President Luiz Inacio Lula da Silva’s economic team is growing worried that Brazil’s central bank may soon be forced to reduce the pace of interest rate cuts to fight the impact of rising US Treasury yields on domestic inflation, according to a government official with knowledge of the matter.

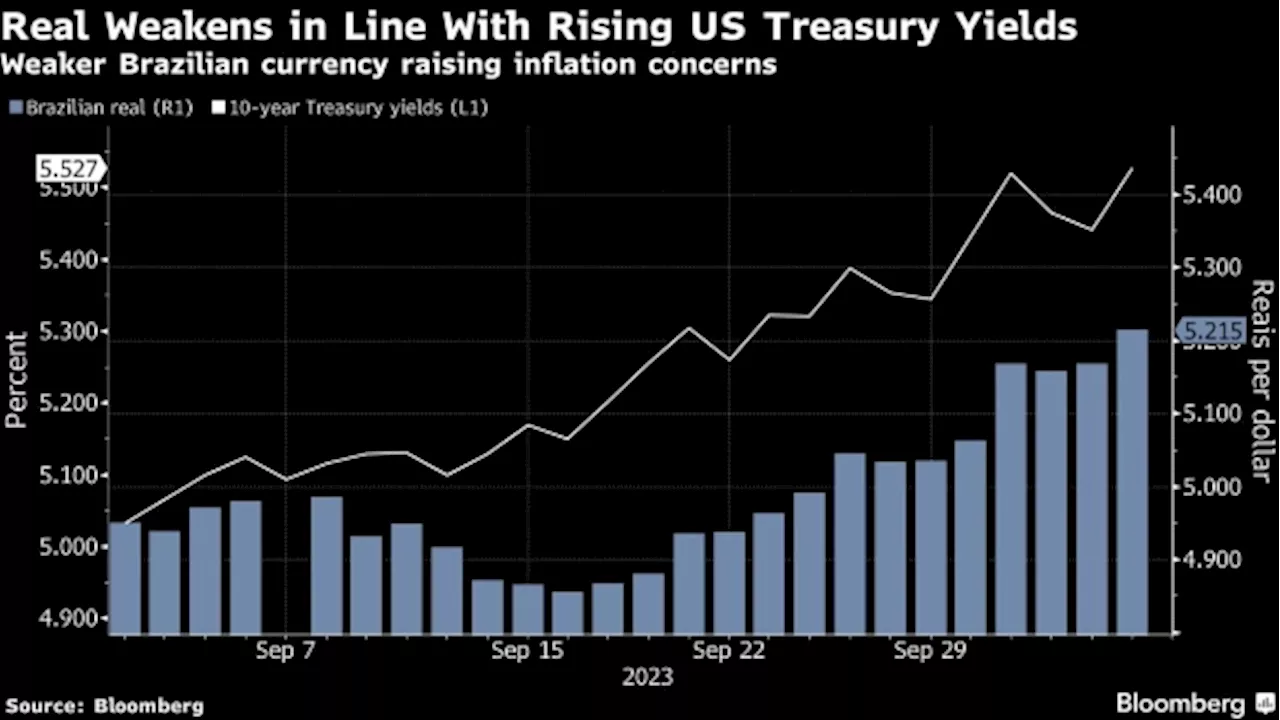

The recent rise in Treasury yields has reduced investors’ appetite for risk across the globe, with the Brazilian real among the worst-performing emerging-market currencies, weakening more than 6% against the dollar over the past three weeks. A weaker real is likely to fuel inflation as imports become more expensive.

Locally, Brazil’s fiscal outlook has also became less clear as lawmakers debate, and make changes to, a series of revenue-boosting measures proposed by Finance Minister Fernando Haddad. The government needs to increase tax income to deliver on its promise to eliminate the primary fiscal deficit next year without cutting expenses.

Yet the moves seen in the Treasury market, which reflect the possibility of additional interest rate hikes by the Federal Reserve, are having a disproportionately bigger impact on the outlook for Brazil’s monetary policy, said the official, requesting anonymity because the discussion isn’t public. Brazil’s central bank has already delivered two consecutive cuts of half a percentage point to the benchmark Selic, bringing it down to 12.75% in September. It has signaled plans to keep the same pace of easing at least until the end of the year, “if the scenario evolves as expected.”Investors, however, have been adjusting their bets on how long and aggressive Brazil’s easing campaign will be.

Being able to tap into quick cash from the equity in your home can still come in handy for those with the ability and discipline to pay it back quickly.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

US dollar's rally supercharged by soaring real yields on TreasuriesSurging U.S. real yields are aiding the dollar's rebound, rewarding bullish investors while making bears think twice before betting against the buck. The real yield on U.S. 10-year Treasuries - which measure how much investors stand to make on U.S. government bonds after inflation is stripped out - hit 2.47% on Tuesday, the highest in nearly 15 years, according to data from the U.S. Treasury Department. That has made betting on the U.S. currency more profitable, since bullish investors can collect yield while sitting on their dollar positions.

US dollar's rally supercharged by soaring real yields on TreasuriesSurging U.S. real yields are aiding the dollar's rebound, rewarding bullish investors while making bears think twice before betting against the buck. The real yield on U.S. 10-year Treasuries - which measure how much investors stand to make on U.S. government bonds after inflation is stripped out - hit 2.47% on Tuesday, the highest in nearly 15 years, according to data from the U.S. Treasury Department. That has made betting on the U.S. currency more profitable, since bullish investors can collect yield while sitting on their dollar positions.

Lire la suite »

US dollar\u0027s rally supercharged by soaring real yields on TreasuriesExplore stories from Atlantic Canada.

US dollar\u0027s rally supercharged by soaring real yields on TreasuriesExplore stories from Atlantic Canada.

Lire la suite »

Soaring Treasury yields ignite turbulence throughout marketsExplore stories from Atlantic Canada.

Soaring Treasury yields ignite turbulence throughout marketsExplore stories from Atlantic Canada.

Lire la suite »

Soaring Treasury yields ignite turbulence throughout marketsitemprop=description content=Market News

Soaring Treasury yields ignite turbulence throughout marketsitemprop=description content=Market News

Lire la suite »

Fed’s Bid to Avoid Recession Tested by Yields Nearing 20-Year Highs - BNN BloombergThe Federal Reserve may be putting its hoped-for soft landing of the economy at risk by tacitly accepting a run-up in long-term interest rates to the highest levels since 2007.

Fed’s Bid to Avoid Recession Tested by Yields Nearing 20-Year Highs - BNN BloombergThe Federal Reserve may be putting its hoped-for soft landing of the economy at risk by tacitly accepting a run-up in long-term interest rates to the highest levels since 2007.

Lire la suite »

Dollar strength and bond yields wane, yet gold continues to declineitemprop=description content=(Kitco commentary) - The dollar opened at 106.81, traded to an intraday high of 106.97 (just below yesterday’s high), and then traded to a lower low and lower close than yesterday.

Dollar strength and bond yields wane, yet gold continues to declineitemprop=description content=(Kitco commentary) - The dollar opened at 106.81, traded to an intraday high of 106.97 (just below yesterday’s high), and then traded to a lower low and lower close than yesterday.

Lire la suite »