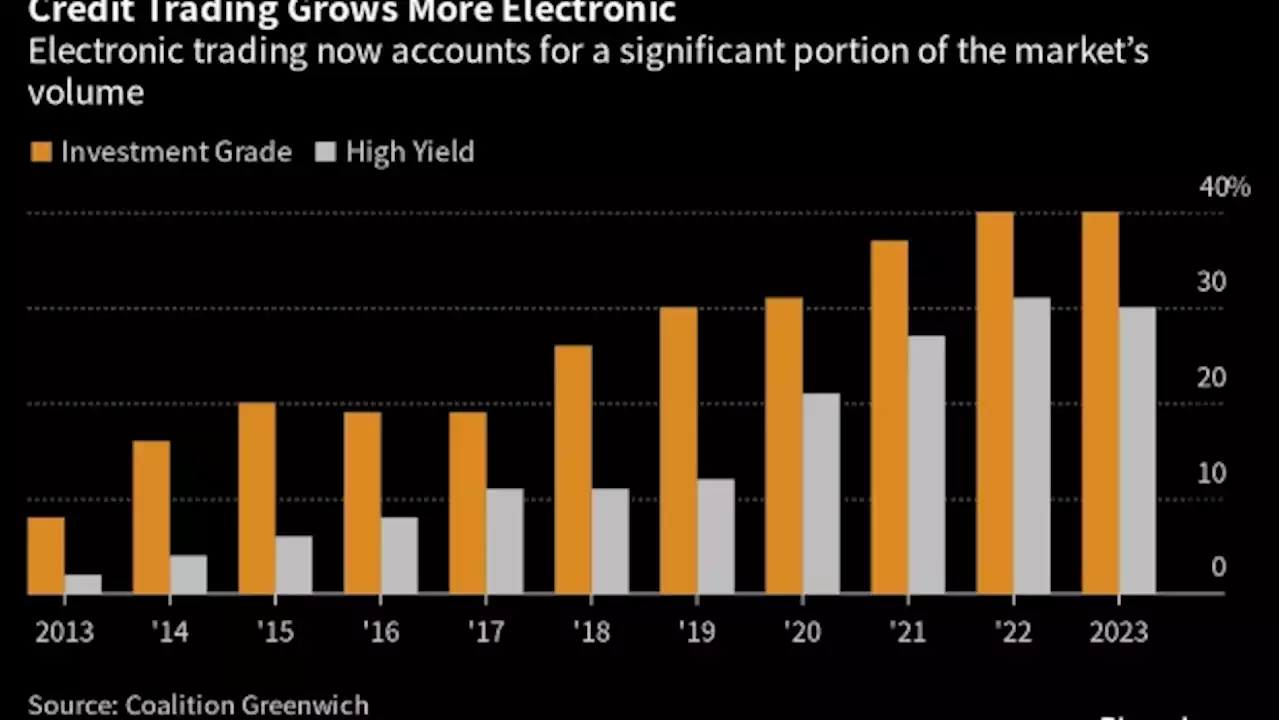

An electronic trading revolution is finally coming to corporate bonds, years after reaching other financial markets.

That’s what Man Numeric, a quant investment arm of the world’s largest publicly listed hedge fund manager, believes. The firm is executing 90% of its high-yield and investment-grade trades through digital platforms, and expects to get to 100% within two years. A year ago, only about a third of its junk bond trades were electronic, with the rest happening on the telephone or a messaging platform.

During times of turmoil, voice trading has often won out for the biggest trades, even as recently as the early part of the pandemic in 2020. But in the last few years, Man Numeric has noticed that trading volume on electronic platforms was growing in both bad times and in good, said Robert Lam, co-head of credit at Man Numeric. More investors seem comfortable using fully electronic trading, in part because they have more sophisticated pricing algorithms that can handle big market shifts.

Man Numeric views its edge as being in security selection. It’s generally looking for individual bonds or groups of securities that are underpriced, or for long-short trades. “We still believe this market has a lot of innovating to do,” McPartland wrote in a recent note. “Retail access to the bond market is still a decade or more behind the equity market.”

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

UAE Firm Buys 30% Stake in Egypt Tobacco Giant for $625 MillionA United Arab Emirates investment firm bought a 30% stake in Egypt’s largest tobacco firm for $625 million, the latest step in the North African nation’s ambitious program to offload state assets and raise sorely-needed foreign currency.

UAE Firm Buys 30% Stake in Egypt Tobacco Giant for $625 MillionA United Arab Emirates investment firm bought a 30% stake in Egypt’s largest tobacco firm for $625 million, the latest step in the North African nation’s ambitious program to offload state assets and raise sorely-needed foreign currency.

