Mid-sized regional banks and community banks around the country are urging regulators to consider lifting the FDIC's threshold for uninsured deposits after they granted exceptions.

and their community banking counterparts around the country are calling on the Federal Deposit Insurance Corporation to insure all bank deposits to prevent bank runs like those that toppled Silicon Valley Bank and Signature Bank.up to a cap of $250,000 per depositor, which leaves balances in excess of that being vulnerable in the event of a bank failure.

Mid-sized regional and community banks are calling on the Federal Deposit Insurance Corporation to raise its threshold for deposit insurance more than $250,000 for all institutions after regulators granted two exceptions.to take a more evenhanded approach to the issue by guaranteeing all uninsured deposits regardless of the banking institution for the next two years.

Treasury Secretary Janet Yellen testified that federal regulators aren't planning to backstop uninsured deposits at banks that aren't deemed systemically important. "Doing so will immediately halt the exodus from smaller banks, stabilize the banking sector and greatly reduce the chances of more bank failures," the MBCA letter reportedly said.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Midsize banks want unlimited FDIC insurance for 2 yearsA coalition of midsize U.S. banks is calling on the government to insure all deposits for the next two years, in the wake of Silicon Valley Bank's emergency rescue that insured all of the firm's deposits regardless of size.

Midsize banks want unlimited FDIC insurance for 2 yearsA coalition of midsize U.S. banks is calling on the government to insure all deposits for the next two years, in the wake of Silicon Valley Bank's emergency rescue that insured all of the firm's deposits regardless of size.

Lire la suite »

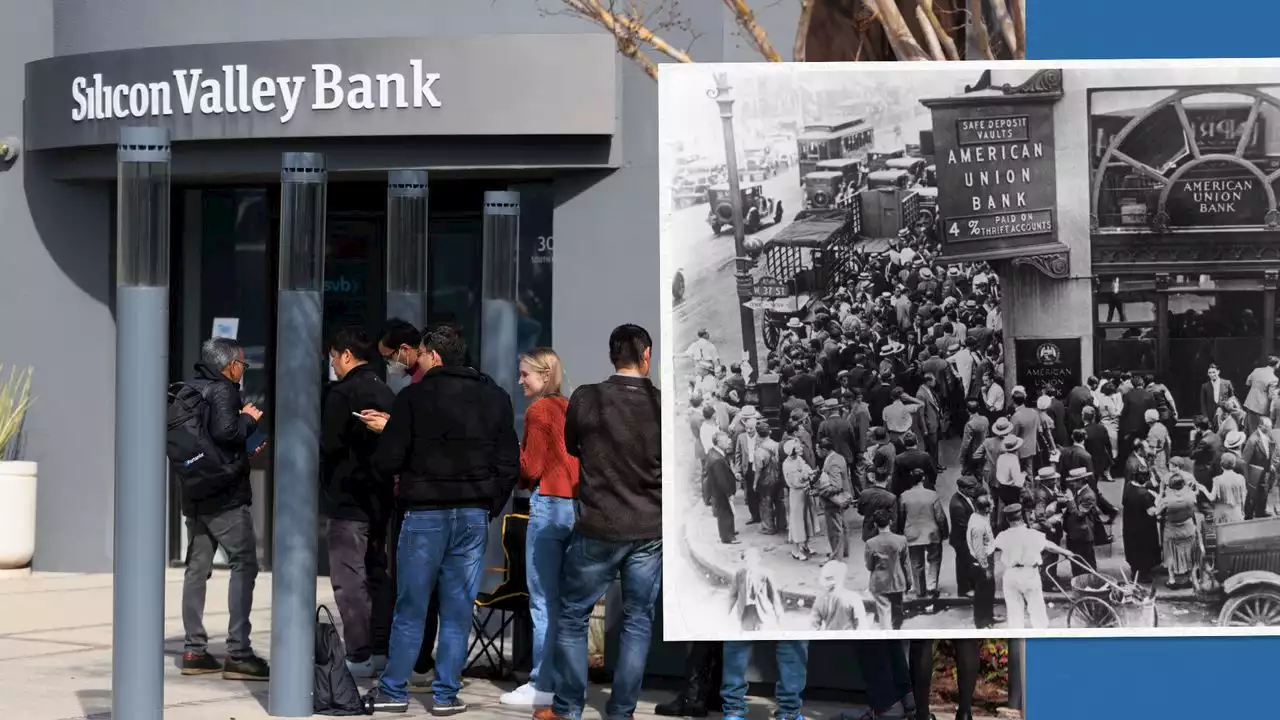

How the FDIC Acts When Banks FailWatch: The Federal Deposit Insurance Corporation was created from the Banking Act of 1933 to prevent the bank runs seen during the Great Depression. Here’s how it’s helping depositors at Silicon Valley Bank and Signature Bank now.

How the FDIC Acts When Banks FailWatch: The Federal Deposit Insurance Corporation was created from the Banking Act of 1933 to prevent the bank runs seen during the Great Depression. Here’s how it’s helping depositors at Silicon Valley Bank and Signature Bank now.

Lire la suite »

SBF shilled FTX risk model to FDIC chairman Gruenberg prior to collapseA spokesperson confirmed that the FDIC chairman met SBF as part of “routine courtesy visits with leaders of financial firms and institutions.”

SBF shilled FTX risk model to FDIC chairman Gruenberg prior to collapseA spokesperson confirmed that the FDIC chairman met SBF as part of “routine courtesy visits with leaders of financial firms and institutions.”

Lire la suite »

FDIC to relaunch sale of SVB, moves toward break-up planThe U.S. Federal Deposit Insurance Corp (FDIC) is planning to relaunch the sale process for Silicon Valley Bank after failing to attract buyers in its latest auction, with the regulator seeking a potential break-up of the failed lender, according to people familiar with the matter.

FDIC to relaunch sale of SVB, moves toward break-up planThe U.S. Federal Deposit Insurance Corp (FDIC) is planning to relaunch the sale process for Silicon Valley Bank after failing to attract buyers in its latest auction, with the regulator seeking a potential break-up of the failed lender, according to people familiar with the matter.

Lire la suite »

Signature Bank Deposits to Be Assumed by New York Community Bank Unit: FDICFormer Signature Bank deposits other than those related to the digital banking business will be assumed by a unit of New York Community Bancorp as of Monday, the FDIC said. GregAhl reports

Signature Bank Deposits to Be Assumed by New York Community Bank Unit: FDICFormer Signature Bank deposits other than those related to the digital banking business will be assumed by a unit of New York Community Bancorp as of Monday, the FDIC said. GregAhl reports

Lire la suite »