview Gardens property into four six-storey buildings with over 1,100 rental units.

Lire la suite »