Like the candy, the central bank's rate hikes start off sour then turn sweet.

The Fed has a Lemonhead problem. That's the term that one investor is using to explain why the central bank's historic rate-hiking campaign hasn't done more damage to the economy .last year; the tech industry shed a lot of jobs. But then they turn sweet — that's where we are now, with consumer spending and the labor market still looking relatively solid.

"The full effect of higher rates is not being felt by consumers and businesses," said James Fishback, founder and chief investment officer at Azoria Partners, a global macro hedge fund.Two key players in the economy have so far been relatively insulated from higher rates: mortgage holders and companies with fixed-rate bonds .

A slew of companies took advantage of the very low rates of 2021 and are now benefiting from the higher rates they can earn on cash.. Many refinanced during a wave two years ago and locked in rates of 3% or less. Plus, the value of their homes has soared — a factor that may lead some tomany companies took advantage of low rates back in 2021. They borrowed money — by issuing bonds — and locked in low rates for long durations.

Companies don't borrow on 30-year timelines like homeowners, but the average duration for investment-grade corporate debt has doubled from four to eight years, Fishback pointed out. And companies are paying less in debt now than a year ago. U.S. corporate net interest payments have fallen for the past five quarters, according toEventually, as one continues to savor the Lemonhead, it turns from sweet back to sour. The idea was the first rate hike, like the first donut you eat, is delicious or effective — but the yum factor, or effectiveness, decreases with each subsequent treat or rate cut.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Fed's Collins says economy has yet to feel full impact of Fed rate hike cycleFed's Collins says economy has yet to feel full impact of Fed rate hike cycle

Fed's Collins says economy has yet to feel full impact of Fed rate hike cycleFed's Collins says economy has yet to feel full impact of Fed rate hike cycle

Lire la suite »

Why you should borrow home equity before the next Fed meetingIf you're considering a home equity loan, now is the time to act.

Why you should borrow home equity before the next Fed meetingIf you're considering a home equity loan, now is the time to act.

Lire la suite »

‘Wonka’ Character Posters Show Off the Film’s Sweet and Sour FacesA new set of character posters for Warner Bros.’ upcoming prequel film Wonka, starring Timothée Chalamet, have been released.

‘Wonka’ Character Posters Show Off the Film’s Sweet and Sour FacesA new set of character posters for Warner Bros.’ upcoming prequel film Wonka, starring Timothée Chalamet, have been released.

Lire la suite »

Why Emails Are So Difficult, Why They're Important And How AI Can HelpCo-founder and CEO at WINN.AI. Helping you close more deals by making your funnel faster, smarter and smoother. Read Eldad Postan-Koren's full executive profile here.

Why Emails Are So Difficult, Why They're Important And How AI Can HelpCo-founder and CEO at WINN.AI. Helping you close more deals by making your funnel faster, smarter and smoother. Read Eldad Postan-Koren's full executive profile here.

Lire la suite »

Five Points Sour Beer Bar Goed Zuur to Shutter on October 22After a six year run, this homage to the world of mixed fermentation sour ales is saying goodbye.

Five Points Sour Beer Bar Goed Zuur to Shutter on October 22After a six year run, this homage to the world of mixed fermentation sour ales is saying goodbye.

Lire la suite »

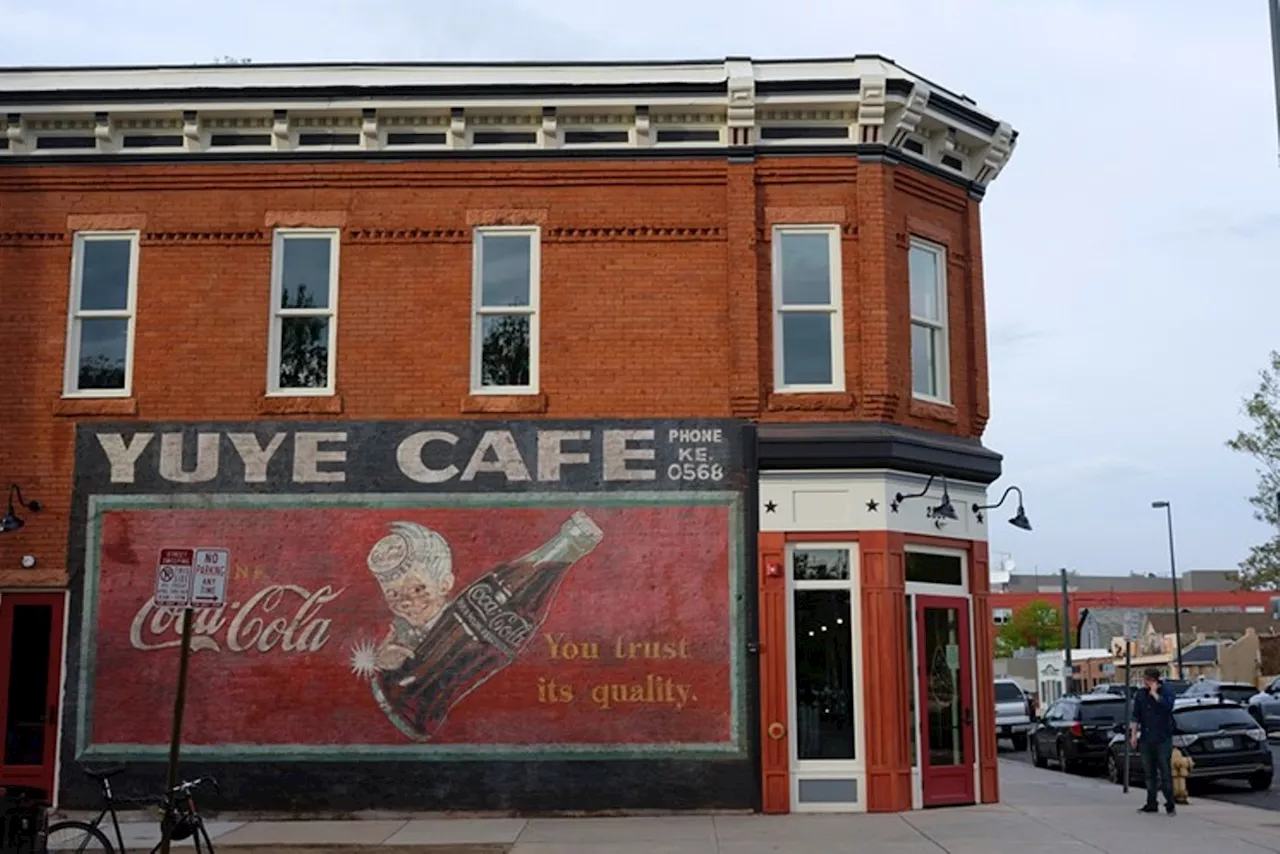

Unique Denver beer bar closing after six years in Five PointsGoed Zuur will pour its last sour ale on Oct. 22.

Unique Denver beer bar closing after six years in Five PointsGoed Zuur will pour its last sour ale on Oct. 22.

Lire la suite »