Silicon Valley Bank imploded after depositors, concerned about the lender’s financial health, rushed to withdraw their deposits

. The frenetic two-day run on the bank blindsided observers and stunned markets, wiping out more than $100 billion in market value for U.S. banks. SVB ranked as the 16th biggest bank in the United States at the end of last year, with about $209 billion in assets and $175.4 billion in deposits.

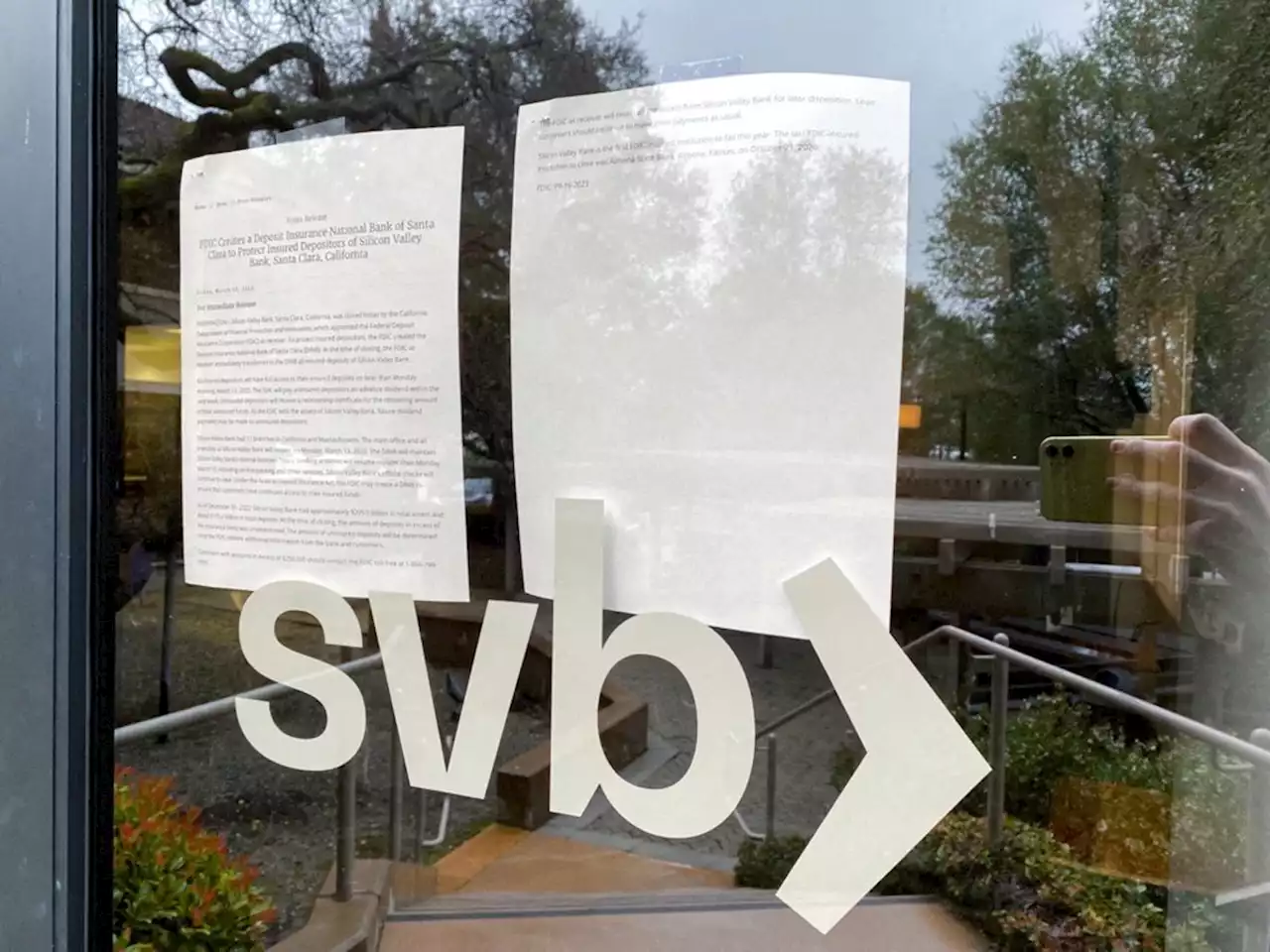

Members of California’s congressional delegation are set to be briefed by FDIC officials on Saturday, according to a report by Politico, which cited two people familiar with the situation. The lender’s main office in Santa Clara, California, and all of its 17 branches in California and Massachusetts will reopen on Monday, the FDIC said in a statement on Friday.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

![]() Silicon Valley Bank fails, shut down by FDIC after run on depositsThe FDIC seized assets of Silicon Valley Bank on Friday after depositors began withdrawing their money creating a run on the bank. Read on.

Silicon Valley Bank fails, shut down by FDIC after run on depositsThe FDIC seized assets of Silicon Valley Bank on Friday after depositors began withdrawing their money creating a run on the bank. Read on.

Lire la suite »

![]() Silicon Valley Bank fails, shut down by FDIC after run on depositsThe FDIC seized assets of Silicon Valley Bank on Friday after depositors began withdrawing their money creating a run on the bank. Read on.

Silicon Valley Bank fails, shut down by FDIC after run on depositsThe FDIC seized assets of Silicon Valley Bank on Friday after depositors began withdrawing their money creating a run on the bank. Read on.

Lire la suite »

![]() Silicon Valley Bank seized by FDIC as depositors pull cashThe Federal Deposit Insurance Corporation seized the assets of Silicon Valley Bank on Friday, marking the largest bank failure since Washington Mutual during the height of the 2008 financial crisis.

Silicon Valley Bank seized by FDIC as depositors pull cashThe Federal Deposit Insurance Corporation seized the assets of Silicon Valley Bank on Friday, marking the largest bank failure since Washington Mutual during the height of the 2008 financial crisis.

Lire la suite »

U.K. finance minister and Bank of England work to contain Silicon Valley Bank falloutMinistry of finance says that the issues affecting Silicon Valley Bank were specific to it and did not have implications for other banks operating in Britain

U.K. finance minister and Bank of England work to contain Silicon Valley Bank falloutMinistry of finance says that the issues affecting Silicon Valley Bank were specific to it and did not have implications for other banks operating in Britain

Lire la suite »

Crypto VCs ask portfolios to pull funds from Silicon Valley BankCrypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank. SVB Financial Group, the parent company of Silicon Valley Bank, lost more than 60% of its value on 9 March. Crypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank, which is struggling […]

Crypto VCs ask portfolios to pull funds from Silicon Valley BankCrypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank. SVB Financial Group, the parent company of Silicon Valley Bank, lost more than 60% of its value on 9 March. Crypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank, which is struggling […]

Lire la suite »

![]() SVB Financial CEO asks Silicon Valley Bank clients to 'stay calm' as shares sink - BNN BloombergUnease is spreading across the financial world as concerns about the stability of Silicon Valley Bank prompt prominent venture capitalists including Peter Thiel’s Founders Fund to advise startups to withdraw their money.

SVB Financial CEO asks Silicon Valley Bank clients to 'stay calm' as shares sink - BNN BloombergUnease is spreading across the financial world as concerns about the stability of Silicon Valley Bank prompt prominent venture capitalists including Peter Thiel’s Founders Fund to advise startups to withdraw their money.

Lire la suite »