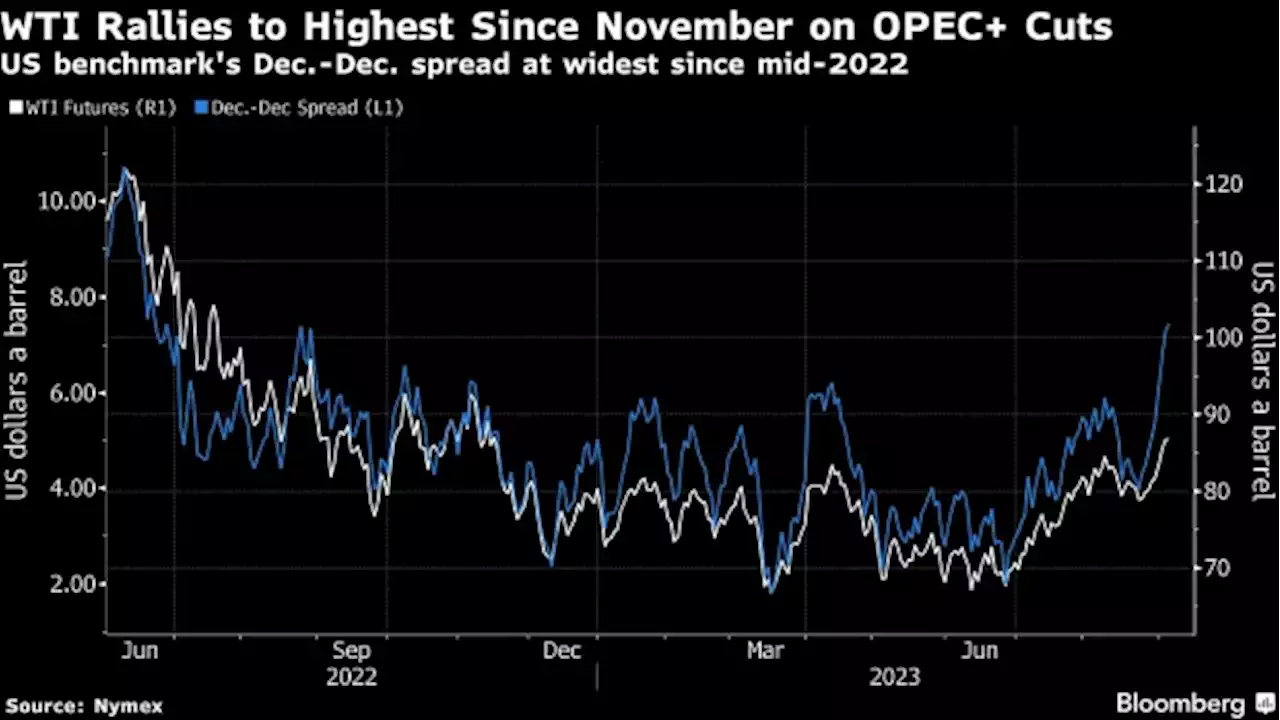

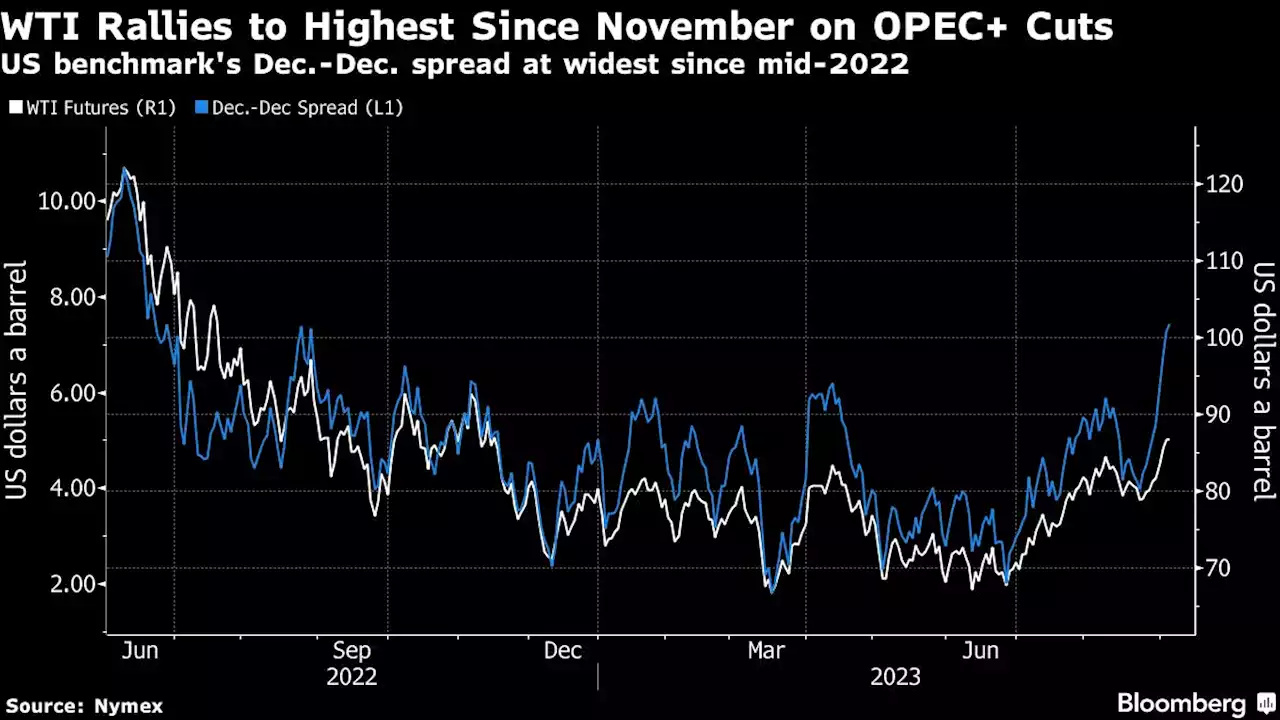

Oil held gains after capping the longest winning run in more than four years as OPEC+ leaders extended supply cuts to the end of 2023 and industry estimates pointed to another draw in US crude inventories.