Lire la suite »

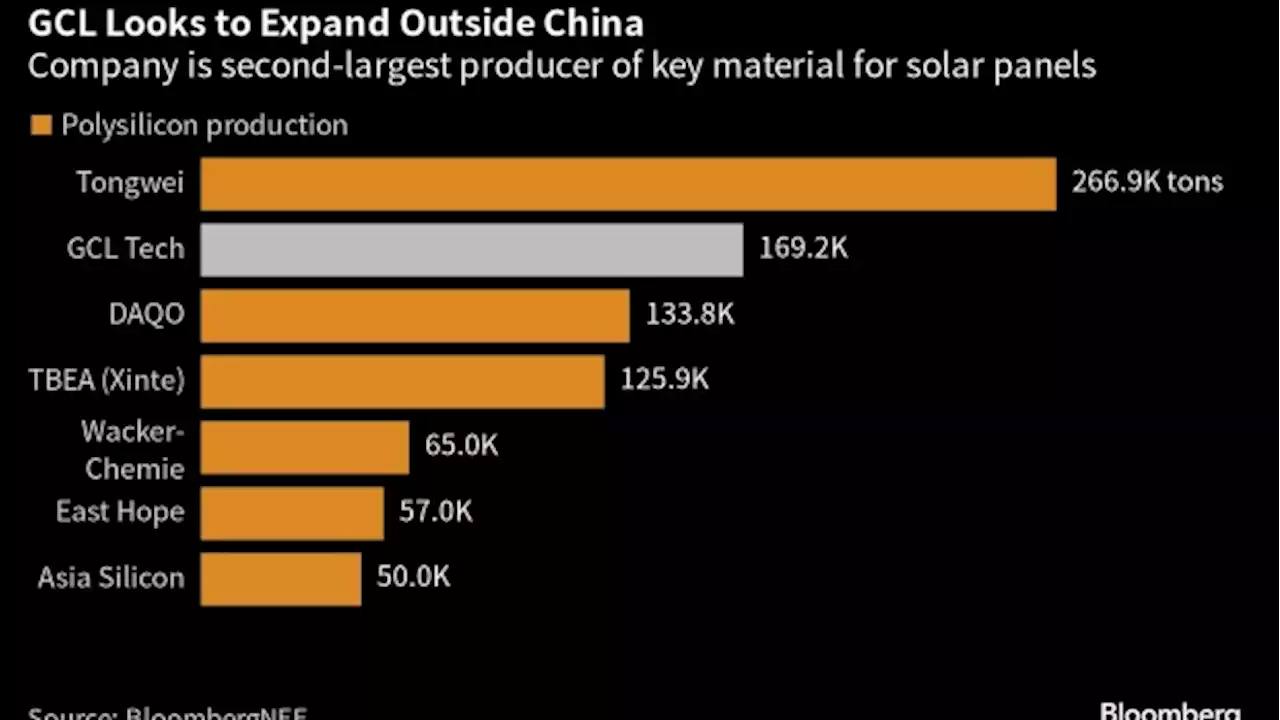

Chinese Solar Firm Eyes Saudi Arabia for First Foreign PlantChina-based solar sector supplier GCL Technology Holdings Ltd. is in advanced talks with Saudi Arabia about opening its first overseas factory as the nations aim to extend their energy ties beyond oil.

Chinese Solar Firm Eyes Saudi Arabia for First Foreign PlantChina-based solar sector supplier GCL Technology Holdings Ltd. is in advanced talks with Saudi Arabia about opening its first overseas factory as the nations aim to extend their energy ties beyond oil.

Lire la suite »

Sudan war crime trial of ex-oil firm executives starts in SwedenSTOCKHOLM (Reuters) - The former CEO and the chairman of a Swedish oil firm go on trial in Sweden on Tuesday, accused of complicity in war crimes in ...

Sudan war crime trial of ex-oil firm executives starts in SwedenSTOCKHOLM (Reuters) - The former CEO and the chairman of a Swedish oil firm go on trial in Sweden on Tuesday, accused of complicity in war crimes in ...

Lire la suite »

Chinese Solar Firm Eyes Saudi Arabia for First Foreign Plant(Bloomberg) -- China-based solar sector supplier GCL Technology Holdings Ltd. is in advanced talks with Saudi Arabia about opening its first overseas factory as the nations aim to extend their energy ties beyond oil.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketStocks Cede China-Led Gains in Thin Holiday Trade: Markets WrapThe world’s sec

Chinese Solar Firm Eyes Saudi Arabia for First Foreign Plant(Bloomberg) -- China-based solar sector supplier GCL Technology Holdings Ltd. is in advanced talks with Saudi Arabia about opening its first overseas factory as the nations aim to extend their energy ties beyond oil.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketStocks Cede China-Led Gains in Thin Holiday Trade: Markets WrapThe world’s sec

Lire la suite »

Tesla sues Chinese firm over tech secret infringement -Chinese state mediaBEIJING (Reuters) - Tesla Shanghai has sued a Chinese firm over tech secret infringement and unfair competition disputes, Shanghai Securities Journal ...

Tesla sues Chinese firm over tech secret infringement -Chinese state mediaBEIJING (Reuters) - Tesla Shanghai has sued a Chinese firm over tech secret infringement and unfair competition disputes, Shanghai Securities Journal ...

Lire la suite »

Microsoft Partners With Abu Dhabi AI Firm G42 on Cloud OfferingMicrosoft Corp. is expanding its partnership with Abu Dhabi’s Group 42, and plans to offer sovereign cloud infrastructure in the United Arab Emirates.

Microsoft Partners With Abu Dhabi AI Firm G42 on Cloud OfferingMicrosoft Corp. is expanding its partnership with Abu Dhabi’s Group 42, and plans to offer sovereign cloud infrastructure in the United Arab Emirates.

Lire la suite »