The new higher-for-longer stage of global monetary policy may last only until the early months of 2024 as central banks begin moving toward cutting borrowing costs.

That’s the outlook foreseen by Bloomberg Economics, whose aggregate gauge of world interest rates is seen beginning a swift descent in the first quarter. In advanced economies, that shift will take only slightly longer to transpire before they too synchronize downwards.

The BE outlook points to a turning tide in the tightening cycle. It also highlights how the ultra-low-rate world that preceded it won’t be back any time soon, as the volatile era European Central Bank President Christine Lagarde terms as an “age of shifts and breaks” keeps officials wary of loosening too far.

Most Fed officials have said they expect to raise their benchmark lending rate once more this year, capping the most aggressive tightening campaign in nearly four decades. But further progress cooling inflation, along with tightening financial conditions, could give them pause over the coming months.

After 10 straight rate increases, the ECB is ready to take a break from hiking. Keeping borrowing costs at current levels for a “sufficiently long” time will make a “substantial contribution” to a speedy return of inflation to 2%, policymakers said after their latest decision. With inflation likely to remain above the bank’s 2% target during the quarter, economists expect the BOJ will need to raise its price forecasts again in October. The bank will also likely get an early glimpse at the direction of next year’s wage talks when the biggest union group unveils its negotiating stance in the coming weeks. The yen is another critical factor. Ueda could come under pressure to take action early if the currency continues to weaken.“The BOJ faces a dilemma.

Canada’s economy unexpectedly contracted in the second quarter as its heavily indebted households feel the pinch of one of the most aggressive hiking cycles in the history of the central bank. Further proof of fading excess demand led Governor Tiff Macklem and his governing council to hold borrowing costs steady at 5% when they met in September, but they threatened the possibility of further tightening to damp expectations for any near term rate cuts.