21Shares and Cathie Wood’s ARK File for First US Spot-Ether ETFAnti-ESG Fund Firm Hits $1 Billion Assets With Co-Founder Ramaswamy on Campaign TrailPot Stocks See Best Week Since 2020 on Call to Lower Marijuana Risk CategorySEC Delays Decisions on Invesco, WisdomTree Bitcoin ETF FilingsGrayscale Ruling Not Enough to Halt Bitcoin’s

Two-Month Losing StreakCash-Like ETFs Lure Billions as Traders Shelter From VolatilityActive ETFs Cash In on Corporate Reform in JapanGutsy Tesla ETF Wants to Time Bets on Famously Volatile SharesMarks & Spencer Makes a Return to the FTSE 100 as Hiscox Loses Out in ReshuffleThe World’s Biggest Bitcoin Fund Posts Best Day in Two Years on Court Ruling

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Oil slips from highest since December ahead of OPEC+ supply moveOil edged lower from the highest level this year after a surge driven by supply cuts from OPEC+ that have tightened the market.

Oil slips from highest since December ahead of OPEC+ supply moveOil edged lower from the highest level this year after a surge driven by supply cuts from OPEC+ that have tightened the market.

Lire la suite »

Brent Oil Hits $90 a Barrel After OPEC+ Extends Supply CurbsBrent oil rallied to $90 a barrel for the first time since November as key OPEC+ producers extended supply cuts that have tightened the crude market.

Brent Oil Hits $90 a Barrel After OPEC+ Extends Supply CurbsBrent oil rallied to $90 a barrel for the first time since November as key OPEC+ producers extended supply cuts that have tightened the crude market.

Lire la suite »

Oil Steady Near Nine-Month High After OPEC+ Extends Supply CutsOil steadied near the highest since November after OPEC+ leaders Saudi Arabia and Russia announced that they would extend supply curbs through the end of the year, tightening the global market.

Oil Steady Near Nine-Month High After OPEC+ Extends Supply CutsOil steadied near the highest since November after OPEC+ leaders Saudi Arabia and Russia announced that they would extend supply curbs through the end of the year, tightening the global market.

Lire la suite »

Oil Steady Near Nine-Month High After OPEC+ Extends Supply Cuts(Bloomberg) -- Oil steadied near the highest since November after OPEC+ leaders Saudi Arabia and Russia announced that they would extend supply curbs through the end of the year, tightening the global market.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsChina Slowdown Means It May Never Overtake US Economy, Forecast ShowsReturn-to-Office Is a $1.3 Trillion Problem Few Have Figured OutBillion-Dollar Corporate Bond Deals Hit Treasuries: Markets WrapUnited A

Oil Steady Near Nine-Month High After OPEC+ Extends Supply Cuts(Bloomberg) -- Oil steadied near the highest since November after OPEC+ leaders Saudi Arabia and Russia announced that they would extend supply curbs through the end of the year, tightening the global market.Most Read from BloombergHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsChina Slowdown Means It May Never Overtake US Economy, Forecast ShowsReturn-to-Office Is a $1.3 Trillion Problem Few Have Figured OutBillion-Dollar Corporate Bond Deals Hit Treasuries: Markets WrapUnited A

Lire la suite »

Oil edges away from US$90 after OPEC+ leaders extend supply cutsBrent oil retreated from US$90 a barrel as traders digested a decision by OPEC+ leaders Saudi Arabia and Russia to extend supply curbs through the end of the year.

Oil edges away from US$90 after OPEC+ leaders extend supply cutsBrent oil retreated from US$90 a barrel as traders digested a decision by OPEC+ leaders Saudi Arabia and Russia to extend supply curbs through the end of the year.

Lire la suite »

Saudi Arabia's oil production cuts are 'significant': AnalystAs Saudi Arabia and Russia extend voluntary oil supply cuts, Vectis Energy Partners Principal Tamar Essner joins Yahoo Finance Live to discuss what this means for the oil market. Essner notes that “Saudi Arabia might have a little bit of difficulty because their production cuts are going to be offset by higher production from other countries within OPEC,” but “it is really significant because they’re trying to address the skepticism of the market.” Essner says “the market’s so sensitive to China.” “The negative headlines about the property sector there have somewhat dampened petrochemical demand for oil. But post Covid and post the lockdowns, mobility demand has more than offset that… so demand in China has really been good,” Essner explains. Essner adds that for oil prices, “the base case is that oil is sort of in a nice range here between now and the end of the year.”

Saudi Arabia's oil production cuts are 'significant': AnalystAs Saudi Arabia and Russia extend voluntary oil supply cuts, Vectis Energy Partners Principal Tamar Essner joins Yahoo Finance Live to discuss what this means for the oil market. Essner notes that “Saudi Arabia might have a little bit of difficulty because their production cuts are going to be offset by higher production from other countries within OPEC,” but “it is really significant because they’re trying to address the skepticism of the market.” Essner says “the market’s so sensitive to China.” “The negative headlines about the property sector there have somewhat dampened petrochemical demand for oil. But post Covid and post the lockdowns, mobility demand has more than offset that… so demand in China has really been good,” Essner explains. Essner adds that for oil prices, “the base case is that oil is sort of in a nice range here between now and the end of the year.”

Lire la suite »