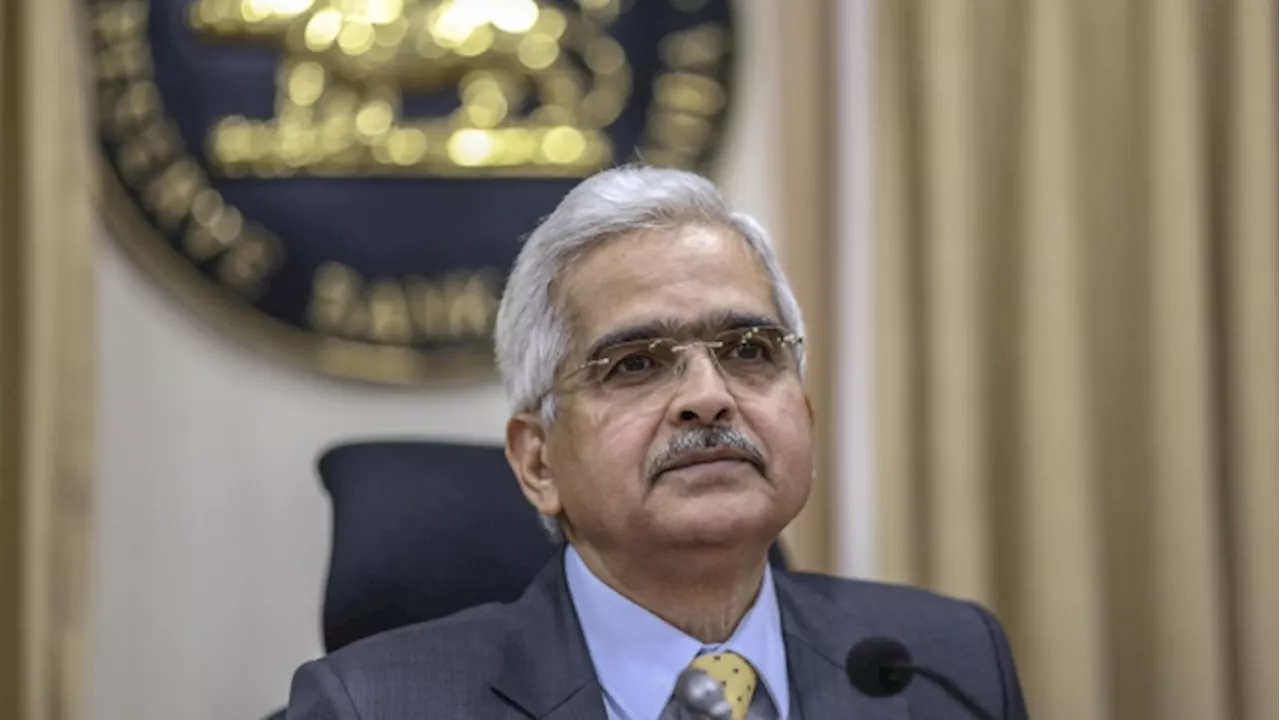

Inflation risks remained front and center of the RBI, forcing it to strike a hawkish tone for the fourth straight meeting last week as it kept key rates and stance unchanged to support growth. Governor Shaktikanta Das highlighted inflation as a “major risk” to stability and growth, a warning that coincides with the weakest monsoon rains in five years and a rise in crude prices.

Such high rates, often criticized by President Luiz Inacio Lula da Silva as an obstacle to growth, have helped to moderate inflation even as economic activity remained relatively strong, with a resilient services sector and a tight labor market. The central bank says it has been able to engineer an economic soft landing, with the economy decelerating but avoiding a recession next year. Yet economists forecast consumer prices to keep rising above target until 2026.

While inflation is near to the midpoint of the central bank’s 3% to 6% target range where it prefers to anchor inflation expectations, policymakers are likely to sustain a pause on the key rate as inflationary pressures and risks to public finances persist. The Reserve Bank will closely watch the government’s budget update on Nov. 1 and should the assessed risks materialize, rate hikes may start again.

Bank Indonesia finds itself at an uneasy pause, unable to cut rates amid a strong dollar, and unwilling to tighten further amid cooling price gains. Instead, it will likely adjust other levers such as bond interventions to boost the rupiah, and reserve requirement discounts to spur lending. Governor Olayemi Cardoso said in Senate hearings last month that the central bank will address Nigeria’s lofty inflation, which is among the highest in Africa, by adopting an evidence-based monetary policy. The central has lifted its benchmark rate by 725 basis points since May 2022.“We think rate hikes are likely to steepen under incoming central bank chief Cardoso to halt runaway inflation.

But that stance may be tested in the weeks ahead as quarterly inflation and updated staff forecasts are due to be released. Any risk of further delay in the RBA’s timeline for returning inflation to the 2-3% target — already long at 2025 — will prompt an increase in rates. The question now shifts to whether officials are in fact done or could still opt for another move at their next meeting in December. Driven by electricity prices and rents, a moderate rebound of consumer-price growth is expected over the coming months, while unions also negotiate wage increases.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Global bond funds post massive weekly outflows on rate hike concernsExplore stories from Atlantic Canada.

Global bond funds post massive weekly outflows on rate hike concernsExplore stories from Atlantic Canada.

Lire la suite »

Newmont’s US$16.68-billion Newcrest deal receives all regulatory approvalsThe deal still awaits the crucial Newcrest shareholder vote, scheduled for Oct. 13

Newmont’s US$16.68-billion Newcrest deal receives all regulatory approvalsThe deal still awaits the crucial Newcrest shareholder vote, scheduled for Oct. 13

Lire la suite »

Vic West Park campers get reprieve as council awaits sheltering reportVictoria council opted not to consider a motion to ban overnight sheltering in the park until it has seen a staff report on the impact of the move on the city’s homeless population.

Vic West Park campers get reprieve as council awaits sheltering reportVictoria council opted not to consider a motion to ban overnight sheltering in the park until it has seen a staff report on the impact of the move on the city’s homeless population.

Lire la suite »

Canadian Press NewsAlert: Economy adds 64K jobs, unemployment rate holds at 5.5%OTTAWA — The Canadian economy added 64,000 jobs last month, while the unemployment rate held steady at 5.5 per cent for the third month in a row. More coming. The Canadian Press

Canadian Press NewsAlert: Economy adds 64K jobs, unemployment rate holds at 5.5%OTTAWA — The Canadian economy added 64,000 jobs last month, while the unemployment rate held steady at 5.5 per cent for the third month in a row. More coming. The Canadian Press

Lire la suite »

Canada’s job gains triple expectations in September; unemployment rate at 5.5%The acceleration in wage growth is likely to worry the central bank, which has stressed that it will be hard to fully curb inflation if wages maintain their current patterns

Canada’s job gains triple expectations in September; unemployment rate at 5.5%The acceleration in wage growth is likely to worry the central bank, which has stressed that it will be hard to fully curb inflation if wages maintain their current patterns

Lire la suite »